Forget the Gold vs. Bitcoin Debate, Kiyosaki Has a Bigger Message for Investors

29.11.2024 22:00 2 min. read Alexander Zdravkov

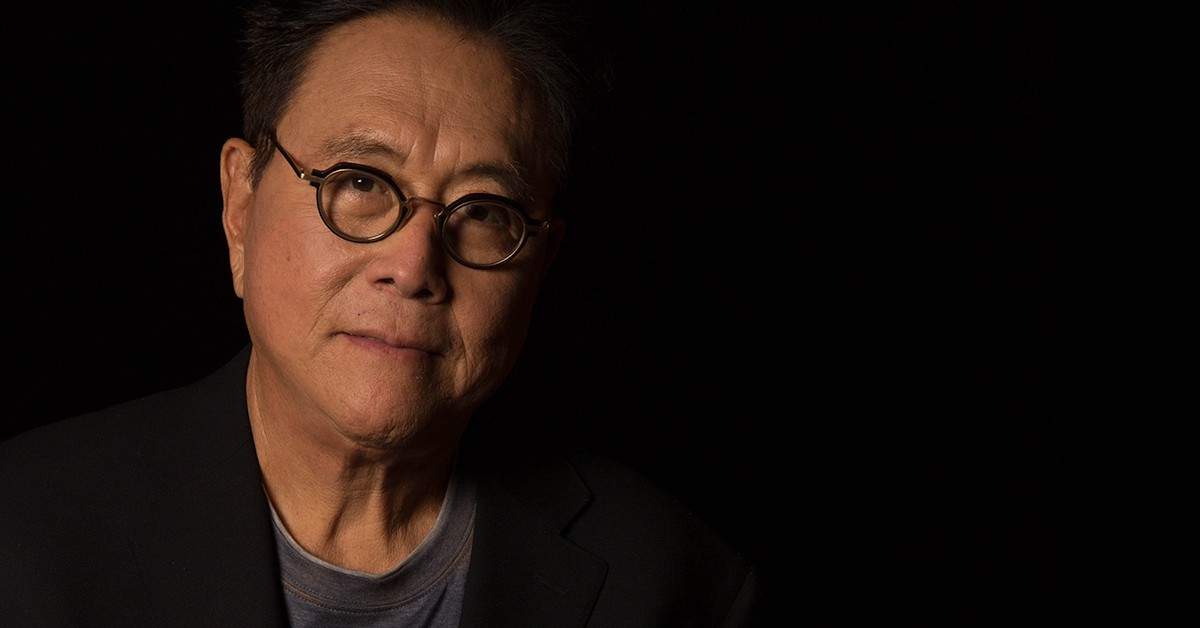

Robert Kiyosaki, the renowned investor and author of Rich Dad Poor Dad, recently shared his thoughts on the ongoing debate between Bitcoin (BTC) and gold.

He expressed amusement at the high-level discussions around which asset is superior, dismissing them as distractions. For Kiyosaki, the real issue is not the debate itself, but the larger forces at play, particularly how individuals are being misled by the government. Reflecting on his experiences from 1965, he recalled first noticing the debasement of silver coins with copper, which led him to believe that people were being misinformed and taken advantage of by the government.

Kiyosaki also took aim at those with advanced academic degrees, humorously referring to PhDs as “Poor, Helpless, and Desperate” instead of “Doctor of Philosophy.” He argues that the true path to financial success lies in taking action—investing in real assets like gold, silver, or Bitcoin—rather than relying on academic theories. Kiyosaki emphasized that while investing may not lead to quick riches, it will help increase one’s financial knowledge and wealth over time.

Reflecting on his own journey, Kiyosaki shared how, in 1965, he began hiding real money as he recognized flaws in the currency system. This evolved into his long-term strategy of accumulating gold and silver, which he continued throughout his life. In 1985, he expanded his investments to include gold and silver mines, and today, he also holds Bitcoin.

Kiyosaki also criticized the U.S. dollar, calling it “fake money.” He connected this to Gresham’s Law, which states that when inferior money enters circulation, it forces out the more valuable kind. For Kiyosaki, the U.S. dollar is an example of this inferior currency, with real money like gold and Bitcoin “hiding” from the system.

Rather than picking one asset over the other, Kiyosaki advocates for a balanced approach, supporting both gold and Bitcoin. Unlike economists such as Peter Schiff, who oppose Bitcoin, Kiyosaki sees the value in both assets. He consistently urges his followers to invest in tangible assets instead of saving in depreciating currencies.

-

1

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

2

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

3

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

4

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

5

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read

Strategy Launches Fourth Preferred stock Offering to Fuel Bitcoin Buys

Strategy Inc. (NASDAQ: MSTR) has announced the launch of its fourth perpetual preferred stock offering, marking a new phase in the company’s ongoing efforts to expand its Bitcoin treasury holdings.

BitGo Files Confidentially for IPO With SEC

BitGo Holdings, Inc. has taken a key step toward becoming a publicly traded company by confidentially submitting a draft registration statement on Form S-1 to the U.S. Securities and Exchange Commission (SEC).

Public Companies Now hold Over $100 Billion in Bitcoin — 4% of Total Supply

According to new data shared by Bitcoin Magazine Pro, publicly traded companies now collectively hold over 844,822 BTC, valued at more than $100.5 billion, marking a historic milestone for institutional Bitcoin adoption.

Trump Media Holds $2B in Bitcoin as Crypto Plan Expands

Trump Media and Technology Group, the parent company of Truth Social, Truth+, and Truth.Fi, has officially disclosed that it now holds approximately $2 billion in Bitcoin and Bitcoin-related securities.

-

1

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

2

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

3

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

4

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

5

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read