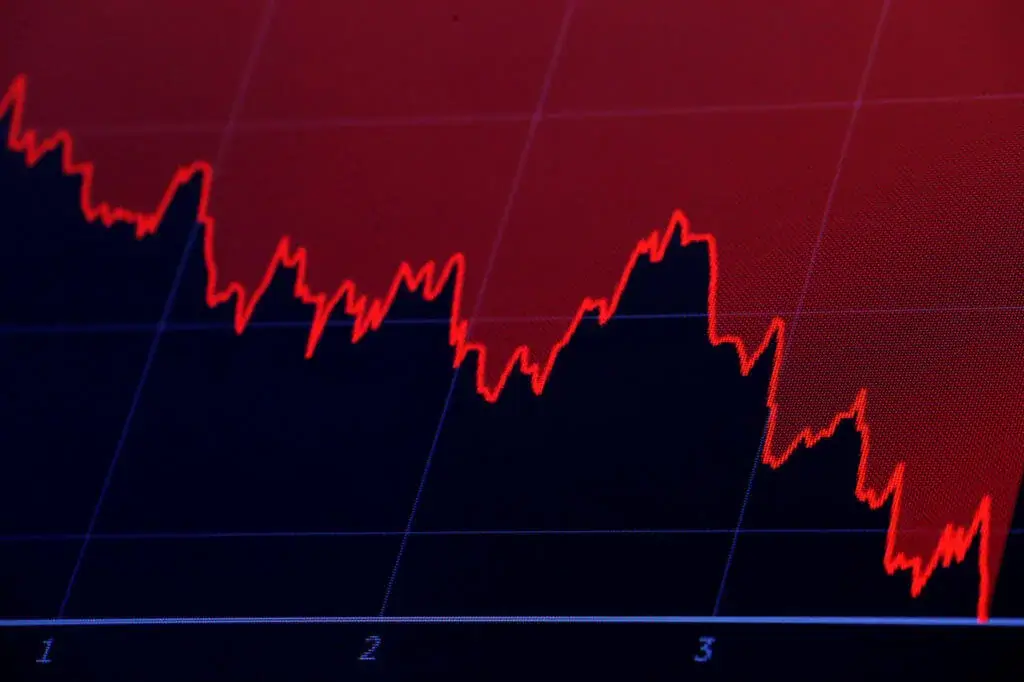

Failed Cryptos Flood the Market as Speculation and Fear Take Over

02.05.2025 21:00 1 min. read Alexander Stefanov

The crypto graveyard is growing fast. According to CoinGecko, more than half of all digital tokens launched since 2021 have already vanished—roughly 3.7 million failed projects, or 52.7% of listings on GeckoTerminal.

And 2025 isn’t slowing down: the first quarter alone has seen over 1.8 million new casualties, nearly topping all of 2024.

The flood of worthless tokens is being fueled by a mix of economic anxiety, impulsive retail speculation, and the meme coin gold rush.

New platforms like pump.fun have made token creation nearly effortless, resulting in an avalanche of one-and-done projects with no roadmap or real intent to last. Binance estimates that nearly all meme coins—about 97%—end up dead shortly after launch.

Geopolitical instability and fears surrounding Trump’s return to office have also spooked the market. With inflation back in the spotlight, investors are shedding high-risk assets in favor of safer havens like gold—leaving even Bitcoin’s role as digital gold up for debate.

Despite the surge in failures, the sheer number of new projects keeps rising. The space has ballooned from 428,000 listings in 2021 to nearly 7 million in 2025. But as nearly half of all coin deaths this decade have occurred just this year, the question now is: how much of this is innovation—and how much is noise?

-

1

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

2

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read

Ethereum ETFs Signal Strong July Surge

Ethereum exchange-traded funds are gaining momentum, with recent inflows ranking among the top ten ever recorded.

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

Bitcoin’s breakout to a new all-time high above $118,000 has reignited momentum across the crypto market. While BTC itself saw nice gains several altcoins are riding the wave of renewed investor interest.

Ethereum Jumps 8% to Reclaim $3,000

Ethereum surged 8.4% in the past 24 hours, reaching $3,010 as renewed interest in altcoins follows Bitcoin’s explosive rally.

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

Grayscale, one of the leading cryptocurrency asset managers, has unveiled its latest benchmark update structured around its Crypto Sectors framework.

-

1

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

2

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read