Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

17.07.2025 18:30 2 min. read Kosta Gushterov

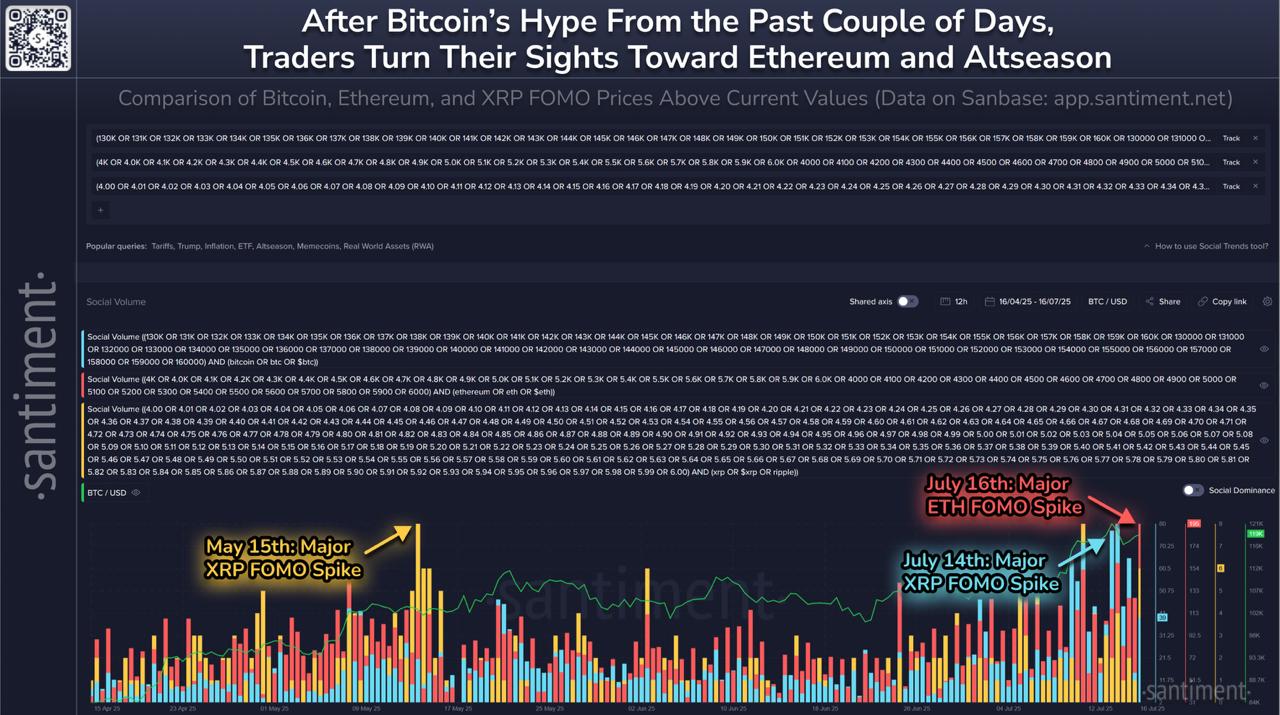

Traders are rapidly shifting their focus to Ethereum and altcoins after Bitcoin’s recent all-time high triggered widespread retail FOMO.

According to Santiment data, the attention has now moved toward Ethereum, which has seen a major spike in social media mentions and price projections above $4,000 across platforms like X, Reddit, and Telegram.

The chart highlights a notable shift in trader behavior. On July 16, Ethereum experienced a significant FOMO spike, following Bitcoin’s hype earlier in the week. This comes just two days after XRP also registered a major spike in online chatter on July 14—mirroring a previous wave on May 15.

These surges indicate that retail interest is rotating quickly between top-layer cryptocurrencies, often following price breakouts or headline-driven momentum.

Ethereum now leads the pack in terms of online buzz, potentially signaling the start of an altcoin season. As Bitcoin cools off after its rally, Ethereum is emerging as the next speculative target for traders anticipating continued upside. The combination of technical breakouts and aggressive social media sentiment is creating a feedback loop that could push ETH further up.

The current environment echoes previous market cycles where retail sentiment rapidly chases outperforming assets. With Ethereum back in the spotlight, the broader altcoin market may follow suit, especially if traders rotate capital from BTC profits into high-beta alternatives. Santiment’s data reveals how quickly crowd behavior shifts, and right now, Ethereum is at the center of that rotation.

-

1

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

03.07.2025 20:00 2 min. read -

2

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

3

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

4

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

BlackRock is seeking to enhance its iShares Ethereum Trust (ticker: ETHA) by incorporating staking features, according to a new filing with the U.S. Securities and Exchange Commission (SEC) submitted Thursday.

IMF Disputes El Salvador’s Bitcoin Purchases, Cites Asset Consolidation

A new report from the International Monetary Fund (IMF) suggests that El Salvador’s recent Bitcoin accumulation may not stem from ongoing purchases, but rather from a reshuffling of assets across government-controlled wallets.

BSTR to Launch With 30,021 BTC, Becomes 4th Largest Public Bitcoin Holder

BSTR Holdings Inc. is set to become the fourth-largest public holder of Bitcoin, announcing it will launch with 30,021 BTC on its balance sheet as part of its public debut.

Ethereum ETF Inflows Hit Record High as Price Jumps Past $3,400

Ethereum saw an explosive surge in institutional demand this week, with spot exchange-traded funds (ETFs) posting their highest single-day inflow on record. O

-

1

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

03.07.2025 20:00 2 min. read -

2

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

3

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

4

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read