Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Ethereum Price Prediction: ETH to Could Soar to $3.5K as Trading Volumes Hit $33.7B

15.07.2025 0:45 4 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Ethereum (ETH) just broke $3,000 for the first time since February, with volume and open interest jumping in tandem. But can ETH continue rising to $3,500 or will this rally fizzle out?

Meanwhile, the rest of the Ethereum ecosystem is benefiting from ETH’s latest surge. Best Wallet Token (BEST) is one project that is taking advantage of traders rotating into smaller altcoins – and it’s now raised $13.8 million in presale.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Ethereum Rally Gains Steam as Trading Volumes Surge Past $33B

Ethereum is currently trading around $3,000, its highest price since February 2. The coin is up around 3% from Saturday’s low and even notched a 6% intraday pop before a quick wave of profit-taking.

That bullish price action aligns with the latest market data: spot trading volume reached $3.7 billion in the past 24 hours, more than double the volume from the day before, while derivatives open interest has surged past $20 billion.

Momentum indicators back up the move. RSI readings on the daily chart are at 71, slightly in the overbought zone but still favoring the bulls, and both the 50-day and 200-day exponential moving averages (EMAs) are trending up.

ETH’s price is also glued to the upper Bollinger Band on the daily chart – a spot that many traders see as the springboard for another breakout. Supply dynamics tilt bullish, too; over 29% of ETH is now staked, exchange balances sit at a nine-year low, and whales are continuing to accumulate.

Ethereum Price Prediction – Could ETH Hit $3.5K Next?

With ETH already trading above $3,000, the $3,500 mark looks less like a long shot and more like the next checkpoint. But what would it take to reach it?

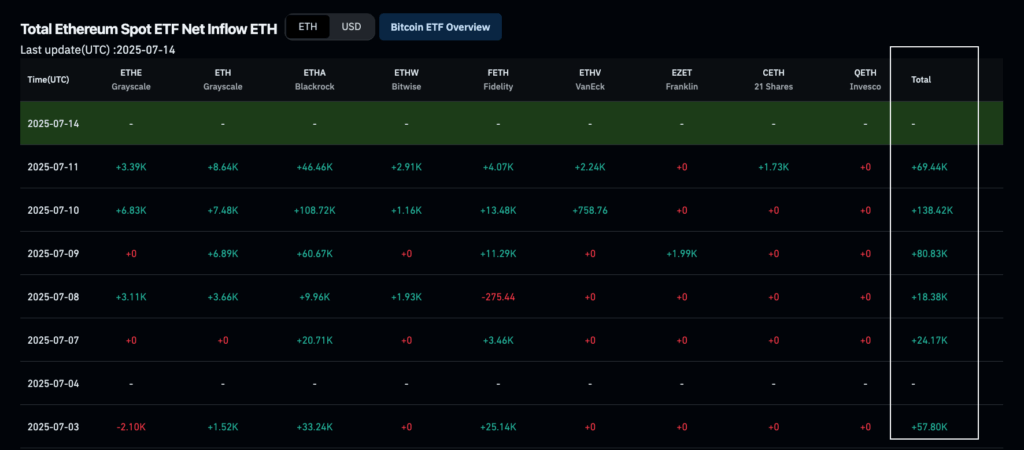

Several catalysts are lining up. Spot ETH ETFs, which went live a year ago, are on a streak of positive inflows. If these inflows keep running anywhere near $200–$500 million a week, the supply squeeze only tightens, especially while exchange balances sit this low.

The recent Pectra upgrade is another catalyst: higher validator limits and faster block times have pushed more ETH into staking contracts, cutting the circulating supply. Add in the growth of Layer-2 networks such as Arbitrum, Optimism, and Base, which processed over 375 million transactions in the past month, and demand for ETH isn’t slowing.

All of these factors – along with Ethereum’s bullish technicals – suggest that hitting $3,500 is more likely than not in the short term.

Why Best Wallet Token Could Benefit as Ethereum’s Price Climbs Toward $3.5K

As the crypto market soars, traders are looking for low cap altcoins that could provide the biggest gains, and one coin that’s gaining momentum is Best Wallet Token (BEST).

Best Wallet Token sits in a corner of the market that could be one of the biggest winners of an Ethereum upswing: wallet infrastructure. As capital flows back into DeFi and new users hunt for tools that feel as smooth as Web2 apps, non-custodial wallets with large feature sets tend to benefit the most.

The combined market cap of wallet tokens is currently $2.5 billion – up significantly over the past quarter, but still small compared to other sectors. This low valuation means there’s enormous room to grow.

Best Wallet could take advantage here. The wallet already serves more than 250,000 monthly users across 60 blockchains, offering built-in swaps, staking, and a launchpad called “Upcoming Tokens” that gives holders early access to presales.

As an anonymous, non-custodial wallet, Best Wallet provides a more secure alternatives to custodial wallets, such as Bybit, that have suffered hacks of late. As such, its user base is rapidly growing.

Holding the BEST token unlocks discounted swap fees, governance rights, and boosted staking yields, currently estimated at 99% APY.

The ongoing presale for BEST has raised $13.8 million so far, with tokens priced at just $0.025325 during the current stage. Cryptonews’ analysts believe this price could 5x (or more) once BEST hits the open market.

While Best Wallet Token may not yet be live, it’s already one of the most talked-about utility tokens in crypto. And with its presale offering a low entry point, now might be the ideal time to gain exposure while ETH is this hot and the crypto market is soaring.

Visit Best Wallet Token Presale

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now as XRP’s Legal Saga With Ripple Ends

28.06.2025 22:31 7 min. read -

2

3 Crypto Presales That Could Generate 100x Returns in Q3

29.06.2025 12:27 4 min. read -

3

Bitcoin Records Another All Time High as Bitcoin Hyper Presale Soars: Best Crypto to Buy?

11.07.2025 12:05 6 min. read -

4

Best Crypto to Buy Now After Trump’s $220 Million Bitcoin Power Play

02.07.2025 19:23 7 min. read -

5

5 Best Crypto to Buy for Q3 Altcoin Season as Bitcoin Dominance Dips

29.06.2025 12:31 5 min. read

Bitcoin Price Prediction: Here’s When BTC Could Hit $150,000 as Bitcoin Hyper Presale Goes Viral

After Bitcoin (BTC) hit a new all-time high just above $123,000 yesterday, investor attention is now turning to the $150,000 milestone. Polymarket’s prediction markets show a roughly 46% chance of BTC hitting $150,000 this year, and a 74% probability for the $130,000 level. A few market commentators are even more bullish. For instance, the analyst […]

Altcoin Season Is Starting as Bitcoin Soars to $123,000: Which Crypto to Buy Now?

Bitcoin (BTC) has hit the $123,000 mark for the first time in history, as the market-leading cryptocurrency continues the price discovery phase that began after BTC started hitting new all-time highs last Wednesday. Bullish news updates and key market data, from a frenzy of ETF inflows to the start of “Crypto Week” on Capitol Hill, […]

Best Crypto to Buy Now as Capitol Hill Ignites a High-Stakes Crypto Showdown

U.S. lawmakers have locked horns over a flurry of legislative proposals that could swing Wall Street’s back door wide open to digital assets. Dubbed “Crypto Week,” the clash pits Republicans championing bills like the CLARITY Act, GENIUS Act and a CBDC ban against Democrats warning of national security risks and weakened investor safeguards. The House […]

Best Crypto Presale to Buy: Bitcoin Hyper Smashes $2.5 Million Amid BTC’s Record Highs

Bitcoin crossed its previous all-time high of $111,800 this week, soaring above $118,000 and pushing towards uncharted territory and liquidating over $1 billion shorts in the process. Apart from the crypto-native retail market, US spot Bitcoin ETFs marked the second-largest day for inflows ever, totalling $1.17 billion. The latest rally comes, unlike the previous ones, […]

-

1

Best Crypto to Buy Now as XRP’s Legal Saga With Ripple Ends

28.06.2025 22:31 7 min. read -

2

3 Crypto Presales That Could Generate 100x Returns in Q3

29.06.2025 12:27 4 min. read -

3

Bitcoin Records Another All Time High as Bitcoin Hyper Presale Soars: Best Crypto to Buy?

11.07.2025 12:05 6 min. read -

4

Best Crypto to Buy Now After Trump’s $220 Million Bitcoin Power Play

02.07.2025 19:23 7 min. read -

5

5 Best Crypto to Buy for Q3 Altcoin Season as Bitcoin Dominance Dips

29.06.2025 12:31 5 min. read