Ethereum ETFs See Significant Surge as Institutions Offset Whale Sell-Offs

28.09.2024 16:00 1 min. read Alexander Stefanov

After a stretch of sluggish activity, spot Ethereum ETFs are seeing renewed momentum, largely attributed to increased liquidity following recent Federal Reserve rate cuts.

Despite a slow start to the week, institutional interest in Ethereum investment products has returned, pushing prices up even as large-scale ETH holders have been selling off.

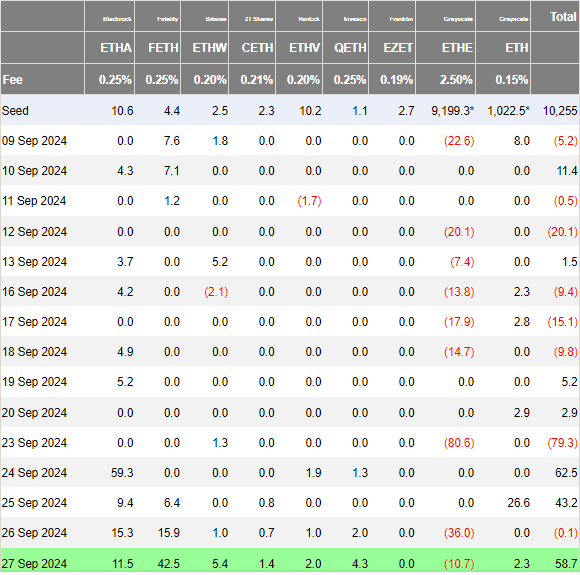

On September 27, Fidelity’s FETH led the pack with $42.5 million, followed by BlackRock’s ETHA with $11.5 million.

At the same time, Grayscale’s ETHE saw $10.7 million in outflows. Earlier in the week, the market had seen nearly $80 million in outflows, but BlackRock’s move quickly restored positive momentum.

Meanwhile, on-chain data reveals significant Ethereum sell-offs. Two major institutions offloaded large sums, including 11,800 ETH by Cumberland and 5,134 ETH from ParaFi Capital.

Additionally, a long-dormant whale sold nearly 13,000 ETH for over $34 million. Despite these large liquidations, the strong ETF inflows seem to be cushioning the market from a deeper decline.

-

1

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

2

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read -

3

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

17.07.2025 18:30 2 min. read -

4

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read -

5

List of Altcoins Seeing Strong Outflows as Binance Signals Shift

13.07.2025 11:00 2 min. read

Standard Chartered: Ethereum Treasury Firms Now Form a Distinct Investment Class

A new report from Standard Chartered highlights that publicly traded companies holding Ethereum (ETH) as a treasury asset have emerged as a unique and fast-evolving asset class, distinct from traditional crypto vehicles such as ETFs or private funds.

Fartcoin Price Prediction: Trader Expects Big Bounce as FARTCOIN Nears $1

Fartcoin (FARTCOIN) has gone down by 17.3% in the past 24 hours and currently sits at $1.14. As the token approaches $1, one trader favors a bullish Fartcoin price prediction. DevKhabib, a pseudonymous trader whose X account is followed by nearly 46,000 users, says that he expects a big bounce off the $1 support after […]

Whale Activity Spikes as Smart Money Eyes Reversal Zones

Amid current market volatility, blockchain analytics firm Santiment has reported a notable rise in whale activity targeting a select group of altcoins.

Binance to Launch PlaysOut (PLAY) Trading on July 31 With Airdrop

Binance has officially announced the launch of PlaysOut (PLAY), a new token debuting on Binance Alpha, with trading scheduled to begin on July 31, 2025, at 08:00 UTC.

-

1

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

2

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read -

3

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

17.07.2025 18:30 2 min. read -

4

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read -

5

List of Altcoins Seeing Strong Outflows as Binance Signals Shift

13.07.2025 11:00 2 min. read