Ethereum ETFs Reversed the Trend, Registering Over $100 million in Inflows

31.07.2024 17:41 1 min. read Kosta Gushterov

For the second time since their launch, spot Etherium (ETH) exchange traded funds saw net positive inflows.

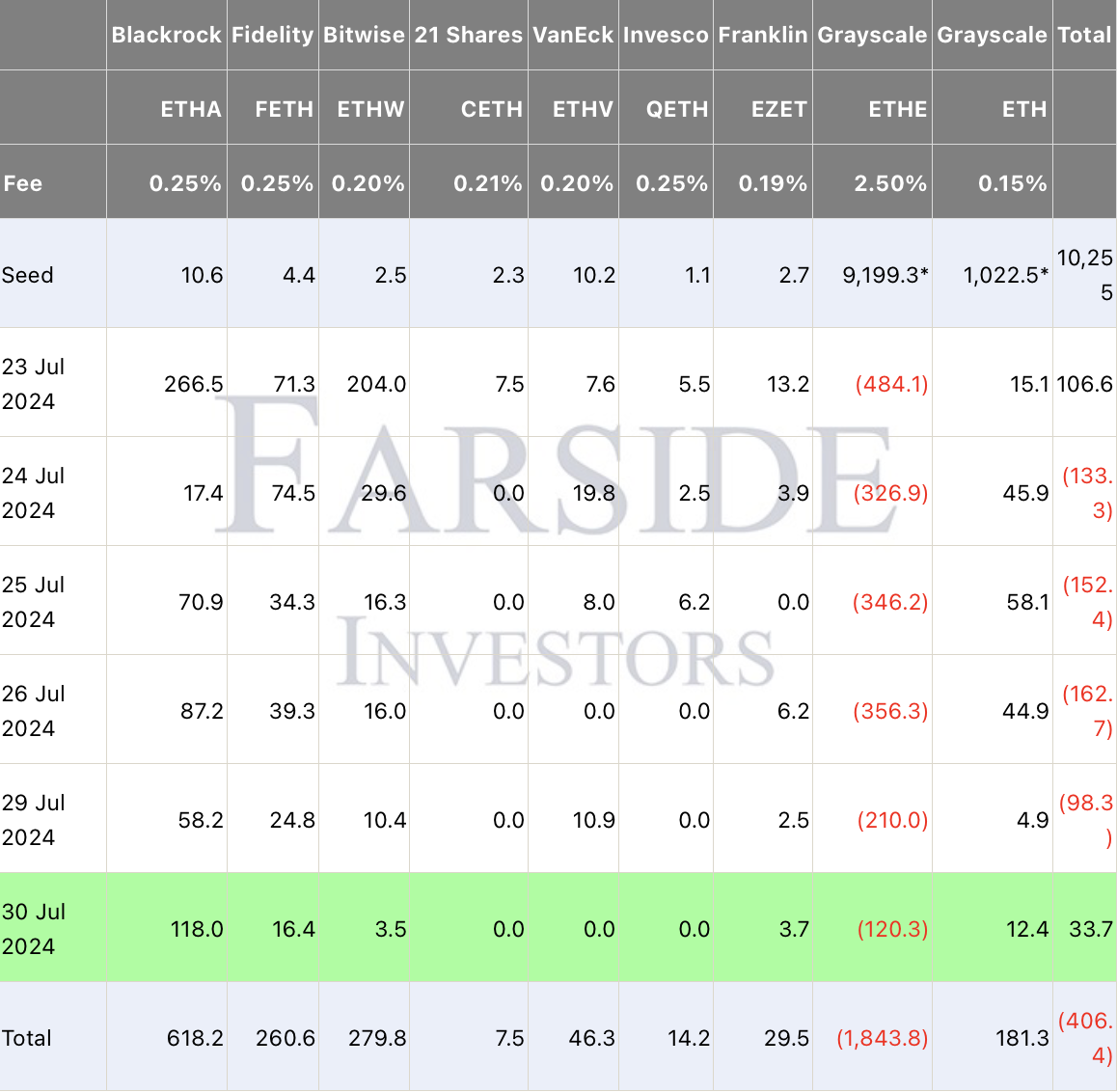

According to Farside Investors, on July 30 these funds saw inflows of $33.7 million, marking a significant change from the last four trading days.

This positive change was mainly due to the reduction in withdrawals from Grayscale’s ETHE.

On July 30, ETHE saw outflows of $120.3 million, which is much lower compared to earlier periods, which is in line with analysts’ forecasts of weakening outflows.

Among ETFs with more significant inflows, BlackRock’s iShares Ethereum ETF (ETHA) led the way with $118 million, followed by Fidelity’s FETH, which attracted $16.4 million.

Bitwise’s ETHW and Franklin Templeton’s EZET added $3.5 million and $3.7 million, respectively, to the totals.

-

1

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

Bitcoin’s breakout to a new all-time high above $118,000 has reignited momentum across the crypto market. While BTC itself saw nice gains several altcoins are riding the wave of renewed investor interest.

Ethereum Jumps 8% to Reclaim $3,000

Ethereum surged 8.4% in the past 24 hours, reaching $3,010 as renewed interest in altcoins follows Bitcoin’s explosive rally.

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

Grayscale, one of the leading cryptocurrency asset managers, has unveiled its latest benchmark update structured around its Crypto Sectors framework.

Trump’s Truth Social to Launch Utility Token for Subscribers

Truth Social, the platform founded by Donald Trump, is moving deeper into the crypto space with plans for a utility token tied to its premium services.

-

1

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read