Ethereum ETFs Reversed the Trend, Registering Over $100 million in Inflows

31.07.2024 17:41 1 min. read Kosta Gushterov

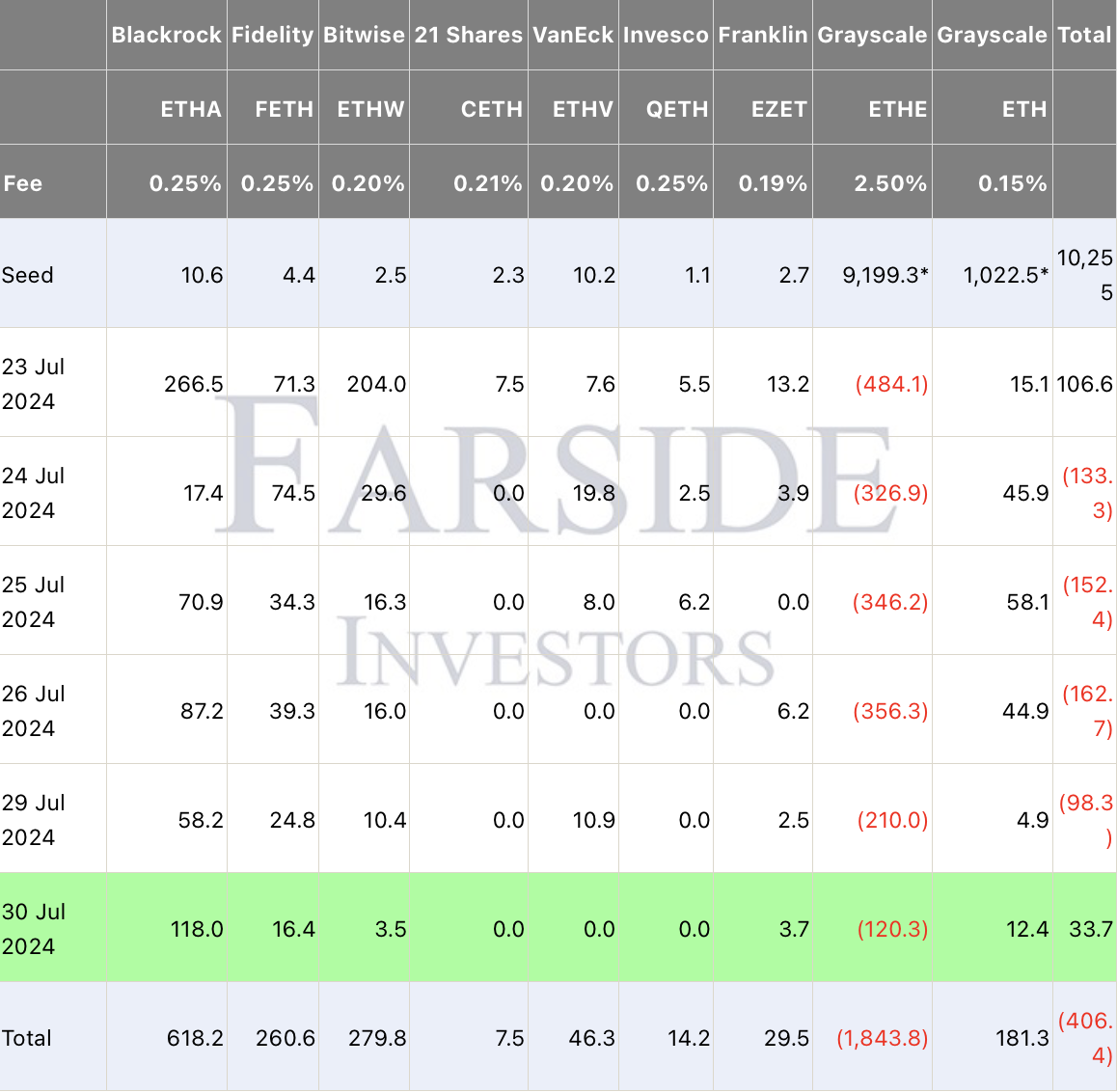

For the second time since their launch, spot Etherium (ETH) exchange traded funds saw net positive inflows.

According to Farside Investors, on July 30 these funds saw inflows of $33.7 million, marking a significant change from the last four trading days.

This positive change was mainly due to the reduction in withdrawals from Grayscale’s ETHE.

On July 30, ETHE saw outflows of $120.3 million, which is much lower compared to earlier periods, which is in line with analysts’ forecasts of weakening outflows.

Among ETFs with more significant inflows, BlackRock’s iShares Ethereum ETF (ETHA) led the way with $118 million, followed by Fidelity’s FETH, which attracted $16.4 million.

Bitwise’s ETHW and Franklin Templeton’s EZET added $3.5 million and $3.7 million, respectively, to the totals.

-

1

Crypto Expert Shares Top Strategies for Spotting High-Potential Altcoins

24.04.2025 9:00 2 min. read -

2

Pi Network Activates Wallets for Millions as Mainnet Access Expands

04.05.2025 13:00 2 min. read -

3

Aptos Network Debates Cutting Staking Rewards to Encourage Real Participation

19.04.2025 10:00 2 min. read -

4

Solana’s Q1 Performance Hints at a Major Shift in Blockchain Dominance

20.04.2025 14:55 2 min. read -

5

ARK Invest Makes Bold Move into Solana with Staked ETF Bet

22.04.2025 13:00 1 min. read

PEPE Adds $600M to Its Market Cap Aided by Whales – Price Prediction and Chart Analysis Inside

Pepe (PEPE) is one of the best-performing meme coins today with 24-hour gains of 29% as the crypto market as a whole is ripping. The token has broken through a long-dated resistance at $0.00000900 and currently sits at $0.000001062. Trading volumes have surged by 168% for PEPE and currently sit at nearly $1.5 billion as […]

Binance Adds New Altcoin with 66% APR Intro Offer

Space and Time’s native token, SXT, debuted across Binance’s full suite of trading and earning products on May 8, 2025.

Pectra is Boosting Ethereum Network, Pushing the Price Toward $2,000

The latest upgrade to Ethereum, Pectra, implemented on May 7, has begun to influence the dynamics of supply on the network.

Pi Network Faces Headwinds as Token Unlocks Threaten Market Stability

Once a rising star in the crypto world, Pi Network is now under pressure as its token unlock schedule threatens to overwhelm market demand.

-

1

Crypto Expert Shares Top Strategies for Spotting High-Potential Altcoins

24.04.2025 9:00 2 min. read -

2

Pi Network Activates Wallets for Millions as Mainnet Access Expands

04.05.2025 13:00 2 min. read -

3

Aptos Network Debates Cutting Staking Rewards to Encourage Real Participation

19.04.2025 10:00 2 min. read -

4

Solana’s Q1 Performance Hints at a Major Shift in Blockchain Dominance

20.04.2025 14:55 2 min. read -

5

ARK Invest Makes Bold Move into Solana with Staked ETF Bet

22.04.2025 13:00 1 min. read