Ethereum ETFs Returned to Negative Results

01.08.2024 10:21 1 min. read Kosta Gushterov

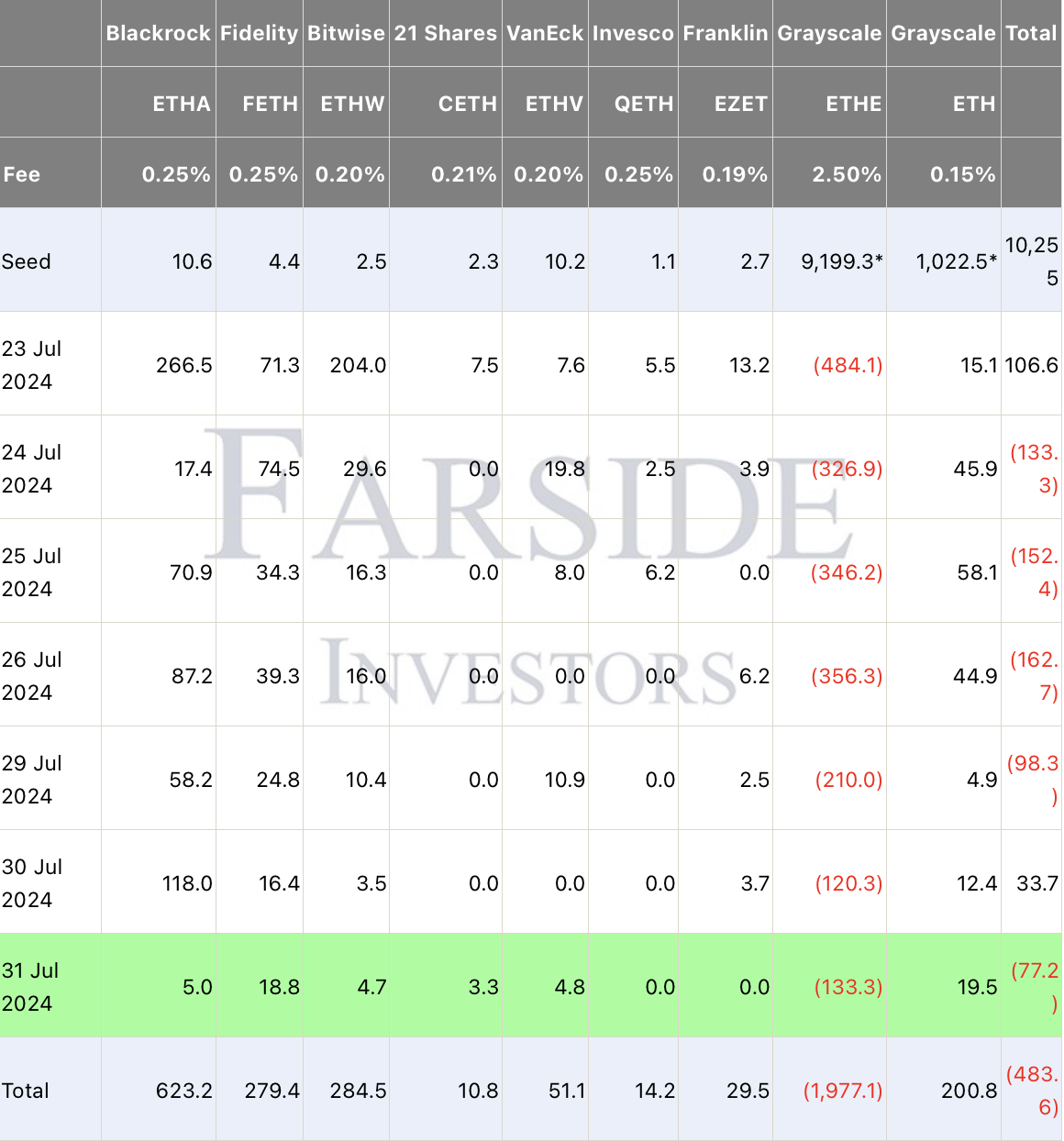

On July 31, U.S. Ethereum ETFs returned to negative results with net outflows of $77.2 million, after registering only their second day of positive inflows since inception on July 30.

According to data from Farside, the Grayscale Ethereum Trust (ETHE) saw a significant one-day outflow of $133.3 million. In contrast, the Grayscale Ethereum Mini Trust (ETH) attracted inflows of $19.5 million, which is also the best result relative to all ETH ETFs.

On the other hand, BlackRock’s iShares Ethereum Trust (ETHA) saw inflows of $5 million, recording its weakest performance since inception, while Fidelity’s FETH garnered $18.8 million.

Bitwise’s ETHW, 21 Shares’ CETH and VanEck’s ETHV attracted $4.7 million, $3.3 million and $4.8 million, respectively,

Overall, the most significant inflows year-to-date have come from BlackRock’s, Bitwise’s and Fidelity’s funds, which have attracted $623.2 million, $284.5 million and $279.4 million, respectively, since launch through July 30.

In contrast, the Grayscale-created Ethereum Trust suffered outflows of $1.997 billion over the same time period.

-

1

Sui Price Prediction: SUI Could Rise to $5 If This Pattern Plays Out

16.06.2025 23:35 3 min. read -

2

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

3

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

4

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

5

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

According to a new analysis from CryptoQuant, TRON (TRX) may be gearing up for a breakout as tightening Bollinger Bands point to an imminent expansion in volatility.

BNB Chain Boosts Transaction Speed and Stability with New Upgrade

BNB Chain is set to upgrade the BNB Smart Chain (BSC) by cutting the block time in half, from 1.5 seconds down to 0.75 seconds.

Chainlink Bounces From Key Support, Eyes Breakout From Downtrend

Cryptocurrency analytics firm MakroVision has shared its technical assessment of Chainlink (LINK) price action.

Pennsylvania Man Sentenced to 8 Years for $40M Crypto Ponzi Scheme

The U.S. Department of Justice has sentenced Dwayne Golden, 57, of Pennsylvania to 97 months in prison for orchestrating a fraudulent crypto investment scheme that stole over $40 million from investors.

-

1

Sui Price Prediction: SUI Could Rise to $5 If This Pattern Plays Out

16.06.2025 23:35 3 min. read -

2

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

3

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

4

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

5

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read