Ethereum ETFs Returned to Negative Results

01.08.2024 10:21 1 min. read Kosta Gushterov

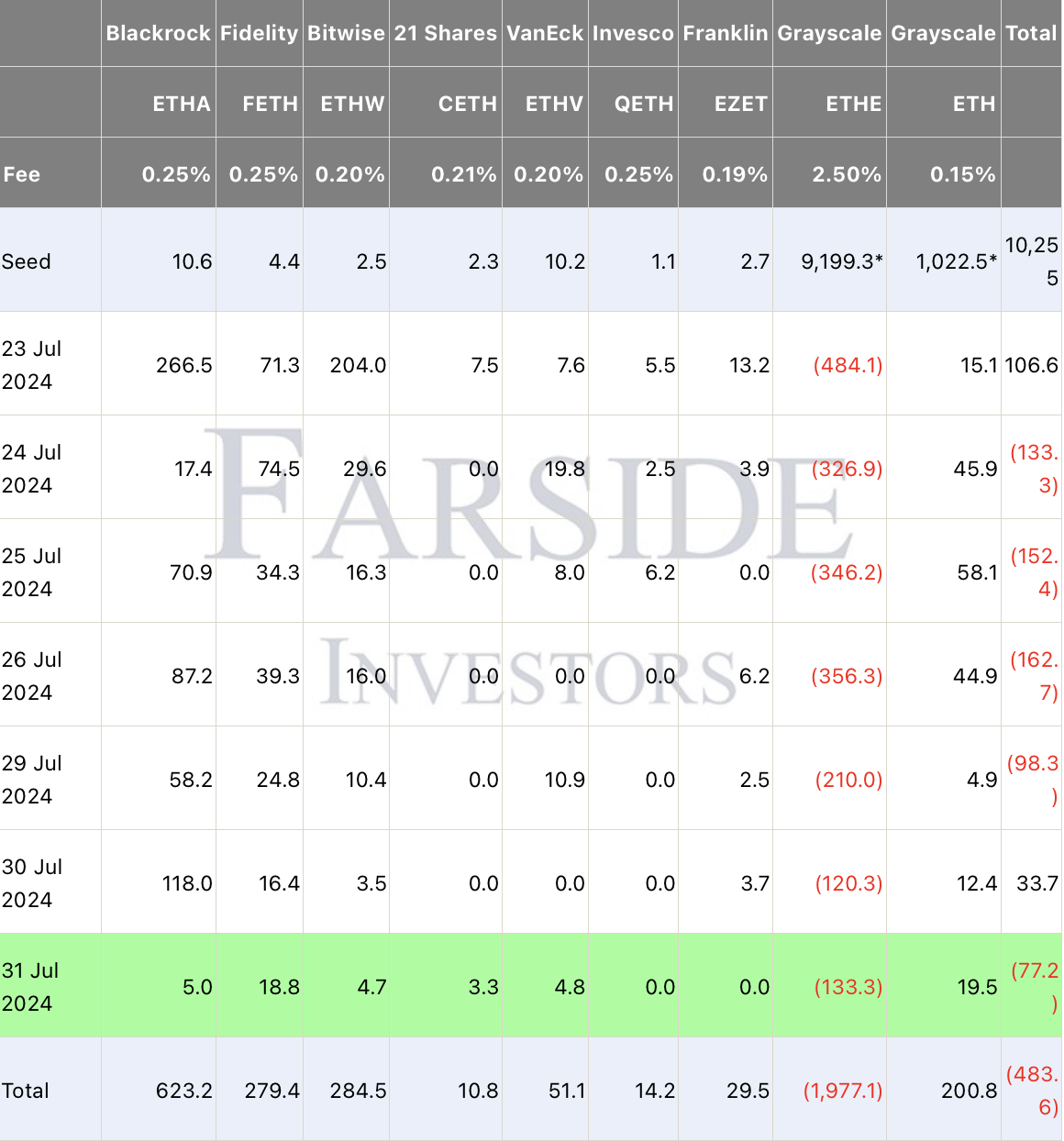

On July 31, U.S. Ethereum ETFs returned to negative results with net outflows of $77.2 million, after registering only their second day of positive inflows since inception on July 30.

According to data from Farside, the Grayscale Ethereum Trust (ETHE) saw a significant one-day outflow of $133.3 million. In contrast, the Grayscale Ethereum Mini Trust (ETH) attracted inflows of $19.5 million, which is also the best result relative to all ETH ETFs.

On the other hand, BlackRock’s iShares Ethereum Trust (ETHA) saw inflows of $5 million, recording its weakest performance since inception, while Fidelity’s FETH garnered $18.8 million.

Bitwise’s ETHW, 21 Shares’ CETH and VanEck’s ETHV attracted $4.7 million, $3.3 million and $4.8 million, respectively,

Overall, the most significant inflows year-to-date have come from BlackRock’s, Bitwise’s and Fidelity’s funds, which have attracted $623.2 million, $284.5 million and $279.4 million, respectively, since launch through July 30.

In contrast, the Grayscale-created Ethereum Trust suffered outflows of $1.997 billion over the same time period.

-

1

TRON’s TRX Sees Price Lift Amid Major Upgrade and Security Breach Drama

04.05.2025 21:00 2 min. read -

2

PEPE Adds $600M to Its Market Cap Aided by Whales – Price Prediction and Chart Analysis Inside

08.05.2025 23:42 3 min. read -

3

JUST Token Gains Momentum Following Bold Forecast from Justin Sun

28.04.2025 14:30 1 min. read -

4

Solana Faces Key Test as Bulls Push Toward Breakout Zone

05.05.2025 14:00 1 min. read -

5

Trump Faces Backlash Over Memecoin-Linked White House Access

04.05.2025 9:00 2 min. read

Speculation Mounts as Cardano ETF Odds Rise, Network Activity Surges

The likelihood of a spot Cardano (ADA) exchange-traded fund (ETF) getting the green light by the end of 2025 is gaining momentum—at least in the eyes of the betting markets.

How This Crypto Trader Turned $9,000 Into Millions in a Month

In one of the most dramatic wealth flips seen this year, a crypto trader has reportedly transformed a modest four-figure investment into millions—thanks to the meteoric rise of a Solana-linked SocialFi project.

Stablecoins Go Mainstream: 90% of Institutions Now Onboard or Exploring Use

A growing wave of financial institutions is turning to stablecoins, not just for cost-cutting—but as a cornerstone of future growth.

Ethereum Could Outpace Bitcoin, Says Project Co-Founder at Consensus 2025

Speaking at Consensus 2025 in Toronto, Ethereum co-founder Anthony Di Iorio offered a nuanced take on the evolving relationship between the world’s two most prominent cryptocurrencies.

-

1

TRON’s TRX Sees Price Lift Amid Major Upgrade and Security Breach Drama

04.05.2025 21:00 2 min. read -

2

PEPE Adds $600M to Its Market Cap Aided by Whales – Price Prediction and Chart Analysis Inside

08.05.2025 23:42 3 min. read -

3

JUST Token Gains Momentum Following Bold Forecast from Justin Sun

28.04.2025 14:30 1 min. read -

4

Solana Faces Key Test as Bulls Push Toward Breakout Zone

05.05.2025 14:00 1 min. read -

5

Trump Faces Backlash Over Memecoin-Linked White House Access

04.05.2025 9:00 2 min. read