Ethereum ETFs Registered First Positive Results in 14 Days

29.08.2024 14:00 1 min. read Alexander Stefanov

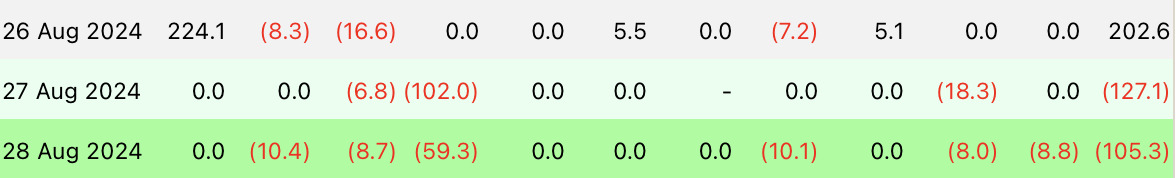

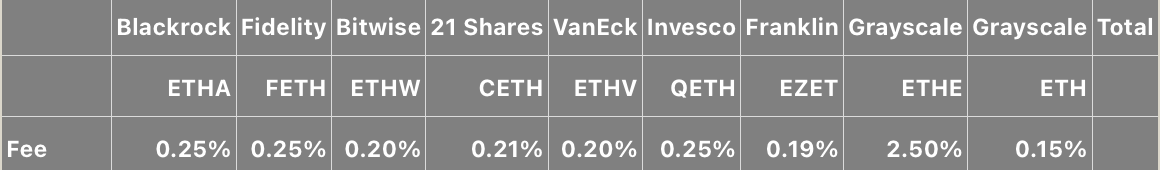

Farside's latest data shows an outflow of funds from Bitcoin ETFs in the U.S. equaling $105.3 million.

Of the 11 ETF issuers, six have realized losses, led by ARKB’s ARK, which has lost $59.3 million.

Fidelity’s FBTC saw an outflow of $10.4 million, while Bitwise’s BITB and VanEck’s HODL lost $8.7 million and $10.1 million, respectively.

Grayscale’s products also suffered outflows, with GBTC and BTC withdrawing $8 million and $8.8 million, respectively. Despite the outflows over the last two trading days, BlackRock’s IBIT did not register any outflows.

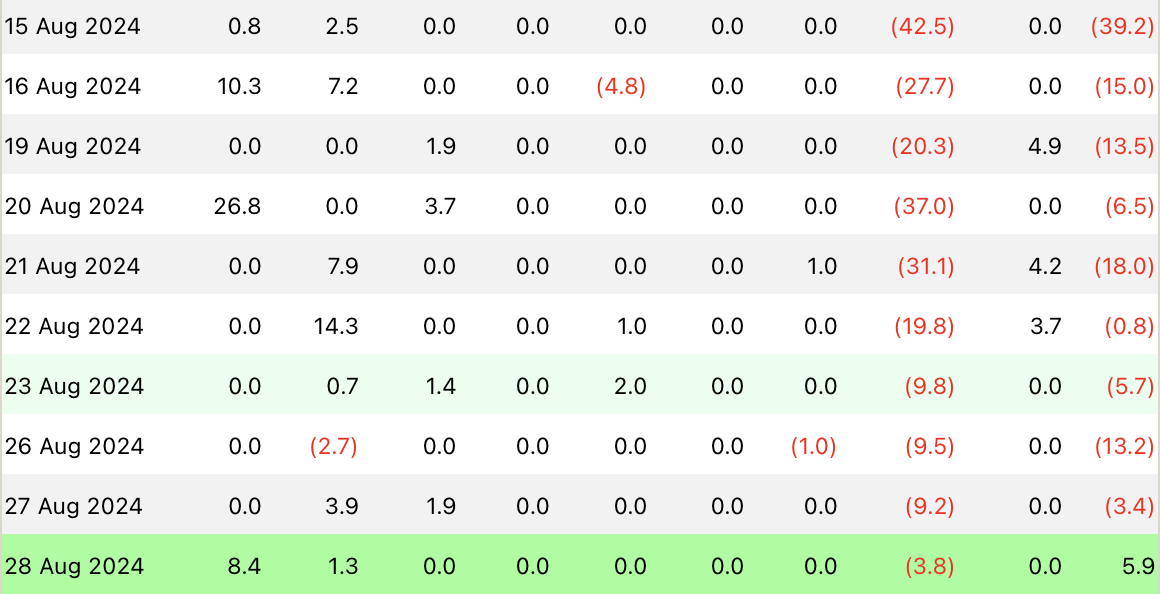

On the other hand, the Ethereum ETFs showed a slight positive change, registering their first inflow since August 14, with $5.9 million coming in.

Blackrock’s ETHA registered the best performance, attracting $8.4 million, followed by Fidelity’s FETH with $1.3 million.

However, Grayscale’s ETHE continued to report outflows, albeit at a reduced rate, losing only $3.8 million.

-

1

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

2

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

Spot Bitcoin ETFs recorded a massive influx of over $1 billion in a single day on Thursday, fueled by Bitcoin’s surge to a new all-time high above $118,000.

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

Bitcoin’s breakout to a new all-time high above $118,000 has reignited momentum across the crypto market. While BTC itself saw nice gains several altcoins are riding the wave of renewed investor interest.

Bitcoin Outlook: Rising U.S. Debt and Subdued Euphoria Suggest More Upside Ahead

As Bitcoin breaks above $118,000, fresh macro and on-chain data suggest the rally may still be in its early innings.

Analysis Firm Explains Why Bitcoin’s Breakout Looks Different This Time

Bitcoin’s surge to new all-time highs is playing out differently than previous rallies, according to a July 11 report by crypto research and investment firm Matrixport.

-

1

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

2

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read