Ethereum ETFs Registered First Positive Results in 14 Days

29.08.2024 14:00 1 min. read Alexander Stefanov

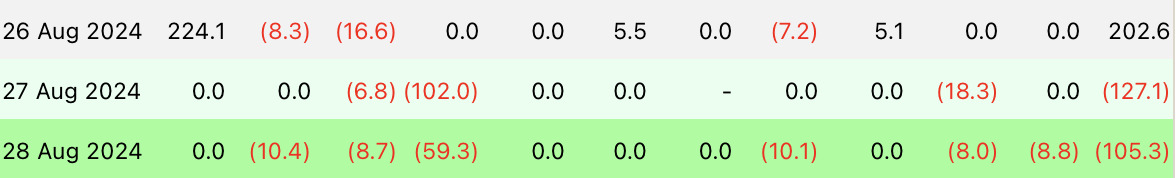

Farside's latest data shows an outflow of funds from Bitcoin ETFs in the U.S. equaling $105.3 million.

Of the 11 ETF issuers, six have realized losses, led by ARKB’s ARK, which has lost $59.3 million.

Fidelity’s FBTC saw an outflow of $10.4 million, while Bitwise’s BITB and VanEck’s HODL lost $8.7 million and $10.1 million, respectively.

Grayscale’s products also suffered outflows, with GBTC and BTC withdrawing $8 million and $8.8 million, respectively. Despite the outflows over the last two trading days, BlackRock’s IBIT did not register any outflows.

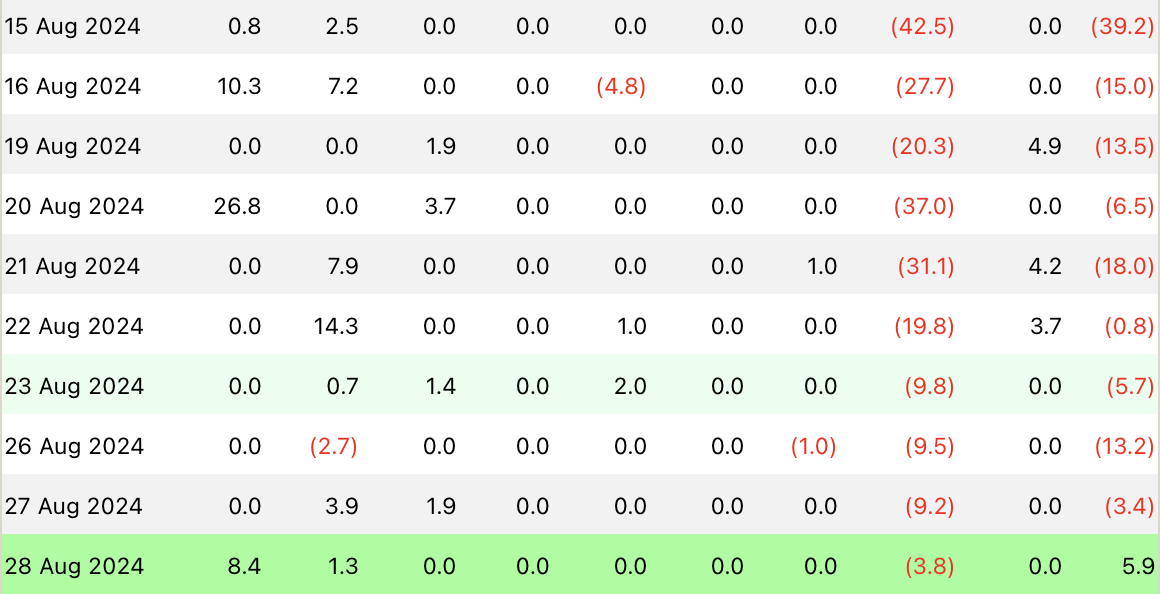

On the other hand, the Ethereum ETFs showed a slight positive change, registering their first inflow since August 14, with $5.9 million coming in.

Blackrock’s ETHA registered the best performance, attracting $8.4 million, followed by Fidelity’s FETH with $1.3 million.

However, Grayscale’s ETHE continued to report outflows, albeit at a reduced rate, losing only $3.8 million.

-

1

Cardano ETF Approval Odds Hit Record High on Polymarket

22.06.2025 12:00 2 min. read -

2

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

3

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

4

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read -

5

Solana Price Prediction: Trader Thinks SOL Could Rise to $200 in July – Here’s Why

26.06.2025 22:25 3 min. read

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

BlackRock’s iShares Bitcoin Trust (IBIT) has officially crossed the 700,000 BTC mark, reinforcing its position as one of the fastest-growing exchange-traded funds in financial history.

Trump’s Truth Social Files For Spot Crypto ETF Holding 5 Cryptocurrencies

Truth Social, the media venture linked to U.S. President Donald Trump, has taken a bold step into the digital asset space with a fresh filing for a spot cryptocurrency exchange-traded fund (ETF).

Whales Quietly Accumulate Four Altcoins: Early Signals of Potential Rally

Large-scale investors are steadily increasing long positions in several overlooked altcoins, signaling a potential early-stage accumulation phase.

Ethereum Price Prediction: ETH Ongoing Accumulation Favors Bullish Outlook – Can It Rise to $5,000?

Ethereum (ETH) has gone up by 1% in the past 24 hours and trading volumes have increased by 12% after news that Donald Trump’s media company has filed an application to list a crypto exchange-traded fund (ETF). The top altcoin is included in the prospectus with a target 15% weight on the ETF’s portfolio. This […]

-

1

Cardano ETF Approval Odds Hit Record High on Polymarket

22.06.2025 12:00 2 min. read -

2

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

3

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

4

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read -

5

Solana Price Prediction: Trader Thinks SOL Could Rise to $200 in July – Here’s Why

26.06.2025 22:25 3 min. read