Ethereum ETFs Attract $2 Billion, Yet Trail Behind Bitcoin Funds

22.08.2024 14:00 1 min. read Alexander Stefanov

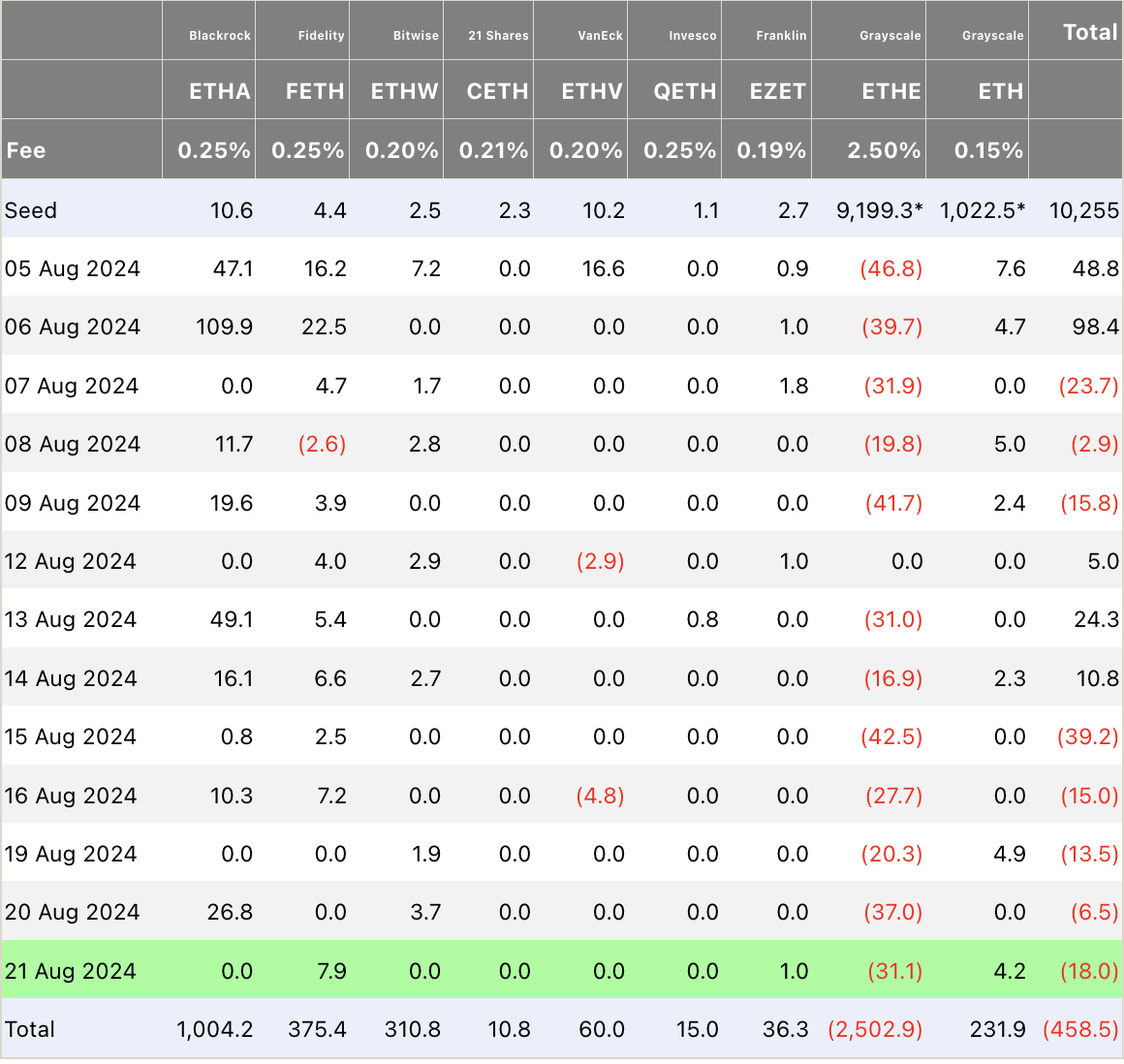

In the past four weeks, spot Ethereum ETFs have attracted over $2 billion in new investments, excluding a major $2.5 billion outflow from Grayscale’s ETHE, as reported by Farside Investors.

Nate Geraci, CEO of ETF Store, remarked that if all Ethereum ETF inflows were consolidated into a single fund, it would rank as the fourth-largest ETF debut ever. Currently, only Bitcoin ETFs—BlackRock’s IBIT, Fidelity’s FBTC, and ARK 21Shares’ ARKB—exceed this total.

Bloomberg’s Eric Balchunas highlighted that, globally, ETF investments have reached $911 billion for the year, with US-based spot crypto ETFs contributing $17 billion, or about 2% of the total. IBIT is now the third-largest ETF by inflows, approaching $20.5 billion, while FBTC has nearly $10 billion.

Despite hitting the $2 billion mark, Ethereum ETFs are not performing as well as their Bitcoin counterparts. Bitfinex analysts link this to Ethereum’s recent downturn, which saw its value fall by 40% in the last month.

The broader economic climate has also impacted the market. Recent interest rate hikes in Japan have cooled investor enthusiasm, and a significant sell-off in the crypto market earlier this year led to notable losses.

Aurelie Barthere of Nansen noted that a subsequent sell-off from July to August further pressured Ethereum due to its increasing correlation with traditional equities, amid slowing US economic growth and high valuations in other risk assets.

-

1

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

2

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

3

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

4

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

5

Ethereum Price Prediction: ETH Ongoing Accumulation Favors Bullish Outlook – Can It Rise to $5,000?

08.07.2025 16:35 3 min. read

Dogecoin Soars 11% as Bit Origin Bets $500M on Meme Coin Reserves

Dogecoin posted an 11% surge in 24 hours, powered by institutional moves, bullish chart signals, and growing altcoin momentum.

Dogecoin Price Prediction: DOGE Volumes Nearly Double – Can It Get to $1 In This Cycle?

Dogecoin (DOGE) has gone up by 10% in the past 24 hours and currently sits at $0.2360 as the top meme coin is playing catch-up with newcomers to maintain its leadership. In the past 30 days, DOGE has shined as it has delivered gains of 40.5%. Trading volumes in the past day have surged by […]

Binance to Support Maker (MKR) Token Swap and Rebranding to Sky (SKY)

Binance has officially announced its support for the upcoming token swap, redenomination, and rebranding of Maker (MKR) to a new token named Sky (SKY).

Top 10 Trending Cryptocurrencies, According to CoinGecko

As of July 18, 2025, the cryptocurrency market continues to showcase sharp volatility, led by meme tokens, Layer 1 innovations, and key large-cap assets.

-

1

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

2

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

3

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

4

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

5

Ethereum Price Prediction: ETH Ongoing Accumulation Favors Bullish Outlook – Can It Rise to $5,000?

08.07.2025 16:35 3 min. read