Ethereum ETFs Attract $2 Billion, Yet Trail Behind Bitcoin Funds

22.08.2024 14:00 1 min. read Alexander Stefanov

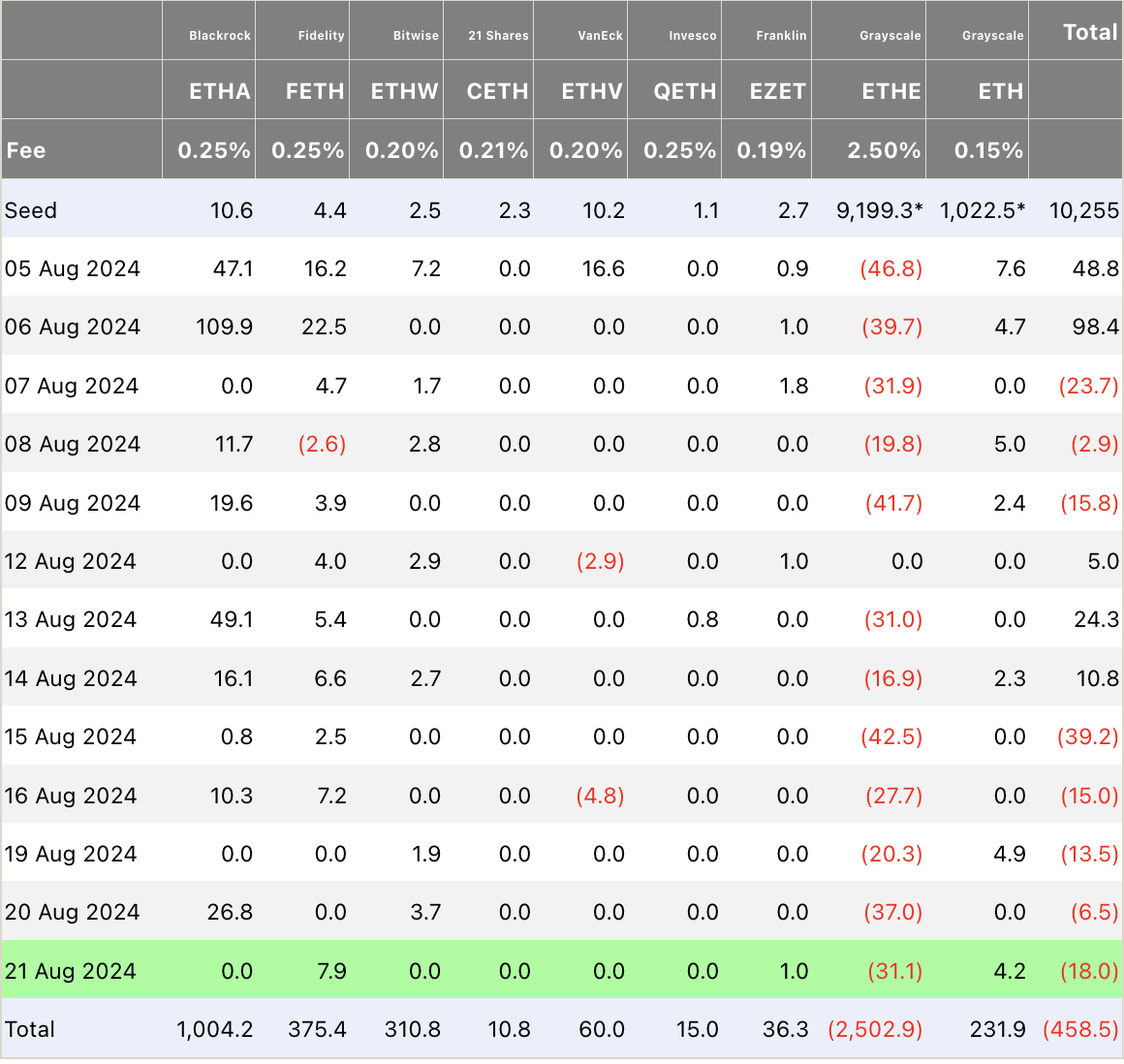

In the past four weeks, spot Ethereum ETFs have attracted over $2 billion in new investments, excluding a major $2.5 billion outflow from Grayscale’s ETHE, as reported by Farside Investors.

Nate Geraci, CEO of ETF Store, remarked that if all Ethereum ETF inflows were consolidated into a single fund, it would rank as the fourth-largest ETF debut ever. Currently, only Bitcoin ETFs—BlackRock’s IBIT, Fidelity’s FBTC, and ARK 21Shares’ ARKB—exceed this total.

Bloomberg’s Eric Balchunas highlighted that, globally, ETF investments have reached $911 billion for the year, with US-based spot crypto ETFs contributing $17 billion, or about 2% of the total. IBIT is now the third-largest ETF by inflows, approaching $20.5 billion, while FBTC has nearly $10 billion.

Despite hitting the $2 billion mark, Ethereum ETFs are not performing as well as their Bitcoin counterparts. Bitfinex analysts link this to Ethereum’s recent downturn, which saw its value fall by 40% in the last month.

The broader economic climate has also impacted the market. Recent interest rate hikes in Japan have cooled investor enthusiasm, and a significant sell-off in the crypto market earlier this year led to notable losses.

Aurelie Barthere of Nansen noted that a subsequent sell-off from July to August further pressured Ethereum due to its increasing correlation with traditional equities, amid slowing US economic growth and high valuations in other risk assets.

-

1

Canada Green-Lights First XRP ETF, Beating the U.S. to Market

17.06.2025 9:00 1 min. read -

2

Cardano Shows Signs of Recovery as Market Sentiment Turns Positive

17.06.2025 16:00 1 min. read -

3

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

06.06.2025 13:00 1 min. read -

4

Uphold Wants to Pay Yield on XRP – Here’s the Work-Around

15.06.2025 19:00 2 min. read -

5

Public Company Makes Bold Bet on Ethereum With $463M Investment

13.06.2025 19:00 1 min. read

Pennsylvania Man Sentenced to 8 Years for $40M Crypto Ponzi Scheme

The U.S. Department of Justice has sentenced Dwayne Golden, 57, of Pennsylvania to 97 months in prison for orchestrating a fraudulent crypto investment scheme that stole over $40 million from investors.

Snorter Token ($SNORT) Price Prediction, ChatGPT Forecasts 10x by end of 2025

Snorter Token ($SNORT) is a new meme coin and utility token designed to enhance crypto trading with its Telegram-native trading bot, Snorter Bot. This bot is equipped with sniping capabilities, copy trading, and swap functionalities, offering traders the ability to profit from the volatile crypto markets. As the presale has garnered significant attention, raising over […]

Binance Netflow Data Shows Diverging Altcoin Trends

According to a new report from CryptoQuant, recent Binance netflow data reveals a clear divergence in altcoin behavior — offering insights into which tokens may be poised for upside and which could face near-term sell pressure.

What Are the Most Talked-About Words in Crypto Today?

Cryptocurrency analysis firm Santiment has revealed the words that have attracted the most attention in the cryptocurrency community in the last 24 hours.

-

1

Canada Green-Lights First XRP ETF, Beating the U.S. to Market

17.06.2025 9:00 1 min. read -

2

Cardano Shows Signs of Recovery as Market Sentiment Turns Positive

17.06.2025 16:00 1 min. read -

3

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

06.06.2025 13:00 1 min. read -

4

Uphold Wants to Pay Yield on XRP – Here’s the Work-Around

15.06.2025 19:00 2 min. read -

5

Public Company Makes Bold Bet on Ethereum With $463M Investment

13.06.2025 19:00 1 min. read