Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

30.06.2025 18:00 2 min. read Kosta Gushterov

A new CryptoQuant report highlights a growing divergence between long-term Ethereum holders and short-term Bitcoin buyers, with significant accumulation behavior unfolding in both markets amid increasing political and economic tension in the U.S.

According to on-chain data, Ethereum has seen a notable uptick in long-term accumulation activity throughout June. During a period of price consolidation, significant buying pressure emerged from addresses classified as long-term holders.

The chart shared by CryptoQuant shows a clear divergence: while ETH price moved sideways, accumulation volume spiked—often a precursor to a breakout move.

This behavior reflects confidence from experienced investors who tend to buy during periods of uncertainty, when retail activity is subdued.

Bitcoin: Short-Term Holders Jump In

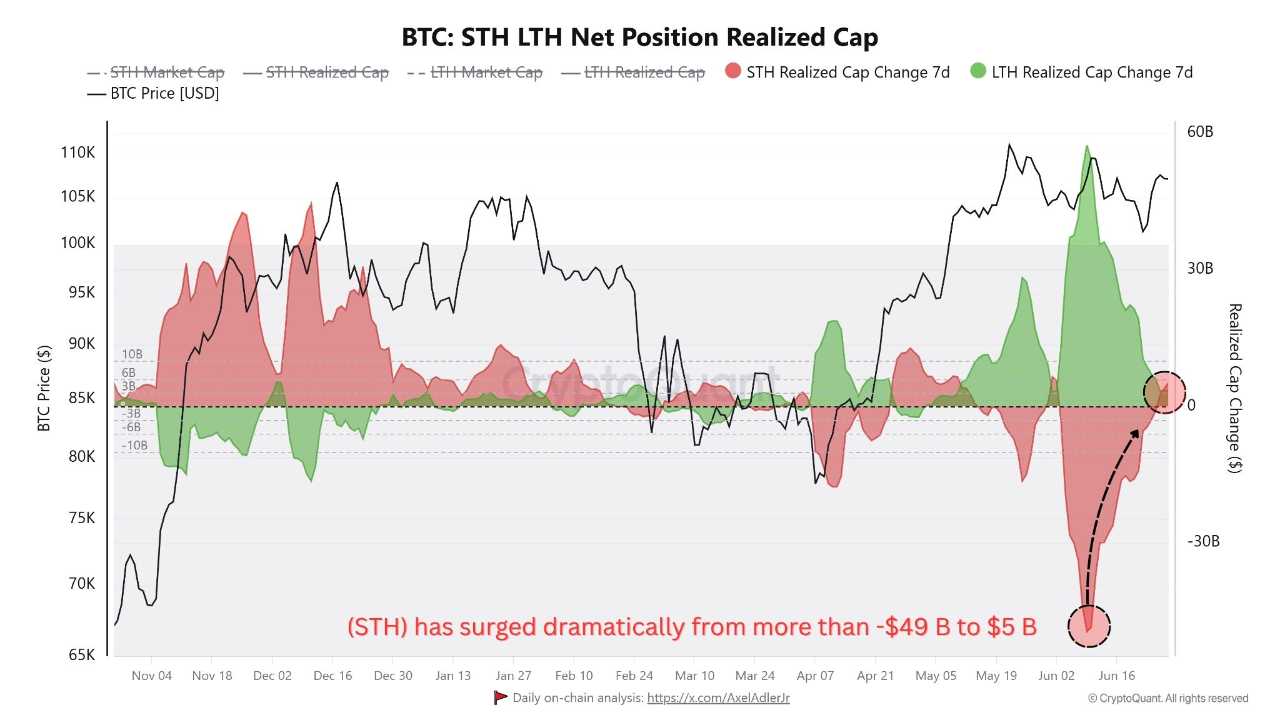

Meanwhile, Bitcoin is seeing an opposite trend. CryptoQuant’s Short-Term Holder (STH) Net Position Realized Cap jumped from -$49 billion to over $5 billion in recent days. This aggressive rise indicates a wave of new entrants—primarily retail traders—buying Bitcoin at elevated levels.

Historically, such behavior has signaled heightened market euphoria, and has often coincided with local tops. The combination of surging short-term interest and long-term ETH accumulation suggests a possible market inflection point ahead.

Binance ETH Inflows Raise Caution

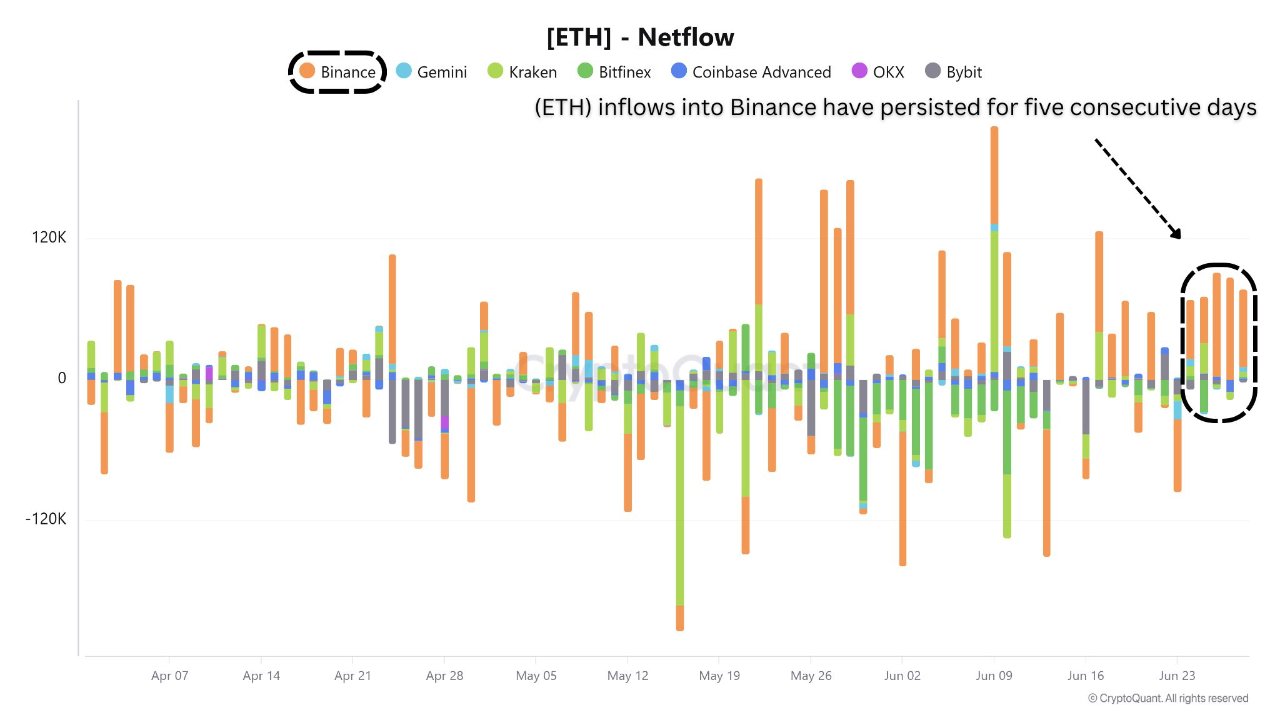

Adding to the complexity, Ethereum inflows to Binance have continued for five consecutive days, a pattern that often signals rising sell-side pressure. Traders moving ETH to centralized exchanges may be preparing to take profits or rebalance portfolios—especially after weeks of sideways price action.

U.S. Politics May Drive Volatility Ahead

The on-chain signals emerge just as political developments heat up in the United States. President Trump recently urged the Senate to pass the “One Big Beautiful Bill,” a sweeping package of tax cuts and military spending proposals. The legislation includes major tax relief for seniors and workers and is positioned as a patriotic win ahead of the July 4 holiday.

However, Elon Musk voiced concern about the bill’s long-term implications. He warned that unfunded tax cuts could swell the U.S. deficit and pose structural risks to strategic industries. Economists echo similar concerns, noting that without matching spending cuts, the bill could fuel debt accumulation and future inflationary pressure.

Market Outlook: Divergence May Resolve Soon

In the face of political crosswinds and mixed on-chain signals, investors appear divided. Ethereum’s long-term holders are showing conviction, while Bitcoin’s retail surge suggests fear of missing out is returning. Coupled with inflows to Binance and macroeconomic uncertainty, the next few weeks could bring significant price action across crypto markets.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

3

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

4

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read

Ethereum: What The Last Move Tells us About the Next One

Ethereum is showing strength in the face of broader market weakness, holding firm even as Bitcoin and other major assets trend downward.

PENGU Price Eyes Bounce From Key Support Level – What’s Next?

Pudgy Penguins’ native token $PENGU is attracting renewed attention from traders after showing consistent support at a key technical level.

Sui Price Prediction: As DeFi TVL Jumps by 42% – Will SUI Hit $5 Soon?

Sui (SUI) has gone up by 34% in the past 30 days as the project’s DeFi ecosystem has been growing rapidly this year. This favors a bullish SUI price prediction as it indicates increased adoption by developers. Data from DeFi Llama shows that the total value locked (TVL) within the Sui blockchain has expanded by […]

Eric Trump Says Ethereum is Undervalued, Backs Analyst’s $8,000 Target

U.S. President Donald Trump continues to draw attention for his pro-cryptocurrency stance—and now his son, Eric Trump, is turning the spotlight to Ethereum.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

3

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

4

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read