Eric Trump Says Ethereum is Undervalued, Backs Analyst’s $8,000 Target

25.07.2025 15:50 2 min. read Kosta Gushterov

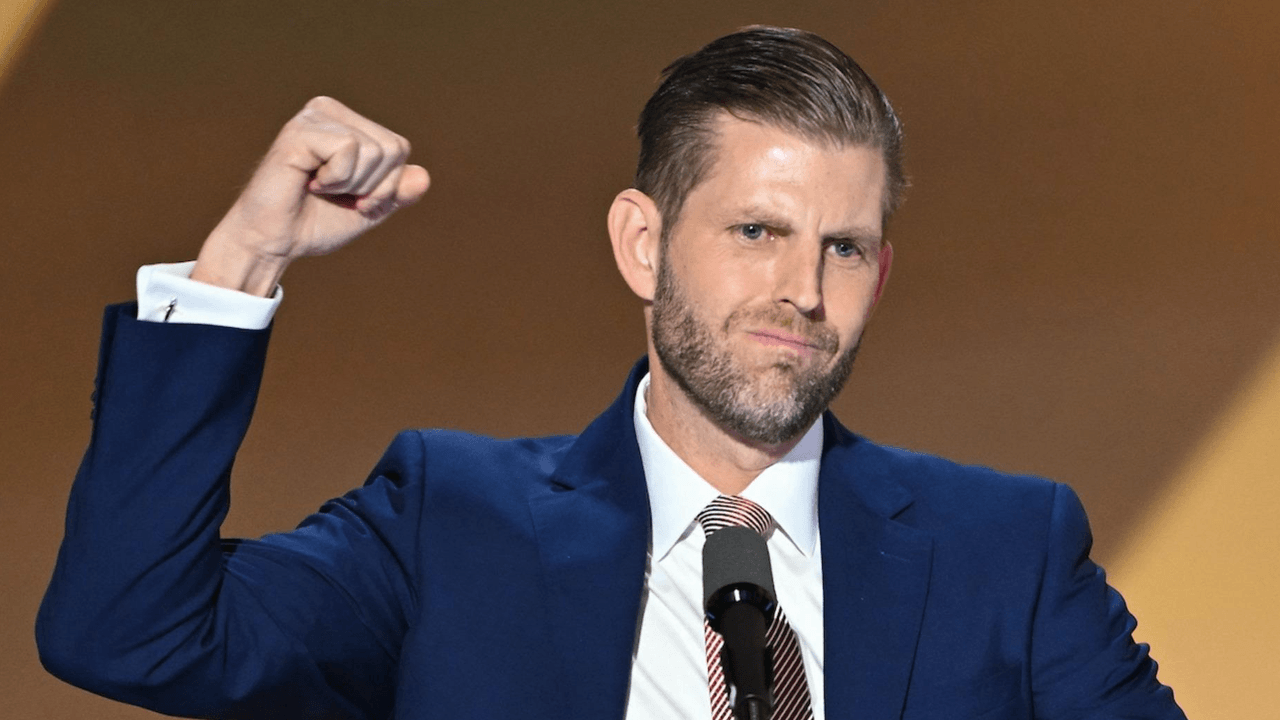

U.S. President Donald Trump continues to draw attention for his pro-cryptocurrency stance—and now his son, Eric Trump, is turning the spotlight to Ethereum.

In a recent post on X, Eric Trump backed a bold valuation thesis suggesting ETH is significantly undervalued in today’s market.

A bullish signal from the Trump circle

Eric Trump, director of Bitcoin mining company American Bitcoin and an open supporter of crypto, retweeted a post by analyst Ted Pillows, who argued that Ethereum is tracking global liquidity and should already be priced above $8,000.

Pillows based his argument on the correlation between Ethereum’s historical price trends and M2 money supply growth. He described ETH as one of the most promising opportunities in the market right now—an opinion Eric Trump echoed with a simple but direct response: “I agree.”

Agreed! $ETH https://t.co/3vUn5kOiT0

— Eric Trump (@EricTrump) July 24, 2025

Eric has previously stated that his crypto portfolio includes Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Sui (SUI), signaling broader interest in Layer-1 assets.

Short-term headwinds temper long-term optimism

While the Trump family’s crypto enthusiasm fuels market buzz, analysts are sounding cautious notes about Ethereum’s near-term outlook. Markus Thielen, head of research at 10X Research, warned this week that ETH may be facing an unstable period as borrowing costs rise sharply.

Thielen pointed to data from Aave, a leading Ethereum-based lending platform. Since July 8, Aave’s ETH borrow utilization has surged from 86% to 95%, pushing variable interest rates higher. This spike in borrowing demand has made it less profitable to borrow ETH—signaling potential strain on the network.

“If this dynamic doesn’t cool down,” Thielen warned, “it could trigger a meaningful pullback in Ethereum, especially if funding rates and positioning stay tight.”

He also noted that while technical indicators now show signs of overvaluation, his longer-term view remains optimistic. Thielen expects more favorable market conditions—and a return to upside momentum for ETH—sometime after September.

Conclusion

As institutional demand grows and figures like Eric Trump publicly support Ethereum’s long-term case, the spotlight on ETH continues to intensify. But with borrowing pressures building and volatility rising, the next few weeks may test how far sentiment alone can carry the market.

-

1

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

4

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

5

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read

XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

Top 5 Most Trending Cryptocurrencies Today: Zora, Pudgy Penguins, SUI and More

Crypto markets are buzzing with momentum as several altcoins post double-digit gains and surging volumes.

Sui Price Jumps 14% to $4.26 amid ETF Hopes

Sui (SUI) surged 14% in the past 24 hours, reaching $4.26 as bullish technical patterns, Bitcoin’s rebound, and renewed ETF speculation pushed the altcoin higher.

HBAR Mirrors 2021 Cycle as Key Breakout Test Approaches

Hedera Hashgraph (HBAR) is closely tracking its 2021 price behavior, according to crypto analyst Rekt Capital.

-

1

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

4

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

5

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read