Dow Jones and S&P 500 signal an imminent market crash

17.02.2025 14:00 2 min. read Alexander Zdravkov

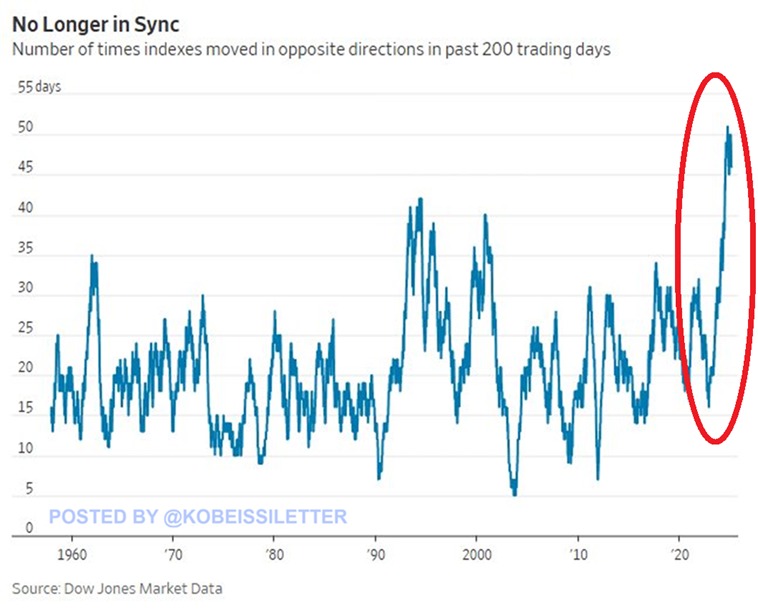

The stock market may be headed for turmoil as a historic divergence emerges between the Dow Jones Industrial Average and the S&P 500.

Over the past 200 trading days, the two indexes have moved in opposite directions 50 times – an unprecedented divergence, according to a Feb. 16 post in The Kobeissi Letter. Remarkably, this divergence exceeds those seen during previous financial crises, including the 1994 bond market crash and the 2000 dotcom bubble.

A key factor in this divergence is the dominance of large-cap technology stocks in the S&P 500. Nearly a third of the index is weighted to companies that are benefiting from the artificial intelligence boom, while the Dow, which is less exposed to technology investments, has lagged – by 17 percentage points over the past two years. Such gaps between indexes are rare and have historically signaled big market shifts, often preceding corrections.

This divergence has also renewed the debate about the significance of the Dow Jones. Some argue that with just 30 stocks and a price-weighted methodology, it no longer reflects broader market trends, while the S&P 500 with its tech composition may provide a more accurate picture.

Analysts warn that if tech valuations are too high, the gap could signal an imminent correction. Alternatively, sector rotation – a shift of capital from technology to industrial and financial stocks – could allow the Dow to recover while slowing the S&P 500’s momentum.

Economist Henrik Seeberg warned that while the S&P 500 has reached all-time highs, this could be a prerequisite for a serious decline. Recent volatility and large capital movements have only heightened fears of an imminent crash.

-

1

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

2

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

3

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

4

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read

U.S. Public Pension Giant Boosts Palantir and Strategy Holdings in Q2

According to a report by Barron’s, the Ohio Public Employees Retirement System (OPERS) made notable adjustments to its portfolio in Q2 2025, significantly increasing exposure to Palantir and Strategy while cutting back on Lyft.

Key Crypto Events to Watch in the Next Months

As crypto markets gain momentum heading into the second half of 2025, a series of pivotal regulatory and macroeconomic events are poised to shape sentiment, liquidity, and price action across the space.

Here is Why Stablecoins Are Booming, According to Tether CEO

In a recent interview with Bankless, Tether CEO Paolo Ardoino shed light on the growing adoption of stablecoins like USDT, linking their rise to global economic instability and shifting generational dynamics.

U.S. Dollar Comes Onchain as GENIUS Act Ushers in Digital Era

In a statement that marks a major policy shift, U.S. Treasury Secretary Scott Bessent confirmed that blockchain technologies will play a central role in the future of American payments, with the U.S. dollar officially moving “onchain.”

-

1

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

2

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

3

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

4

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read