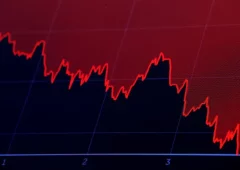

Billionaire Ray Dalio Warns of U.S. Debt Crisis, Calls for Urgent Action

16.02.2025 20:00 2 min. read Kosta Gushterov

Billionaire investor Ray Dalio has issued a stark warning about the U.S. economy, suggesting that the country is heading toward a dangerous "debt death spiral" due to its growing fiscal deficits.

Speaking in a CNBC interview, the Bridgewater Associates founder explained that a healthy credit system benefits all participants, from borrowers to lenders, as long as debt is used productively to generate income.

However, he believes the U.S. government is now borrowing at an unsustainable pace, potentially outstripping demand from buyers. This could force the government to take on more debt just to cover existing obligations, a scenario that Dalio says could spiral out of control.

He compares the situation to a clogged circulatory system, where excessive debt functions like plaque restricting blood flow. With interest payments alone approaching $1 trillion annually, the ability to allocate funds elsewhere is becoming increasingly constrained.

Dalio also highlights a critical supply-and-demand imbalance in the credit markets. With the U.S. deficit projected at around 7.5% of GDP, the government must sell a significant amount of debt to cover its shortfall. But if investor appetite fails to keep pace, the situation could deteriorate rapidly. He describes this as a classic debt cycle where borrowing becomes self-perpetuating, leading investors to lose confidence and offload government debt—pushing the system closer to collapse.

To prevent a full-blown crisis, Dalio argues that the U.S. must take decisive action by reducing its deficit to 3% of GDP, a strategy he calls “the 3% solution.” Achieving this, he says, would require both spending cuts and lower interest rates. He warns that failure to implement these measures could lead to dire consequences, urging political leaders to take responsibility before it’s too late.

-

1

Warren Buffett Narrows His Bets as He Prepares to Step Down

14.06.2025 16:00 2 min. read -

2

Why Gold Could Be the Smart Play Amidst US Debt Surge

11.06.2025 11:00 1 min. read -

3

MEXC Sets Up $100M Emergency Fund to Protect Users From Major Security Incidents

12.06.2025 11:00 1 min. read -

4

NFTs Quietly Evolve Into Core Digital Infrastructure

13.06.2025 17:00 2 min. read -

5

Peter Thiel-Backed Bullish Quietly Files for IPO as Crypto Firms Eye Wall Street

11.06.2025 22:00 1 min. read

Key U.S. Events to Watch This Week That Could Impact Crypto

The first week of July brings several important developments in the United States that could influence both traditional markets and the cryptocurrency sector.

Here Is How Your Crypto Portfolio Should Look Like According to Investment Manager

Ric Edelman, one of the most influential voices in personal finance, has radically revised his stance on crypto allocation. After years of cautious optimism, he now believes that digital assets deserve a far larger share in investment portfolios than ever before.

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

In the case involving Terraform Labs and its co-founder Do Hyeong Kwon, the defense has asked the Federal Court for the Southern District of New York to extend the deadline for pretrial filings by two weeks, pushing it beyond the original date of July 1, 2025.

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

Coinbase has emerged as the best-performing stock in the S&P 500 for June, climbing 43% amid a surge of bullish momentum driven by regulatory clarity, product innovation, and deeper institutional interest in crypto.

-

1

Warren Buffett Narrows His Bets as He Prepares to Step Down

14.06.2025 16:00 2 min. read -

2

Why Gold Could Be the Smart Play Amidst US Debt Surge

11.06.2025 11:00 1 min. read -

3

MEXC Sets Up $100M Emergency Fund to Protect Users From Major Security Incidents

12.06.2025 11:00 1 min. read -

4

NFTs Quietly Evolve Into Core Digital Infrastructure

13.06.2025 17:00 2 min. read -

5

Peter Thiel-Backed Bullish Quietly Files for IPO as Crypto Firms Eye Wall Street

11.06.2025 22:00 1 min. read