Dogecoin Price Surges as Department of Government Efficiency Adds Memecoin Logo

21.01.2025 14:10 1 min. read Alexander Zdravkov

The launch of a new government department during Trump’s inauguration has sparked widespread discussion in the digital asset community, largely due to its playful nod to the popular meme coin, Dogecoin.

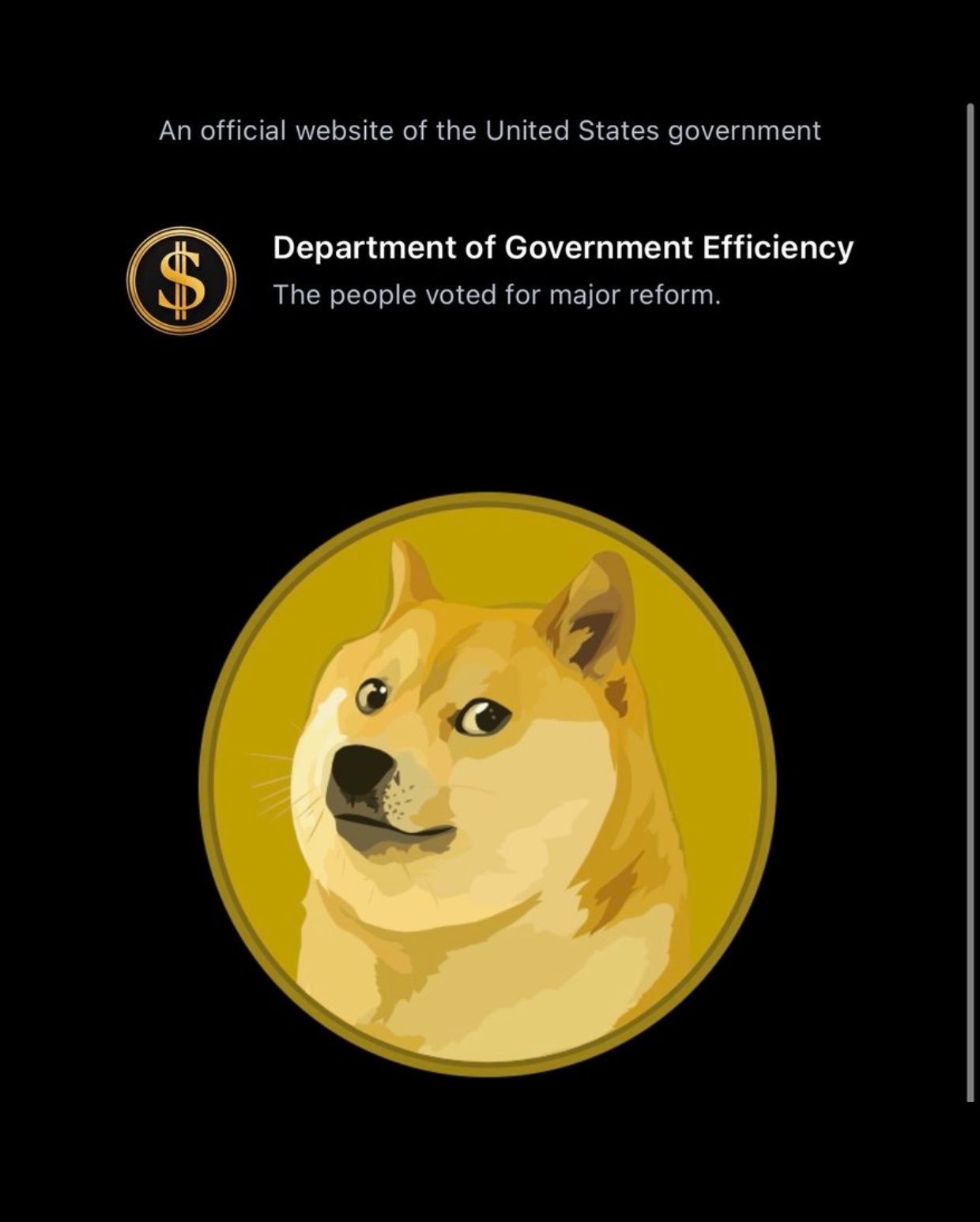

The Department of Government Efficiency (D.O.G.E.), first teased during Trump’s pro-crypto campaign, quickly became a focal point of interest.

Initially set to be led by Elon Musk and Vivek Ramaswamy, the leadership structure shifted as Ramaswamy opted to step away to focus on a potential run for Ohio governor.

Despite this change, D.O.G.E. was officially introduced during Trump’s inauguration, with its website prominently displaying Dogecoin’s logo—a detail that caught the attention of many.

The impact on Dogecoin’s market value was immediate. Before the announcement, the coin had dropped to $0.345, but the unveiling of the D.O.G.E. branding triggered a surge of over 15%, pushing the price above $0.40.

This marked the highest level for Dogecoin in two days, underscoring the market’s response to the connection between the department and the iconic meme coin.

At the time of writing, DOGE is trading at $0.39 and has a market cap of $57.7 billion.

-

1

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read -

2

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

3

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read -

4

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

5

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read

Fartcoin Price Prediction: Trader Expects Big Bounce as FARTCOIN Nears $1

Fartcoin (FARTCOIN) has gone down by 17.3% in the past 24 hours and currently sits at $1.14. As the token approaches $1, one trader favors a bullish Fartcoin price prediction. DevKhabib, a pseudonymous trader whose X account is followed by nearly 46,000 users, says that he expects a big bounce off the $1 support after […]

Whale Activity Spikes as Smart Money Eyes Reversal Zones

Amid current market volatility, blockchain analytics firm Santiment has reported a notable rise in whale activity targeting a select group of altcoins.

Binance to Launch PlaysOut (PLAY) Trading on July 31 With Airdrop

Binance has officially announced the launch of PlaysOut (PLAY), a new token debuting on Binance Alpha, with trading scheduled to begin on July 31, 2025, at 08:00 UTC.

Cboe BZX Files for Injective-based ETF Alongside Solana Fund Proposal

The Cboe BZX Exchange has submitted a filing with the U.S. Securities and Exchange Commission (SEC) seeking approval for a new exchange-traded fund (ETF) that would track Injective’s native token (INJ).

-

1

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read -

2

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

3

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read -

4

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

5

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read