Dogecoin on the Brink of a Major Price Surge – What to Expect

15.07.2024 15:00 1 min. read Alexander Stefanov

Dogecoin's recent activity has drawn attention, particularly due to a significant decline in its active addresses, now standing at 40,000, a level last seen in March 2020.

This historical trend has previously preceded a major price surge for Dogecoin several months later, highlighting a potential pattern that could repeat around March or April 2025.

Currently trading at $0.1168, Dogecoin has seen a notable 60% increase over the past year, yet it remains considerably significantly below its all-time high (almost 85%).

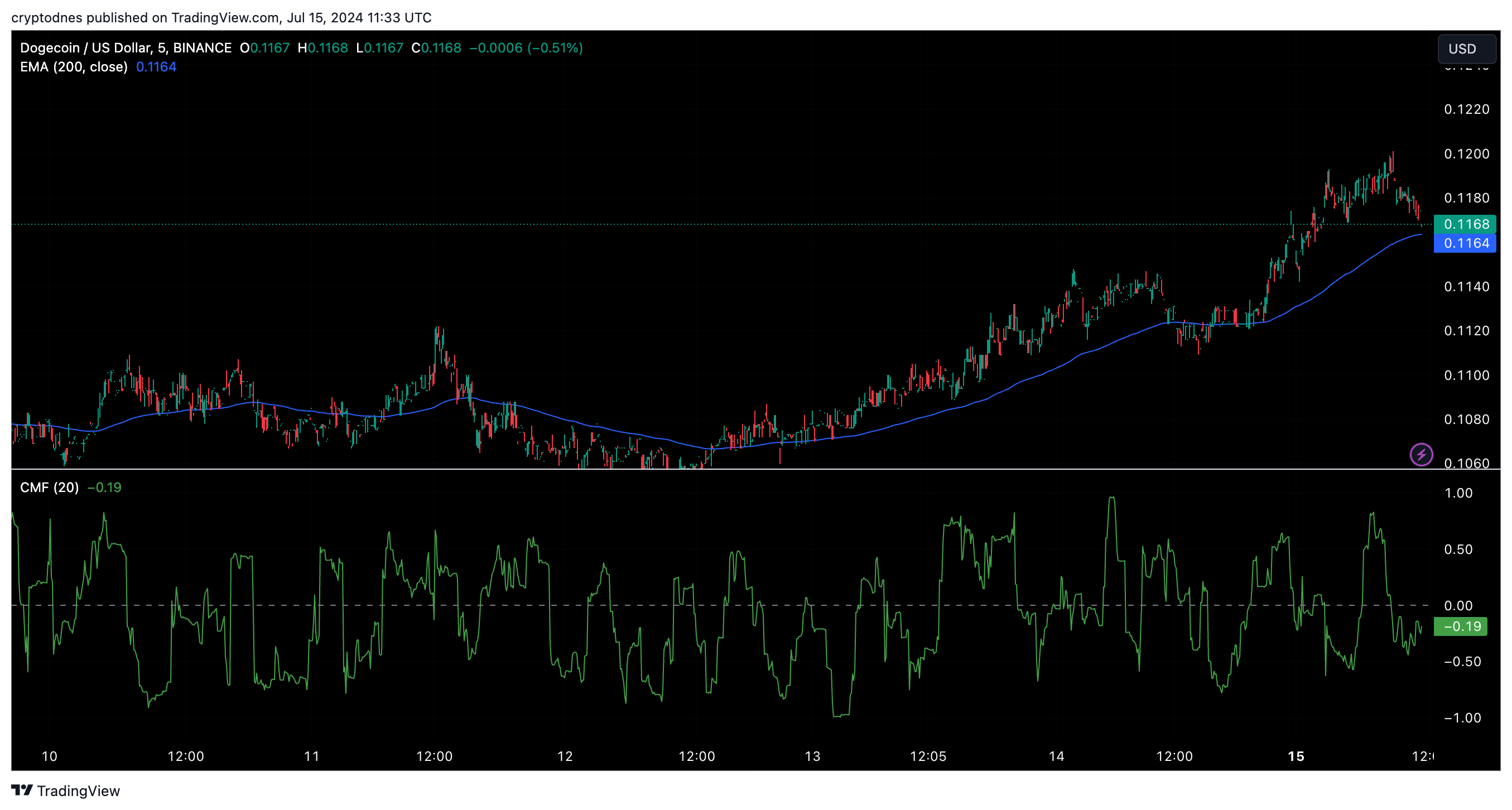

Technical indicators such as the 200-day Exponential Moving Average (EMA) indicate a pivotal point; the price currently sits below this level, suggesting potential for a bullish breakout if it breaches above.

Additionally, the Chaikin Money Flow (CMF) indicator has signaled increased buying pressure, possibly driving Dogecoin up by 27.56% to $0.13 if momentum persists.

Investors are closely monitoring market sentiment, as indicated by the Bulls and Bears indicator, which leans slightly towards bulls in recent trading volumes.

This could potentially fuel a short-term rally towards $0.13, with long-term projections eyeing a bullish scenario towards $1. However, caution is advised, as heightened selling pressure could prompt a retracement towards $0.10 in the near future, despite promising long-term prospects for Dogecoin.

-

1

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

2

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

3

Solana Price Prediction: Trader Thinks SOL Could Rise to $200 in July – Here’s Why

26.06.2025 22:25 3 min. read -

4

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read -

5

Peter Schiff Doubts Stablecoins Can Shield a Weakening Dollar

19.06.2025 13:00 1 min. read

Here is How Ethereum Can Change Wall Street, According to ETH Co-founder

Ethereum co-founder and Consensys CEO Joe Lubin believes Ethereum’s growing use in corporate treasuries could redefine how traditional finance views the second-largest digital asset.

Whale Activity Alert: Which Altcoins Saw Millions Flow Into Exchanges?

A wave of large-scale altcoin deposits has hit centralized exchanges over the past 24 hours, according to data from on-chain analytics platform Santiment.

Trump’s Truth Social Files For Spot Crypto ETF Holding 5 Cryptocurrencies

Truth Social, the media venture linked to U.S. President Donald Trump, has taken a bold step into the digital asset space with a fresh filing for a spot cryptocurrency exchange-traded fund (ETF).

Whales Quietly Accumulate Four Altcoins: Early Signals of Potential Rally

Large-scale investors are steadily increasing long positions in several overlooked altcoins, signaling a potential early-stage accumulation phase.

-

1

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

2

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

3

Solana Price Prediction: Trader Thinks SOL Could Rise to $200 in July – Here’s Why

26.06.2025 22:25 3 min. read -

4

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read -

5

Peter Schiff Doubts Stablecoins Can Shield a Weakening Dollar

19.06.2025 13:00 1 min. read