Next 1000x Crypto: Top 10+ Coins with 1000x Potential in 2025

Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

We may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Crypto enthusiasts constantly search for that elusive moonshot in the crypto world – tokens capable of delivering 1000x returns that transform modest investments into life-changing wealth. These astronomical gains represent a 99,900% increase, turning a $1,000 investment into $1 million when the stars align perfectly.

But many don’t know that finding the next 1000x crypto requires more than luck.

It demands understanding emerging trends, identifying undervalued projects before mainstream adoption, and recognizing the key factors that separate future winners from the thousands of tokens launched monthly.

Discover The Next 1000x Crypto

👇

Next 1000x Crypto Key Factors

- Low market cap tokens offer the most realistic path to 1000x returns

- Usually crypto presale projects provide optimal entry prices before exchange listings

- Penny cryptos offer 1000x potential due to their low entry price

- Meme coins can deliver massive returns due to viral community support and hype

- Community engagement and real-world utility drive sustainable growth

- Early adoption timing remains crucial if you want to maximize return potential

- Retail traders often pursue high-risk, high-reward investments, making diversification and risk management essential

Top Picks For The Next 1000x Crypto in 2025

- Bitcoin Layer 2 for scalability and faster transactions

- High APY staking with governance rights

- Uses SVM tech to enhance Bitcoin’s capabilities

Bank card

Bank card ETH

ETH USDT

USDT- +1 more

- 80% presale allocation

- Fixed hard cap of $5M

- Start price at 0.006400 USD

- Staking rewards at a rate of 17.71 $T6900 tokens

ETH

ETH USDT

USDT BNB

BNB- +1 more

- Telegram-native platform with instant sniping and copy trading

- Honeypot and rugpull detection for safer trades

- Low fees with fast execution on token launches

ETH

ETH SOL

SOL Bank card

Bank card

- Boosts staking yields on Best Wallet platform

- Early access to exclusive new projects

- Reduces fees within the Best Wallet ecosystem

Bank card

Bank card ETH

ETH USDT

USDT- +1 more

- 600 % spike after Solana expansion

- Best-selling ICO of 2025 ($70M+)

- Alpha Chat for sniping tips

USDT

USDT ETH

ETH BNB

BNB- +1 more

- AI-powered tools for content creation and marketing

- Staking rewards with creator benefits

- Supports community-driven monetization

USDT

USDT ETH

ETH USDC

USDC- +2 more

Reviewing The Next 1000x Crypto Tokens in 2025

We know that most investors are looking into the “fine print”, and that’s why we’ve provided you with a more detailed review of each crypto project. These reviews cover a range of crypto assets, highlighting their unique features and investment potential.

Strong tokenomics and mechanisms that increase a token’s demand, such as scarcity and utility, are key factors in a project’s investment potential.

Early holders of these projects can often benefit the most, taking advantage of early-stage opportunities and potential rewards.

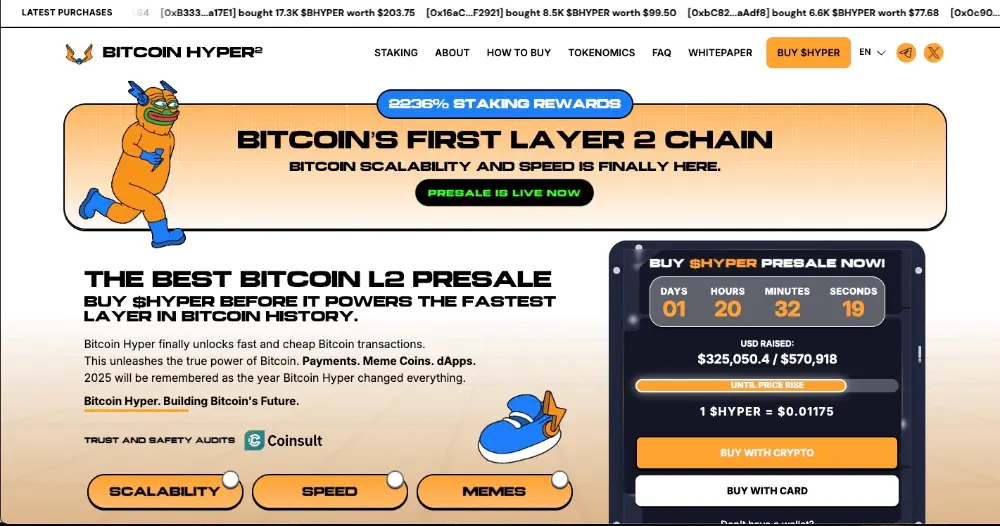

1. Bitcoin Hyper ($HYPER) – Bitcoin Layer 2 Scaling Through Innovative Solana Virtual Machine Integration

Bitcoin Hyper pioneers Bitcoin Layer 2 scaling through innovative Solana Virtual Machine integration, dramatically improving transaction speeds while reducing costs for Bitcoin users. The project leverages Solana’s proven high throughput and scalability infrastructure to power a Layer 2 solution specifically designed for Bitcoin, enabling near-instant finality and significantly lower transaction fees. This technical approach combines Bitcoin’s security with Solana’s performance characteristics.

One notable use case is facilitating cross border payments, allowing users and financial institutions to send international transactions with greater speed and lower fees compared to traditional methods.

The native HYPER token serves multiple ecosystem functions including transaction processing, staking participation, and decentralized governance voting rights. Early presale participants can immediately stake their tokens for up to 2,475% dynamic APY rewards, creating strong incentives for early adoption. The staking mechanism helps secure the network while providing attractive returns for long-term holders.

With nearly 1 million HYPER tokens already staked during the presale phase and over $292,000 raised, the project demonstrates growing community engagement and investor confidence. The combination of Bitcoin’s established value proposition and innovative scaling technology positions HYPER for significant growth potential as Bitcoin adoption continues expanding globally.

The Layer 2 solution addresses Bitcoin’s primary limitations – slow transaction speeds and high fees – which have hindered its adoption for everyday transactions. Bitcoin Hyper’s technical innovation could unlock new use cases for Bitcoin while maintaining the security and decentralization that makes it valuable. The project’s success depends on successful technical execution and adoption by Bitcoin users seeking improved functionality.

2. Token6900 ($T6900) – Satirical ERC-20 meme coin with zero utility, 80% presale allocation, and massive staking APY

Everyone’s chasing the next 1000x crypto, but real moonshots are rare. If you want a shot, you need to catch projects before they get big – think fresh presales, stealth meme launches, or viral plays with zero baggage.

That’s where Token6900 comes in: a meme coin that throws utility out the window and gives 80% of supply to presale buyers, plus wild staking rewards out of the gate.

Here’s the thing: Token6900 launched with a hard cap of $5 million, token supply fixed at 930,993,091, and offers up to 3,519% dynamic staking rewards: a scale that dwarfs traditional assets like the S&P’s ~9.96% CAGR.

During our testing, the presale clock was ticking fast, and with over 744 million tokens up front, there’s no elephant in the room – just pure retail-powered action.

The beauty of plays like Token6900 is they’re powered by community hype, not corporate backing – meaning insane upside if the vibe takes off.

Of course, most of these never make it past the first pump, so never go all-in. If you’re cool with chaos, set tight exits, and love the thrill of the next big thing, Token6900 is the kind of ticket you’re looking for.

3. Snorter Bot ($SNORT) – Revolutionizing The Meme Coin Trading Through Sophisticated Telegram-Based Automation

Snorter Bot revolutionizes the meme coin trading through sophisticated Telegram-based automation featuring a mascot that symbolizes its ability to sniff out profitable opportunities before they explode. The platform delivers real-time trading alerts for hot Solana meme coins immediately upon launch, including notifications on the current price, providing users with critical early entry opportunities that can make the difference between modest gains and life-changing profits.

But beyond simple notifications, SNORT offers trading infrastructure like instant sniping capabilities, copy trading tools, and advanced security features. The closed beta testing demonstrates high accuracy in detecting fraudulent projects, honeypots, and common scam patterns that plague the meme coin space.

Users can benefit from reduced trading fees as low as 0.85%, MEV protection, and planned multi-chain expansion covering Ethereum, Polygon, BNB Chain, and Base.

Current staking rewards reach an impressive 853% APY, creating strong incentives for early token holders while the project prepares for broader market deployment. The combination of practical utility in meme coin trading and generous rewards positions SNORT for significant growth as automated trading continues gaining popularity among retail investors seeking competitive advantages.

The team’s roadmap includes expansion beyond Solana to multiple blockchain networks, potentially multiplying the addressable market and utility scope. Strong user engagement and community involvement on Telegram and Twitter, combined with the practical benefits already demonstrated in beta testing, suggests solid fundamentals underlying the meme-inspired branding and mascot appeal.

Will it spike after the launch? We don’t know. But for what it’s worth, Snorter really shows up big potential right now.

4. Best Wallet Token ($BEST) – A 360° Web3 Wallet with Advanced Features

Best Wallet Token transforms the traditional wallet experience into a 360-degree Web3 platform that comes with advanced features, reduced costs, and much better earning opportunities for token holders. The $BEST token unlocks premium ecosystem benefits including exclusive access to reduced transaction fees, higher staking rewards, governance participation, iGaming bonuses, and early access to promising ICO projects. The utility-driven design creates genuine demand for token holding beyond speculative trading.

Platform integration extends beyond basic wallet functionality, though. It incorporates a built-in DEX, wallet presale investment opportunities, iGaming experiences, and unique reward mechanisms. The app positions Best Wallet as a one-stop solution for crypto users seeking simplified Web3 interaction. The ecosystem design encourages long-term token holding through multiple value-added services and exclusive benefits.

Current staking programs offer up to 111% APY for early adopters, with carefully structured tokenomics allocating 8% of total supply specifically for staking rewards and 25% for ongoing platform development. The wallet presale has already secured nearly $13 million, demonstrating strong investor confidence in the project’s vision and execution capabilities.

The platform’s focus on user experience and practical utility differentiates it from purely speculative tokens. iGaming integration taps into the growing blockchain gaming market, while DEX functionality provides competitive trading options. The combination of multiple revenue streams and user retention mechanisms creates sustainable economics supporting long-term token appreciation.

5. Wall Street Pepe – Next 1000x Crypto to Watch This Cycle, Especially Given The Record Bitcoin Price

If you’re on the hunt for the next 1000x, Wall Street Pepe ( $WEPE ) has the kind of heat that catches eyes fast. A 600% run in July sent $WEPE from “just another meme” to degen front-runner, with market cap and volume to match. The Ethereum-to-Solana bridge means more buyers, more FOMO, and a growing frog army across chains.

$WEPE isn’t shy about being a high-risk play. The team keeps retail fired up with Alpha Chat sniping tips, NFT drops, and aggressive social raids – all designed to fuel momentum and keep eyes glued to the charts.

Smart contract audits by Coinsult help, but nothing’s fully safe in meme land.

This is moonshot territory – massive upside, but wild swings that can wipe out late entries. If you want to chase 1000x gains, time your entries, track DEX volume, and always keep your exit plan ready. Never YOLO the bag on a pump.

6. SUBBD ($SUBBD) – Blending AI with Creator Economy Innovations, Providing Access to Staking Rewards

SUBBD transforms content creation by using advanced ai tech as the foundation of its platform, merging artificial intelligence with influencer economics. It enables both creators and fans to produce, customize, and monetize content through advanced AI tools.

SUBBD is blending AI with creator economy innovations, as it combines artificial intelligence with new trends to offer a holistic approach for creators and fans. The platform empowers fans to generate original content inspired by their favorite creators while providing influencers with automated management tools that reduce operational overhead.

Targeting the massive $85 billion creator subscription market, SUBBD enters with significant momentum through the established Honny brand, verified ambassadors, and combined reach exceeding 250 million potential users. The project’s foundation provides immediate market access and credibility that many startups lack. The team’s proven track record in influencer marketing adds legitimacy to their blockchain expansion plans.

The native SUBBD token serves as the ecosystem’s central utility, providing access to staking rewards, exclusive AI creation tools, discounted subscription fees, and early access to premium content. This multi-faceted utility creates sustained demand while supporting platform growth. Token holders benefit from both platform success and AI technology advancement trends.

The convergence of AI technology and creator economy represents a massive growth opportunity, with both sectors experiencing rapid expansion and mainstream adoption. SUBBD’s positioning at this intersection, combined with established relationships and proven team execution, creates multiple catalysts for exponential growth as the platform scales globally.

7. SpacePay ($SPY) – Real-World Crypto Payments Made Easy

SpacePay develops terminal-agnostic payment protocols that seamlessly integrate cryptocurrency transactions into existing retail point-of-sale systems, making crypto payments accessible at millions of locations globally. By delivering real utility, SpacePay enables practical crypto payments for everyday purchases, demonstrating tangible value beyond speculation. The platform’s innovative approach connects over 325 crypto wallets to traditional payment infrastructure, eliminating the technical barriers that have prevented widespread crypto adoption for everyday purchases. This bridge between traditional and decentralized finance addresses a critical market need.

Strong early momentum includes over $935,000 raised through public presale and an additional $750,000 secured through private funding rounds, indicating institutional confidence in the product’s commercial viability. The combination of public and private investment validates market demand for crypto payment solutions while providing sufficient funding for platform development and market expansion.

SPY token holders receive monthly airdrops, voting rights for community governance, and access to quarterly leadership webinars. With 20% of the 34 billion total supply allocated for presale distribution, early investors position themselves for potential exponential gains as crypto payments gain mainstream adoption. The tokenomics structure rewards early supporters while maintaining sufficient supply for platform operations.

The crypto payment market represents a massive opportunity as digital asset adoption accelerates and businesses seek alternative payment methods. SpacePay’s focus on existing infrastructure integration reduces adoption friction compared to completely new payment systems. Success depends on merchant adoption rates and regulatory approval in key markets worldwide.

8. Protocol AI ($PROAI) – AI-Powered Blockchain Development, From Text to Web3 DApps

Protocol AI revolutionizes blockchain application development through artificial intelligence that transforms simple text descriptions into fully functional Web3 decentralized applications, eliminating technical barriers for non-developers. The platform’s AI-powered tool generates operational dApps based on written instructions, democratizing blockchain development and accelerating innovation across the ecosystem. This breakthrough approach makes Web3 development accessible to entrepreneurs and creators without coding expertise.

The integrated marketplace enables AI-generated dApps to be listed and sold for cryptocurrency, creating immediate revenue opportunities for users while establishing a sustainable economic model. This practical utility demonstrates real-world value beyond speculative trading, as users can monetize their creative ideas through the platform’s AI capabilities. The marketplace concept creates network effects as more users generate and trade applications.

DAO governance structure provides token holders with decision-making authority over platform development, while presale staking opportunities allow early investors to earn rewards before public exchange listings. Security audits by Coinsult and SolidProof add credibility and reduce technical risk concerns. Additionally, team credibility – demonstrated through transparent leadership and proven expertise – plays a crucial role in building trust and confidence in the project. The combination of proven security, strong team credibility, and innovative functionality positions the project for mainstream adoption.

The convergence of AI and blockchain technology represents a significant growth opportunity, with both sectors experiencing rapid advancement and investment. Protocol AI’s positioning at this intersection, combined with practical utility and revenue generation capabilities, creates multiple value drivers for token appreciation as the platform gains users and transaction volume.

9. Influencer Pepe ($INPEPE) – Global Web3 Influencer Ecosystem, Enabling Direct Payments Between Creators and Agencies

Influencer Pepe targets the $25 billion influencer marketing industry through blockchain-based solutions that eliminate intermediaries, reduce costs, and prevent fraud through transparent on-chain transactions. The Ethereum-based platform establishes INPEPE as the native token and standard currency for a global Web3 influencer ecosystem, enabling direct payments between creators and agencies while storing all transactions on the blockchain for transparency and fraud prevention.

Beyond serving influencers and agencies, the platform welcomes investors through staking programs that contribute to network security while earning substantial rewards. Current presale staking offers up to 4,200% dynamic APY, creating compelling incentives for early participation. Positive investor sentiment, fueled by market excitement and the project’s innovative approach, is driving strong participation in the presale. The high staking rewards reflect the project’s commitment to building a strong holder base before mainstream adoption.

Since launching in April 2025, the project has raised nearly $170,000 while targeting an industry projected to reach $48 billion by 2027. The combination of established market size and blockchain innovation positions INPEPE for significant growth as Web3 adoption accelerates. The project benefits from clear market opportunity and demonstrated demand for influencer marketing solutions.

The platform’s blockchain approach addresses key industry problems including payment delays, fraud, and lack of transparency that plague traditional influencer marketing. Smart contract automation can streamline campaign management while providing verifiable metrics for engagement and performance. Success depends on attracting major influencers and brands to the platform ecosystem.

10. Snek ($SNEK) – One of The Most Beloved and Successful Meme coins Native to the Cardano Ecosystem

Snek represents one of the most beloved and successful meme tokens native to the Cardano ecosystem, featuring minimalist snake branding that has resonated strongly with the ADA community. The project demonstrates that simple, memorable branding combined with authentic community engagement and the presence of strong communities can create lasting value in the meme coin space. Unlike many flash-in-the-pan meme tokens, Snek has maintained consistent community support and organic growth across multiple market cycles.

The token’s success stems from its deep integration within the Cardano ecosystem and genuine grassroots community development rather than artificial hype or celebrity endorsements. Snek holders actively participate in community initiatives, creating organic marketing and social media engagement that sustains long-term interest. The project’s approach proves that authentic community building and fostering strong communities often outperforms expensive marketing campaigns.

Cardano’s focus on sustainability, peer-reviewed development, and academic rigor provides a stable foundation for ecosystem tokens like Snek to build upon. As Cardano continues expanding its smart contract capabilities and DeFi ecosystem, native tokens positioned within this infrastructure benefit from network effects and ecosystem growth. Snek’s early establishment gives it first-mover advantages within Cardano’s growing meme token sector.

The project’s tokenomics remain simple and transparent, avoiding complex mechanisms that often confuse users and create selling pressure. This straightforward approach, combined with consistent community engagement and Cardano ecosystem benefits, positions Snek for continued growth as the broader Cardano ecosystem expands and attracts more users seeking alternatives to Ethereum-based meme tokens.

Read more: Best Meme Coins To Buy Right Now

11. Gigachad ($GIGA) – One of The Most Recognizable meme coin of recent years, Leveraging The Iconic Muscular Figure

Gigachad capitalizes on one of the most recognizable internet meme phenomena of recent years, leveraging the iconic muscular figure that has become synonymous with ultimate masculinity and success across social media platforms. The token’s branding taps into widespread meme culture recognition that extends far beyond crypto communities, potentially attracting mainstream attention from meme enthusiasts who might not otherwise engage with cryptocurrency markets.

Strategic community building and viral marketing approaches target mainstream meme culture adoption through social media campaigns, influencer partnerships, and cross-platform promotion. The project’s marketing strategy focuses on organic viral spread rather than traditional advertising, aligning with how internet memes naturally propagate. Strong social media presence across multiple platforms helps maintain visibility and community engagement.

The Gigachad meme’s association with success, strength, and winning mentality creates psychological appeal for investors seeking tokens that represent positive outcomes and achievement. This aspirational branding differentiates Gigachad from meme tokens focused on humor or absurdity, potentially attracting investors who resonate with the success-oriented messaging and imagery.

Success in the meme token space often depends on cultural timing and viral adoption rather than traditional fundamentals. Gigachad’s established meme recognition provides a foundation for potential viral moments, while the crypto market’s appetite for culture-driven tokens creates opportunities for exponential growth when community momentum builds effectively.

12. Fartcoin ($FARTCOIN) – Strong Community Driven Meme Coin which Blows Past Expectations

Fartcoin demonstrates the unpredictable and often irrational nature of meme coin markets through deliberately absurd branding that resonates with crypto communities seeking humorous alternatives to serious blockchain projects. The token’s success proves that simplicity, humor, and community engagement can drive significant market interest and price appreciation, often outperforming technically sophisticated projects with complex use cases.

Despite its deliberately crude branding, Fartcoin has built a surprisingly engaged community that embraces the absurdist humor while participating in active trading and social media promotion. The project’s approach strips away pretense and technical complexity, focusing purely on entertainment value and community building. This straightforward strategy often proves more effective than elaborate tokenomics or utility promises.

🚨 FARTCOIN is the most bought token by smart money in the last 24 hours pic.twitter.com/s5xm6Qvlcr

— The Solana Post (@thesolanapost) June 2, 2025

The token’s market performance illustrates important lessons about crypto investing, particularly the role of community sentiment and viral marketing in driving short-term price movements. Fartcoin’s success challenges traditional investment analysis by demonstrating that cultural relevance and meme appeal can create value independent of underlying technology or business fundamentals.

While the absurd branding might seem limiting, it actually provides freedom from expectations around serious utility or long-term roadmaps. This allows the community to focus on pure speculation and entertainment, which can drive explosive price movements when market conditions align with community enthusiasm and broader meme token trends.

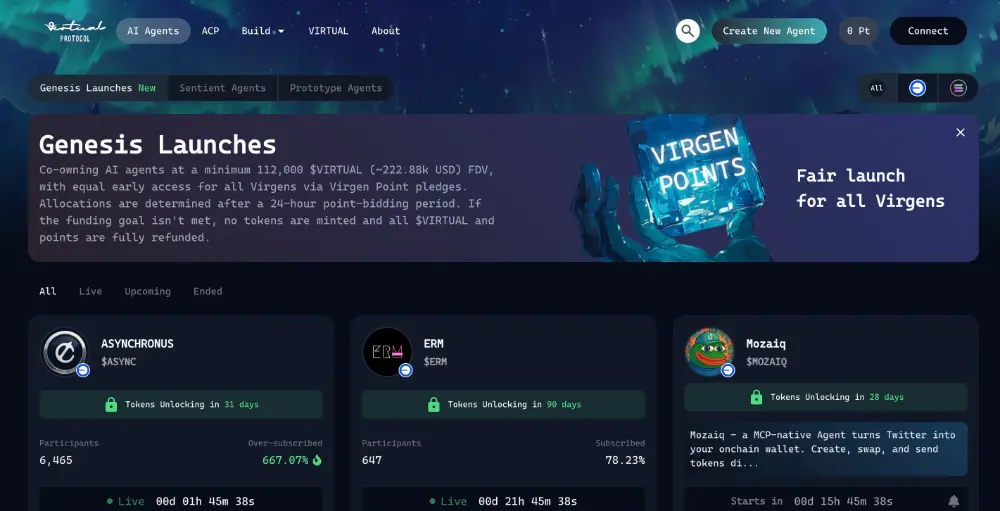

13. Virtuals Protocol ($VIRTUAL) – The Investable Layer Behind the Rise of AI Agent Economies and Web3 Automation

Virtuals Protocol represents the cutting edge of AI agent infrastructure, enabling creation and deployment of autonomous AI agents across various blockchain ecosystems. The platform addresses the growing demand for intelligent automation within decentralized systems, providing tools and frameworks for developers to build sophisticated AI agents that can operate independently within blockchain environments. This convergence of artificial intelligence and decentralized technology creates numerous opportunities for innovation and value creation.

The protocol’s technical foundation supports diverse AI agent applications including automated trading, content creation, community management, and complex smart contract interactions. Developers can leverage pre-built components while customizing agent behavior for specific use cases, reducing development time and technical barriers. The platform’s modular architecture allows for continuous innovation and expansion of AI capabilities.

Strong technical fundamentals combined with the explosive growth in AI technology create multiple catalysts for platform adoption and token appreciation. As businesses and developers increasingly seek AI automation solutions, Virtuals Protocol’s infrastructure becomes more valuable. The protocol benefits from both the AI boom and continued blockchain ecosystem expansion, positioning it at the intersection of two major technology trends.

The platform’s monetization opportunities include agent deployment fees, marketplace transactions, and premium feature access, creating sustainable revenue streams that support long-term token value. Developer adoption metrics and AI agent deployment volume serve as key indicators of platform success, while partnerships with major blockchain networks could accelerate growth and mainstream adoption.

List of the Next 1000x Crypto Coins for 2025

- Bitcoin Hyper – Bitocoin L2 chain that has a lot to offer to new investors

- Token6900 – A low-cap degen coin which can sell out within weeks

- Snorter Bot – Telegram-based bot which can “snipe” Solana meme coins

- Best Wallet Token – The Best Wallet app token which grants exclusive perks

- Wall Street Pepe – A record-breaking Ppresale which went 6X up

- SUBBD – Community engagement coin that has some fancy AI feautres

- SpacePay – Crypto payment protocol which is made to easy cross-country transactions

- Protocol AI – AI agent that wants to empower everyday users to create blockchains

- Influencer Pepe – Influencer-based coin based on the Pepe meme

- Snek – Community-driven Cardano meme token with organic growth and strong ecosystem

- Gigachad – Viral meme culture token leveraging iconic internet phenomenon

- Fartcoin – Absurdist meme token proving humor and simplicity

- Virtuals Protocol – AI agent infrastructure enabling autonomous blockchain deployments

How to Find The Next 1000x Crypto?

Finding the next 1000x cryptocurrency requires understanding the fundamental forces that drive explosive growth. While most projects fail to achieve such astronomical returns, certain patterns emerge when examining past success stories. These five critical factors often separate the rare moonshots from the countless projects that fade into obscurity.

Revolutionary Technology or Use Case

Cryptocurrencies that achieve 1000x returns typically introduce groundbreaking technology or solve real-world problems in ways nobody thought possible before. Bitcoin pioneered digital scarcity, For example, some of the best altcoins – like Ethereum – created programmable smart contracts, and Solana addressed blockchain scalability issues. These weren’t just incremental improvements – they represented paradigm shifts.

The key lies in identifying projects that don’t just follow trends but create entirely new categories. Look for protocols that make previously impossible things achievable, whether that’s cross-chain interoperability, zero-knowledge privacy, or novel consensus mechanisms. Projects copying existing solutions rarely achieve massive multipliers. The technology needs to be so compelling that it attracts developers, institutions, and users organically, creating a network effect that becomes impossible to ignore.

Perfect Market Timing and Conditions

Timing matters enormously in crypto markets. Even the best projects can struggle if launched during bear markets or periods of regulatory uncertainty. Conversely, mediocre projects sometimes achieve incredible returns simply by launching during peak bull runs when capital flows freely and risk appetite runs high.

Successful 1000x projects often coincide with broader technological adoption cycles or macro-economic conditions. DeFi tokens exploded during 2020-2021 when traditional finance showed its limitations and people sought alternatives. NFT projects peaked when digital ownership concepts went mainstream. The most successful projects ride these waves while solving genuine problems within those trending sectors.

Market psychology plays a crucial role too. When retail investors feel optimistic and institutional money starts flowing into crypto, even solid projects with smaller market caps can experience exponential growth that compounds rapidly.

Exceptional Team and Community Building

Behind every successful 1000x project stands a team with proven track records, strong team credibility, and the ability to execute complex technical visions. Team credibility is a key factor, encompassing transparency, team expertise, and the potential impact on the project’s long-term success. These teams usually combine deep technical expertise with strong business acumen and marketing skills. They understand that building technology represents just one piece of the puzzle.

Community development becomes equally important. Projects that achieve massive returns cultivate passionate user bases who become genuine advocates, not just speculators. These communities provide valuable feedback, help with adoption, and create organic marketing that money can’t buy. Look for teams that engage transparently with their communities, deliver on promises consistently, and adapt based on user feedback.

The most successful projects also demonstrate staying power during difficult periods. Teams that keep building through bear markets, continue innovating when hype dies down, and maintain community engagement regardless of token price often emerge stronger when markets recover.

Strategic Partnerships and Adoption

Major partnerships can catalyze explosive growth by providing instant credibility, technical resources, and access to existing user bases. For example, financial ICOs are absolutely dominant in terms of new cryptos. When established companies or protocols integrate new technologies, it validates the concept and opens doors to massive adoption that individual marketing efforts could never achieve.

However, partnerships alone aren’t enough – they need to result in real usage and value creation. The most impactful partnerships involve mutual benefit where both parties actively promote and integrate the new technology. Strategic investments from respected venture capital funds or industry leaders also signal confidence and provide resources for rapid scaling.

Distribution partnerships become particularly valuable. Projects that secure listings on major exchanges, integration with popular wallets, or inclusion in institutional investment products gain access to millions of potential users instantly. These distribution channels can transform promising projects into household names virtually overnight.

Read more: Top New Crypto Coins to Buy

Low Market Cap with High Potential

Mathematical reality dictates that smaller market cap projects have better odds of achieving 1000x returns than established cryptocurrencies. A $10 million market cap project needs to reach $10 billion for 1000x returns, while a $1 billion project would need to reach $1 trillion – clearly much more challenging.

Smart money targets projects with strong fundamentals trading at relatively low valuations, often during early stages or after temporary setbacks that don’t affect long-term viability. These opportunities frequently appear when broader markets experience downturns, regulatory concerns create temporary fear, or when promising projects haven’t yet gained mainstream attention.

The key is to find genuinely undervalued projects rather than cheap tokens with fundamental problems. Strong tokenomics, effective token supply management, reasonable supply schedules, and clear value accrual mechanisms become essential. Projects that manage token supply to enhance scarcity – such as through burning or buybacks – and have utility tokens that capture value from growing protocol usage often outperform pure governance tokens or memecoins over longer timeframes.

Are 1000x Crypto Coins Worth It?

Chasing 1000x returns represents one of crypto’s most compelling yet dangerous pursuits. These astronomical gains remain theoretically possible, especially for projects with market caps under $10 million that solve genuine problems or introduce revolutionary technology. Historical precedents exist – early Bitcoin investors who held from 2010 to 2017 witnessed exactly these kinds of returns, as did early Ethereum supporters.

However, the mathematics work against most investors. For every project that achieves 1000x growth, thousands fail completely or deliver modest returns. The risk-reward calculation becomes intensely personal, depending on individual financial situations, risk tolerance, and investment timelines. Successful 1000x hunting requires exceptional research skills, iron stomach for volatility, and ability to hold through multiple boom-bust cycles.

The appeal extends beyond pure profit motives. Many investors find intellectual satisfaction in identifying breakthrough technologies before mainstream adoption. Supporting innovative projects that could reshape finance, gaming, or digital ownership creates a sense of participation in technological revolution rather than passive speculation.

Risk management becomes absolutely critical. Experienced investors typically allocate only 1-5% of portfolios to high-risk, high-reward plays. Dollar-cost averaging into promising projects over time reduces timing risk while maintaining upside exposure.

Smart investors focus on projects with strong fundamentals rather than pure speculation. Teams with proven track records, clear roadmaps, growing user bases, and genuine utility provide better odds than memecoins or marketing-heavy projects without substance. The goal is finding tomorrow’s blue-chip protocols while they’re still trading at venture capital valuations.

Ultimately, 1000x hunting suits investors who understand the risks, can afford complete losses, and possess patience for multi-year holding periods.

Which Are the Risks Associated Chasing The Next 1000x Crypto?

Pursuing 1000x cryptocurrency returns involves substantial risks that can result in complete capital loss. Most high-potential projects fail due to technical challenges, market conditions, or execution problems, making this strategy unsuitable for conservative investors.

- Complete Loss of Investment – Most small-cap cryptocurrencies eventually become worthless as projects fail, teams abandon development, or market interest disappears entirely. Unlike traditional investments with residual value, failed crypto projects typically go to zero.

- Extreme Volatility and Emotional Stress – These investments experience massive price swings daily, sometimes losing 50-90% value in hours. The psychological pressure can lead to panic selling at the worst possible moments or holding onto obvious failures for too long.

- Liquidity Problems and Exit Difficulties – Small-cap tokens often have thin trading volumes, making it difficult to sell significant positions without dramatically impacting price. During market crashes, liquidity can disappear completely.

- Regulatory Risks and Legal Uncertainty – Government crackdowns can instantly destroy project value, especially for tokens operating in legal gray areas. Regulatory changes affect smaller projects disproportionately compared to established cryptocurrencies.

- Technical Failures and Security Vulnerabilities – Smart contract bugs, protocol exploits, or fundamental technical flaws can eliminate value overnight. Newer projects lack the battle-testing that established protocols have undergone through multiple market cycles.

Conclusion

Finding the next 1000x cryptocurrency remains challenging but not impossible for dedicated researchers willing to take calculated risks. Success requires combining multiple information sources, thorough due diligence, and disciplined risk management strategies that protect against inevitable losses.

Currently, Bitcoin Hyper & T6900 represent our top picks due to their innovative technology and strong fundamentals, though achieving 1000x returns rarely happens easily or quickly. Even capturing 10x returns multiple times through careful selection and timing creates wealth that surpasses what most traditional S&P 500 investors ever achieve, making the pursuit worthwhile for those who understand the risks involved.