Best Altcoins to Buy Now: 10+ Altcoins With Huge Potential in 2025

Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

We may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Altcoin momentum is picking up in 2025 – and smart money is already rotating out of legacy blue chips into high-potential projects with lower market capitalization.

But which are the best altcoins to buy today? Well, that’s what we’re about to find out now.

The Best Altcoins To Buy Now

- Bitcoin Layer 2 for scalability and faster transactions

- High APY staking with governance rights

- Uses SVM tech to enhance Bitcoin’s capabilities

Bank card

Bank card ETH

ETH USDT

USDT- +1 more

- 80% presale allocation

- Fixed hard cap of $5M

- Start price at 0.006400 USD

- Staking rewards at a rate of 17.71 $T6900 tokens

ETH

ETH USDT

USDT BNB

BNB- +1 more

- Telegram-native platform with instant sniping and copy trading

- Honeypot and rugpull detection for safer trades

- Low fees with fast execution on token launches

ETH

ETH SOL

SOL Bank card

Bank card

- Boosts staking yields on Best Wallet platform

- Early access to exclusive new projects

- Reduces fees within the Best Wallet ecosystem

Bank card

Bank card ETH

ETH USDT

USDT- +1 more

- 600 % spike after Solana expansion

- Best-selling ICO of 2025 ($70M+)

- Alpha Chat for sniping tips

USDT

USDT ETH

ETH BNB

BNB- +1 more

- AI-powered tools for content creation and marketing

- Staking rewards with creator benefits

- Supports community-driven monetization

USDT

USDT ETH

ETH USDC

USDC- +2 more

Best Altcoins To Invest in 2025: Full Review

There are many altcoins to buy right now, but not all of them are worth your attention. However, it’s important to be aware of the potential drawbacks of altcoin investment, such as high volatility, lack of regulation, and the risk of project failure.

Before choosing any altcoin, make sure you have a clear investment strategy to help manage risks and maximize potential returns. Here’s more information related to each project.

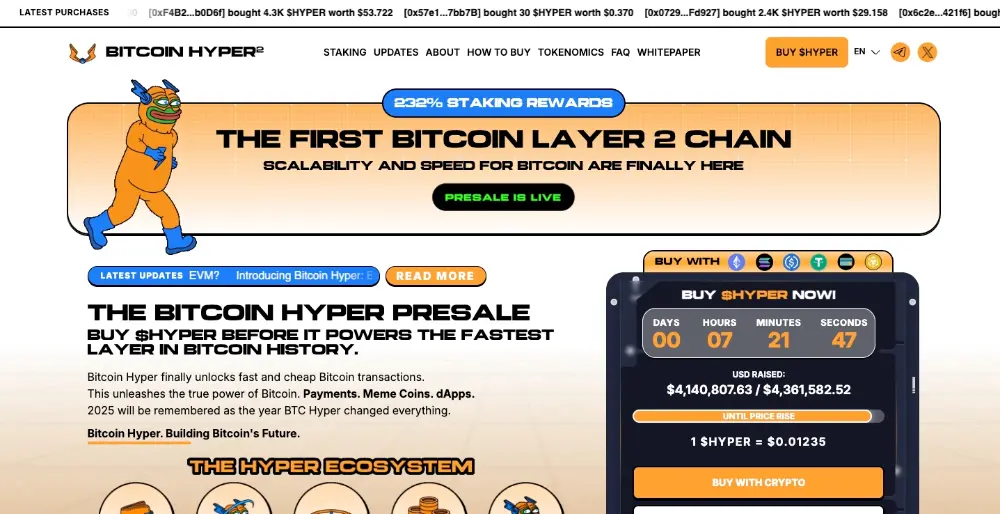

1. Bitcoin Hyper – Layer 2 built for Bitcoin scaling and gas fee reduction

Bitcoin Hyper ($HYPER) is the first Layer 2 project built for Bitcoin that uses Solana’s tech stack (SVM) for smart contracts, staking, and dApps. It combines Bitcoin’s security with Solana’s speed – think sub-second BTC-based transactions with low fees.

DeFi projects like Bitcoin Hyper aim to remove the need for traditional financial companies and middlemen, enabling peer-to-peer transactions on decentralized platforms. Currently in presale, the price is around $0.012375.

So far, Bitcoin Hyper has raised over $4 million, attracting attention from early investors who see potential in a BTC-powered DeFi future. Its staking program offers up to 200% APY, and the staking process involves locking tokens to earn rewards, which is generating growing buzz around the fixed supply and long-term lockups.

Still, it’s early-stage and high-risk. Success depends on dev traction and actual dApp usage. If adoption takes off, it could bring real utility to Bitcoin beyond just being “digital gold.” But if hype fades, liquidity could dry up fast.

2. Token6900 – Wildcard coin with strong presale interest

Token6900 ($T6900) is a high-degen meme coin that plays off crypto culture and absurdist branding. As an example of a meme coin that prioritizes community and viral appeal over utility, it openly embraces the “zero utility, max meme” narrative. The presale price is around $0.0067, and it’s already raised over $1,00,000, aiming for a community-first token model.

The project features 80% public token distribution, no VC allocations, and an optional staking vault offering around 57% APY. It’s pure meme appeal – but with clean tokenomics, fixed supply, and hype flowing in from Telegram and X. Meme coins like T6900 represent a form of digital asset that relies on social momentum rather than traditional utility.

Like all meme coins, T6900 is a wild ride. Price action will depend entirely on community momentum, exchange listings, and viral waves. If it catches fire, it could moon hard. If not – it’s another rug in the pile.

3. Snorter Bot – Telegram bot sniping Solana meme coins

Snorter Bot ($SNORT) is a Telegram-based trading bot built for the Solana ecosystem, designed to auto-snipe new meme coins the second liquidity hits. It’s part utility, part meme – offering a practical tool for degen traders. The current token price is near $0.10, with about $2.3 million raised so far.

Token holders gain perks like discounted trading fees, access to premium sniper settings, and staking with up to 177% APY. The bot is gaining traction among retail and low-cap hunters who value speed and automation.

That said, bot-based trading is risky and highly competitive. If the devs maintain uptime and add new features, Snorter could grow into a legit tool token. But if usage drops or better bots emerge, it might struggle to retain value.

4. Best Wallet Token – Utility token with staking rewards and app perks

Best Wallet Token ($BEST) fuels one of the fastest-growing crypto wallets. It unlocks staking, presale access, swap fee discounts, and more. The token is in late-stage presale, priced at around $0.025375, with over $14 million raised.

The app itself supports 60+ blockchains and offers features like token alerts, launchpad access, and DEX analytics – built for mobile-first DeFi users. $BEST holders earn staking rewards up to 102% APY, with new features planned post-launch.

Its upside is tied directly to the wallet’s adoption. If Best Wallet becomes the go-to for new crypto users, $BEST demand will grow. But if competitors outpace them or mobile UX suffers, price momentum may stall.

5. Wall Street Pepe – Meme coin backed by a record-breaking presale

Wall Street Pepe ($WEPE) is a meme coin born from the mashup of Pepe culture and financial satire. It sold out its presale in days, raising over $70 million, with an initial token price of $0.0003665.

Unlike many meme coins, WEPE adds some utility – holders gain access to premium groups, meme competitions, staking, and exclusive NFT drops. The token also passed a contract audit and locked supply, reducing rug risk.

Still, its future depends entirely on community energy and meme market sentiment. If it captures enough Twitter momentum and secures listings, WEPE could fly. If not, it’s likely to retrace with the rest of the meme sector.

6. SUBBD – Community-driven AI token for social and creator economy

SUBBD ($SUBBD) is a token for creators, powered by AI and gamified fan engagement. It rewards posting, voting, and tipping inside a decentralized content platform. The token is currently priced at $0.056, with over $870,000 raised in presale.

Stakers earn around 20% APY, and users can access tools like voice cloning, image generation, and smart post scheduling. SUBBD also powers an XP reward system and NFT drops for top community members.

Its challenge lies in scaling users and content. If the creator economy embraces on-chain tools, SUBBD could explode. But slow adoption or lack of platform polish could limit momentum.

7. SpacePay – Payment protocol solving cross-border crypto transactions

SpacePay ($SPY) brings real-world crypto payments to the point of sale. It works with standard Android terminals and converts crypto to fiat instantly for merchants. Its presale price is around $0.0032, with over $1.1 million raised so far.

The token supports loyalty rewards, staking, and fee rebates. With merchant trials underway, SPY is one of the few utility coins trying to bring crypto into physical stores – especially in emerging markets.

If the tech rolls out smoothly and user adoption grows, SPY could capture a slice of the global payment space. But regulation and competition from giants like Strike or PayPal could slow it down.

8. Solana – High-speed chain with massive dApp and meme coin growth

Solana ($SOL) is one of the fastest Layer 1 blockchains, capable of over 65,000 transactions per second with gas fees under a cent. It powers everything from DeFi and NFTs to meme coins, and it’s become the go-to chain for high-speed, high-traffic apps. SOL currently trades around $200, with a market cap over $100 billion.

Projects like BONK and Jupiter helped Solana dominate 2024’s meme coin boom. The developer ecosystem is thriving, and wallets like Phantom make onboarding simple. After solving its past network outage issues, Solana is now considered the most scalable alternative to Ethereum, especially for Solana meme coins.

Still, SOL is volatile – its price swings are massive. But with deep liquidity, a huge user base, and growing institutional interest, Solana is more than just hype. It’s one of the strongest infrastructure plays for long-term crypto investors.

9. Cardano – Academic-driven L1 with growing DeFi and utility base

Cardano ($ADA) is a peer-reviewed blockchain known for slow, methodical development. It’s priced near $0.88, with a market cap around $30 billion. Built on a unique Proof-of-Stake consensus called Ouroboros, Cardano focuses on sustainability, security, and academic rigor.

It’s not the fastest mover and it surely won’t be the next 1000 crypto, but that’s the point. The network recently launched Hydra (a Layer 2 scaling solution), plus upgrades to Plutus smart contracts that unlock more DeFi potential. It also has partnerships in Africa and Latin America for digital IDs, real-world payments, and governance pilots.

ADA won’t 100x overnight, but it offers long-term upside for those betting on durable blockchain infrastructure. With staking rewards and low energy consumption, it’s a conservative but powerful altcoin to balance a high-risk portfolio.

10. Tron – Blockchain known for stablecoin volume and high TPS

Tron ($TRX) flies under the radar but handles more stablecoin volume than most chains. It’s priced around $0.31, with a market cap near $25 billion, making it one of the most used but least hyped networks in crypto.

Tron dominates in Southeast Asia and emerging markets, where low fees and fast settlement make it ideal for USDT transfers. The network is also home to a growing number of DeFi and gambling dApps, giving it real usage despite a centralized architecture.

Critics dislike its association with Justin Sun and question the decentralization model. But if you’re looking for a chain with real-world throughput and passive staking rewards (often 5–7% APY), TRX is a solid, practical pick in a sea of speculation.

11. Hyperliquid – PerpDEX token gaining traction in the trading scene

Hyperliquid ($HYPE) is a decentralized perpetuals exchange (PerpDEX) token currently trading around $45, with a $15 billion+ market cap. It’s designed to bring CEX-style speed and liquidity to on-chain derivatives trading – without the middlemen.

The platform supports order books, zero gas fees, and sub-second execution. With active governance and a heavy focus on traders, Hyperliquid is gaining traction fast, especially after its successful airdrop to early adopters. It’s one of the few altcoins targeting serious degens and institutions alike.

But the competition is intense, and any security or volume hiccups could spook traders. Still, if you believe in decentralized finance and want exposure to the trading side of Web3, HYPE is a high-conviction infrastructure play with momentum.

12. Stellar – Cross-border coin with NGO partnerships and fast tx speeds

Stellar ($XLM) is a cross-border payments coin focused on speed and accessibility. At $0.46, it’s a low-volatility and stable pick for those who value steady adoption over hype, with a reputation for maintaining a relatively consistent value. Stellar works closely with NGOs and fintech partners to enable instant, low-cost global transfers.

Its anchor model supports stablecoin issuance and fiat conversion, making it ideal for remittances in emerging markets and further emphasizing its stable characteristics. It also boasts real use cases with the UN and MoneyGram, putting it in rare territory: a crypto with actual adoption outside crypto.

You won’t get insane gains from XLM – but you will get a reliable token with real-world traction, strong branding, and minimal drama. For anyone balancing out a portfolio of moonshots, Stellar is a stabilizer that still has upside.

13. Chainlink – Oracle giant connecting smart contracts to real-world data

Chainlink ($LINK) is the leading oracle token, serving as the data bridge between smart contracts and the real world. Priced around $19, with a market cap over $10 billion, LINK is a cornerstone of DeFi and enterprise blockchain infrastructure.

From price feeds to weather data, Chainlink lets smart contracts “see” off-chain info. It’s used by projects like Aave, Synthetix, and hundreds more. The upcoming CCIP protocol will take things further, enabling secure cross-chain messaging and token transfers.

Chainlink is a slow burner – its growth isn’t meme-fueled, it’s based on adoption. But with real utility, deep integrations, and strong dev support, LINK remains one of the safest and smartest altcoins to hold through any market cycle.

What is an Altcoin?

An altcoin is any cryptocurrency that isn’t Bitcoin. The term comes from “alternative coin”and includes everything from Ethereum and Solana, to meme coins, AI cryptos, and stablecoins. Cryptocurrencies are a form of digital money that operates on blockchain technology, enabling decentralized and trustless transactions.

Altcoins often explore new financial products, blockchain use cases, or community-driven models that Bitcoin doesn’t focus on. They can power smart contracts, fund dApps, facilitate cross-border payments, or even serve as governance tokens in decentralized finance (DeFi) protocols.

While Bitcoin is often seen as digital gold, altcoins offer exposure to innovation and experimentation – with both greater upside and added risk.

Investors often diversify into altcoins to capitalize on smaller market caps and niche utility, but price swings and project failures are more common in this space. Buying crypto is essentially exchanging one form of currency for another, rather than gaining ownership in a company or asset.

Whether you’re after early-stage tokens, DeFi utility, or social-driven momentum, altcoins represent the broad spectrum of the crypto market beyond BTC. Stablecoins, for example, maintain their value by pegging to an external reference, such as the US dollar, to ensure price stability.

Top Altcoins For Investors in 2025

Here are the most promising crypto coins based on tech, momentum, and community:

- Bitcoin Hyper – Layer 2 built for Bitcoin scaling and gas fee reduction

- Token6900 – Wildcard degen coin with strong presale interest

- Snorter Bot – Telegram bot sniping Solana meme coins

- Best Wallet Token – Utility token with staking rewards and app perks

- Wall Street Pepe – Meme coin backed by a record-breaking presale

- SUBBD – Community-driven AI token for social and creator economy

- SpacePay – Payment protocol solving cross-border crypto transactions

- XRP – Ripple Labs’ token for global bank-to-bank settlement

- Solana – High-speed chain with massive dApp and meme coin growth

- Cardano – Academic-driven L1 with growing DeFi and utility base

- Tron – Blockchain known for stablecoin volume and high TPS

- Hyperliquid – PerpDEX token gaining traction in the trading scene

- Stellar – Cross-border coin with NGO partnerships and fast tx speeds

- Chainlink – Oracle giant connecting smart contracts to real-world data

Why Invest in Altcoins?

Altcoins offer upside and utility that Bitcoin alone can’t match. Shiba Inu investor bought $8K worth of $SHIB and saw his investment reach $5.7 billion in October 2021.

However, investors should be aware of the risks and volatility present in the altcoin market, as market behaviors like FOMO and panic selling can significantly impact prices.

Here’s why they deserve a spot in any well-built portfolio. Before investing, decide on your approach by conducting thorough research, assessing your risk tolerance, and considering your personal financial goals.

1. Massive Growth Potential

Altcoins – especially those with low market cap – can multiply in value much faster than large-cap tokens. That’s why early investors flock to presales or new launches, chasing the next 1000x crypto opportunity. But with moonshot potential comes major volatility – gains aren’t guaranteed, and every new project has rug pull risk.

The right research can put you ahead of the curve. Sniper bots, Telegram trading groups, and even tools like Best Wallet help you catch momentum early. Just remember: not every pump lasts, so having an exit strategy is essential.

If you’re willing to stomach the swings, altcoins are the fastest way to grow your crypto stack. But play smart – never all-in on hype alone.

2. Diversification from Bitcoin

Bitcoin is solid – but it’s just one piece of the puzzle. Altcoins give you exposure to different blockchain technologies, ecosystems, and trends. Think Layer 1 smart contract platforms (like Solana), DeFi protocols (like Cardano), or meme coins (like Token6900).

Diversifying into altcoins helps reduce overexposure to a single asset and increases the chances of catching a breakout narrative early.

Some altcoins are less correlated with Bitcoin, offering defensive plays during BTC corrections. Others are high-risk, high-reward, and meant for smaller “moonbag” allocations. The key is balance.

Smart portfolios often mix blue-chip altcoins with promising newcomers. The goal? Survive downturns, thrive in rallies, and build conviction across categories.

3. Community & Narrative-Driven Momentum

Some of the best cryptocurrency coins owe their rise not to tech – but to tribe. Projects like Wall Street Pepe or Snorter Bot exploded thanks to active Telegram groups, meme culture, and viral attention.

Altcoins often live or die by community. If there’s constant chatter, organic memes, and users staking real capital – that’s a green flag.

But beware: hype cycles can fade fast. When activity slows and new users dry up, tokens can bleed hard. That’s why monitoring community sentiment, on-chain data, and dev updates matters.

At the end of the day, crypto is social – and many altcoins reflect that. If you’re early to a strong narrative with real engagement, the upside can be wild.

If a coin shows up in multiple places, has a consistent message, and is building a real following – that’s your signal to dig deeper.

How to Find Good Altcoins?

Success in altcoin investing requires systematic research and the right tools – here’s how smart money identifies winners before the crowd.

Check presales

Crypto presales offer ground-floor entry into promising projects before public trading begins. Look for presales with doxxed teams, clear roadmaps, and working products rather than just whitepapers. Audit reports from CertiK or Hacken provide essential security validation.

The best presales often fill quickly, so joining project Telegrams and following crypto influencers helps you stay ahead.

Warning signs can be unrealistic promises, anonymous teams, and pressure tactics. Legitimate projects welcome questions and provide transparent documentation.

Remember to never invest more than 5% of your portfolio in any single presale.

Use tools like Best Wallet

Best Wallet transforms altcoin discovery from guesswork into data-driven decisions. Best Wallet App’s trending section highlights tokens gaining momentum before they hit mainstream radar. Built-in DEX aggregation finds the best prices across multiple exchanges, while portfolio tracking keeps your investments organized. Advanced features include whale wallet monitoring and automatic rug pull detection.

Beyond basic functionality, Best Wallet’s presale launchpad vets projects before listing, adding a crucial safety layer. The social features let you follow successful traders and copy their strategies. Integration with DexScreener and DEXTools provides professional-grade charts without leaving the app. Power users leverage these tools to spot opportunities while others rely on Twitter rumors.

Monitor the crypto news daily

Staying informed separates successful altcoin investors from bagholders. Major announcements – partnership deals, exchange listings, technical upgrades – often precede significant price movements. Set up Google Alerts for your portfolio projects and follow official channels on Twitter and Telegram.

Understanding broader market narratives helps identify which sectors will outperform. When institutions embrace DeFi, related tokens surge. Regulatory clarity in specific regions benefits compliant projects.

Gaming partnerships drive GameFi tokens. Successful investors connect these dots before price action reflects the news. Just remember to verify news from multiple sources before acting.

Follow the Right Crypto News Channels

Good altcoins don’t appear out of nowhere – they build hype slowly through media exposure, influencer mentions, and dev announcements.

Track news sites like Cryptodnes, Cointelegraph, Cryptonews, and social hubs like Twitter, Telegram, and Reddit’s r/cryptocurrency.

If a coin shows up in multiple places, has a consistent message, and is building a real following – that’s your signal to dig deeper.

Which Are The Most Popular Types of Altcoins

The altcoin ecosystem encompasses many categories, each serving different purposes and risk appetites.

- Meme coins – Community-driven tokens like DOGE, SHIB, and PEPE that leverage viral marketing and social momentum for explosive but volatile gains

- Utility tokens – Functional tokens powering specific platforms or services, such as BNB for Binance fees or LINK for oracle services

- AI cryptos – Projects integrating artificial intelligence with blockchain, including trading bots, predictive analytics, and decentralized computing networks

- DeFi tokens – Governance and reward tokens for decentralized finance protocols, enabling lending, borrowing, and yield farming without traditional intermediaries

- Layer 1 tokens – Native currencies of alternative blockchains like Ethereum, Solana, and Avalanche that compete with or complement Bitcoin

- Gaming tokens – In-game currencies and governance tokens for blockchain games, enabling true ownership of digital assets and play-to-earn mechanics

- Privacy coins – Cryptocurrencies like Monero and Zcash that prioritize transaction privacy through advanced cryptographic techniques, specifically designed to obscure the connection between users and their transactions

The relation between Bitcoin’s market dominance and the performance of other altcoins is significant, as shifts in Bitcoin’s dominance index often relate to changes in altcoin performance during different market cycles.

Final Words

The altcoin season offers unprecedented opportunities for those willing to research thoroughly and manage risk intelligently. While moonshot potential exists, sustainable wealth building requires patience, diversification, and emotional discipline.

Remember that even the best crypto experts can’t predict every market movement. Focus on projects solving real problems with strong communities and transparent teams. The next bull cycle will create new millionaires – proper preparation and risk management determine whether you’ll be among them.

For the most up-to-date information and to verify project legitimacy, always visit the official site, website, or presale page of any project you are interested in.