Crypto Trading Volumes Drop as Market Awaits Regulatory Clarity

30.03.2025 17:30 2 min. read Alexander Stefanov

Since the post-election surge, daily trading volumes have dropped significantly, now averaging around $35 billion, which is comparable to levels seen before Donald Trump's presidential win.

After the election on November 5, trading volumes surged to $126 billion, driven by a mix of market optimism and speculative trading. This represents a decline of roughly 70%, bringing market activity back to pre-election levels. Recent trade policy changes, such as tariffs on major U.S. trading partners, have added uncertainty, slowing enthusiasm in both traditional and cryptocurrency markets.

Trading volumes and overall market capitalization have followed similar trends over the past few months. The total value of the cryptocurrency market peaked at around $3.9 trillion before falling back to about $2.9 trillion, a drop of 25%.

This reduction in trading volume could signal upcoming changes in the market. Historically, periods of low volume have often been followed by significant price shifts, as reduced liquidity can lead to larger price movements when major investors start repositioning. Many market participants may be waiting for more details on how the Trump administration will approach cryptocurrency regulation.

READ MORE:

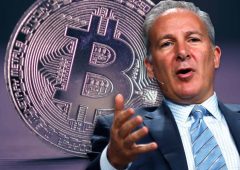

Economist Peter Schiff Criticizes Bitcoin’s “Digital Gold” Claim as Market Pressures Mount

The current combination of lower trading volumes and stable market cap hints at a potential accumulation phase, where investors are more focused on positioning for future moves than on active trading. Key regulatory updates, particularly those addressing cryptocurrency classification and oversight, may serve as triggers for renewed market activity.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read -

5

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read

Top 10 Biggest Crypto Developments This Week

The latest WuBlockchain Weekly report captures a high-volatility week in crypto. From Bitcoin’s new all-time high to controversy around Pump.fun’s presale and Elon Musk’s political Bitcoin endorsement, markets are witnessing sharp shifts in momentum and policy.

Federal Reserve Chair Jerome Powell Reportedly Weighing Resignation

U.S. financial circles are bracing for a potential shake-up as reports suggest Federal Reserve Chair Jerome Powell is considering stepping down.

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

Gold advocate Peter Schiff issued a stark warning on monetary policy and sparked fresh debate about Bitcoin’s perceived scarcity. In a pair of high-profile posts on July 12, Schiff criticized the current Fed rate stance and challenged the logic behind Bitcoin’s 21 million supply cap.

Report Claims That Binance Played a Foundational Role in the Creation of Trump Related StableCoin

Changpeng Zhao, the former CEO of Binance, reportedly supported crypto projects linked to the Trump family while privately seeking a presidential pardon, according to a July 11 report by Bloomberg News.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read -

5

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read