Crypto Trading Volumes Drop as Market Awaits Regulatory Clarity

30.03.2025 17:30 2 min. read Alexander Stefanov

Since the post-election surge, daily trading volumes have dropped significantly, now averaging around $35 billion, which is comparable to levels seen before Donald Trump's presidential win.

After the election on November 5, trading volumes surged to $126 billion, driven by a mix of market optimism and speculative trading. This represents a decline of roughly 70%, bringing market activity back to pre-election levels. Recent trade policy changes, such as tariffs on major U.S. trading partners, have added uncertainty, slowing enthusiasm in both traditional and cryptocurrency markets.

Trading volumes and overall market capitalization have followed similar trends over the past few months. The total value of the cryptocurrency market peaked at around $3.9 trillion before falling back to about $2.9 trillion, a drop of 25%.

This reduction in trading volume could signal upcoming changes in the market. Historically, periods of low volume have often been followed by significant price shifts, as reduced liquidity can lead to larger price movements when major investors start repositioning. Many market participants may be waiting for more details on how the Trump administration will approach cryptocurrency regulation.

READ MORE:

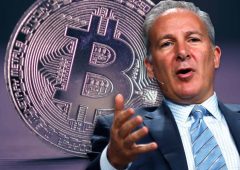

Economist Peter Schiff Criticizes Bitcoin’s “Digital Gold” Claim as Market Pressures Mount

The current combination of lower trading volumes and stable market cap hints at a potential accumulation phase, where investors are more focused on positioning for future moves than on active trading. Key regulatory updates, particularly those addressing cryptocurrency classification and oversight, may serve as triggers for renewed market activity.

-

1

Trump Economic Adviser’s Coinbase Stake Raises Fresh Ethics Questions

05.06.2025 10:00 2 min. read -

2

Trump Advisor Meets Bukele Amid U.S. Interest in Bitcoin Strategy

06.06.2025 9:00 1 min. read -

3

Less Income, No Buybacks: UBS Revises Berkshire Hathaway Forecast

08.06.2025 12:00 1 min. read -

4

Here’s How Much Elon Musk Has Lost Since Splitting from Trump

08.06.2025 16:00 1 min. read -

5

Circle Soars in NYSE Debut Amid Surging Stablecoin Interest — But Not Everyone’s Cheering

06.06.2025 11:00 2 min. read

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

Digital banking platform SoFi Technologies is making a strong return to the cryptocurrency space, relaunching its crypto trading and blockchain services after stepping away from the sector in late 2023.

Chinese Tech Firms Turn to Crypto for Treasury Diversification

Digital assets are gaining ground in corporate finance strategies, as more publicly traded companies embrace cryptocurrencies for treasury diversification.

Ripple Faces Legal Setback as Court Rejects Bid to Ease Penalties

Ripple has been dealt another legal blow after a federal judge rejected its attempt to ease court-imposed restrictions and penalties stemming from its long-standing battle with the U.S. Securities and Exchange Commission (SEC).

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

Stablecoins are failing where it matters most, says the Bank for International Settlements (BIS), which sharply criticized the asset class in its latest annual report.

-

1

Trump Economic Adviser’s Coinbase Stake Raises Fresh Ethics Questions

05.06.2025 10:00 2 min. read -

2

Trump Advisor Meets Bukele Amid U.S. Interest in Bitcoin Strategy

06.06.2025 9:00 1 min. read -

3

Less Income, No Buybacks: UBS Revises Berkshire Hathaway Forecast

08.06.2025 12:00 1 min. read -

4

Here’s How Much Elon Musk Has Lost Since Splitting from Trump

08.06.2025 16:00 1 min. read -

5

Circle Soars in NYSE Debut Amid Surging Stablecoin Interest — But Not Everyone’s Cheering

06.06.2025 11:00 2 min. read