Crypto Market on Edge: Warning Signs of an Imminent Collapse

04.08.2024 10:00 1 min. read Alexander Stefanov

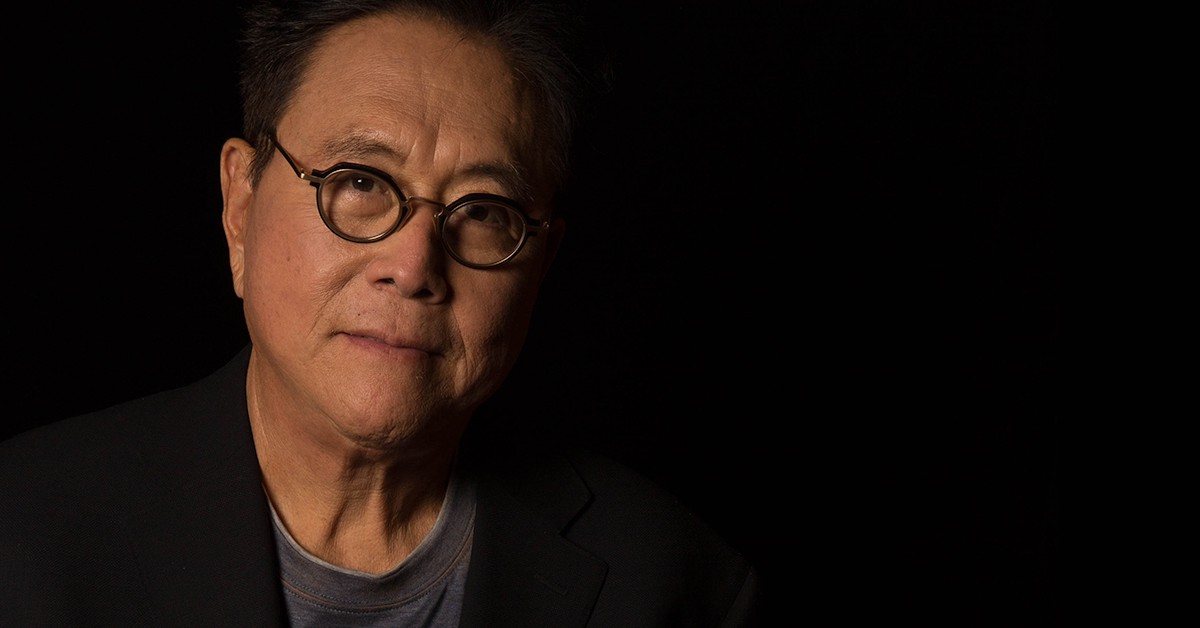

Henrik Zeberg, a well-known trader and analyst who runs The Zeberg Report, has reiterated his prediction of a major economic downturn, the worst since the 1929 Great Depression.

He has revised his timeline for this forecast, suggesting that the downturn could begin this October. Zeberg believes that the cryptocurrency market, along with some small-cap assets, will peak this October, leading to widespread market excitement.

Zeberg maintains that we are on the brink of a significant collapse in the Western economy, similar to the Great Depression. He expects some assets, including Bitcoin (BTC), to reach a “blow-off” top before this downturn begins. Based on Fibonacci analysis, he anticipates that Bitcoin could peak at around $120,000 in this cycle.

Zeberg has adjusted his predictions several times. Initially, he suggested watching for a market top by the end of 2023, then revised this to August 2024, and now expects it to occur by October.

His forecast is based on the Elliott wave theory, which outlines stock market phases and suggests that the end of the fifth phase could lead to a substantial decline, potentially reducing Bitcoin’s value by 60% to 80%.

-

1

Billionaire Investor Sees Dollar Crash If Key Support Breaks

18.06.2025 15:00 1 min. read -

2

Billionaire Slams Meme Stock Hype and Sounds Alarm on U.S. Fiscal Health

15.06.2025 18:00 2 min. read -

3

Nassim Taleb Says Global Trust Is Shifting from the Dollar to Gold

22.06.2025 17:00 1 min. read -

4

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read -

5

U.S. Recession May Already Be Locked In, Economist Warns

23.06.2025 12:00 1 min. read

BlackRock’s Bitcoin ETF Now Out-Earning Its $624B S&P 500 Fund

BlackRock’s spot Bitcoin exchange-traded fund (ETF), known by its ticker IBIT, has surpassed the firm’s flagship S&P 500 ETF in annual revenue, according to a new report from Bloomberg.

Ripple Has Applied for a National Banking License

Ripple has officially applied for a national bank charter from the U.S. Office of the Comptroller of the Currency (OCC), aiming to establish a new regulatory benchmark for trust in the stablecoin market.

Key U.S. Events to Watch This Week That Could Impact Crypto

The first week of July brings several important developments in the United States that could influence both traditional markets and the cryptocurrency sector.

Here Is How Your Crypto Portfolio Should Look Like According to Investment Manager

Ric Edelman, one of the most influential voices in personal finance, has radically revised his stance on crypto allocation. After years of cautious optimism, he now believes that digital assets deserve a far larger share in investment portfolios than ever before.

-

1

Billionaire Investor Sees Dollar Crash If Key Support Breaks

18.06.2025 15:00 1 min. read -

2

Billionaire Slams Meme Stock Hype and Sounds Alarm on U.S. Fiscal Health

15.06.2025 18:00 2 min. read -

3

Nassim Taleb Says Global Trust Is Shifting from the Dollar to Gold

22.06.2025 17:00 1 min. read -

4

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read -

5

U.S. Recession May Already Be Locked In, Economist Warns

23.06.2025 12:00 1 min. read