Crypto Market on Edge: Warning Signs of an Imminent Collapse

04.08.2024 10:00 1 min. read Alexander Stefanov

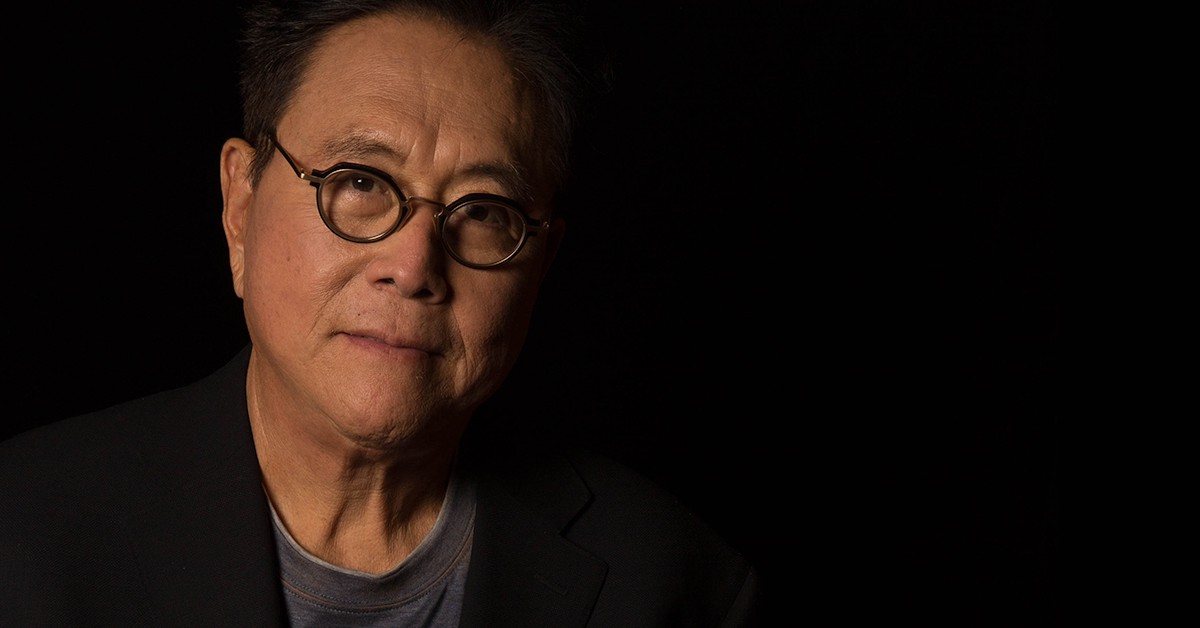

Henrik Zeberg, a well-known trader and analyst who runs The Zeberg Report, has reiterated his prediction of a major economic downturn, the worst since the 1929 Great Depression.

He has revised his timeline for this forecast, suggesting that the downturn could begin this October. Zeberg believes that the cryptocurrency market, along with some small-cap assets, will peak this October, leading to widespread market excitement.

Zeberg maintains that we are on the brink of a significant collapse in the Western economy, similar to the Great Depression. He expects some assets, including Bitcoin (BTC), to reach a “blow-off” top before this downturn begins. Based on Fibonacci analysis, he anticipates that Bitcoin could peak at around $120,000 in this cycle.

Zeberg has adjusted his predictions several times. Initially, he suggested watching for a market top by the end of 2023, then revised this to August 2024, and now expects it to occur by October.

His forecast is based on the Elliott wave theory, which outlines stock market phases and suggests that the end of the fifth phase could lead to a substantial decline, potentially reducing Bitcoin’s value by 60% to 80%.

-

1

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read -

2

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

3

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

4

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

5

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read

Weekly Crypto Roundup: Bitcoin Hits ATH, Ethereum Surges, Trump Advances Crypto Reforms

Analyzing the latest updates shared by Wu Blockchain, this past week underscored a pivotal shift in the crypto landscape. Bitcoin surged to a new all-time high of $123,226, pushing the overall crypto market cap beyond $4 trillion—a milestone reflecting renewed investor confidence and accelerating institutional flows.

Charles Schwab to Launch Bitcoin and Ethereum Trading Soon, CEO Confirms

Charles Schwab is preparing to roll out spot Bitcoin and Ethereum trading, according to CEO Rick Wurster during the firm’s latest earnings call.

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

BlackRock is seeking to enhance its iShares Ethereum Trust (ticker: ETHA) by incorporating staking features, according to a new filing with the U.S. Securities and Exchange Commission (SEC) submitted Thursday.

IMF Disputes El Salvador’s Bitcoin Purchases, Cites Asset Consolidation

A new report from the International Monetary Fund (IMF) suggests that El Salvador’s recent Bitcoin accumulation may not stem from ongoing purchases, but rather from a reshuffling of assets across government-controlled wallets.

-

1

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read -

2

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

3

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

4

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

5

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read