Crypto Market Cools Off as $500 Million Gets Wiped Out, Bitcoin and Ethereum Face Losses

24.11.2024 20:03 1 min. read Alexander Zdravkov

After a week of significant gains, the crypto market seems to be cooling-off with most digital assets witnessing declines.

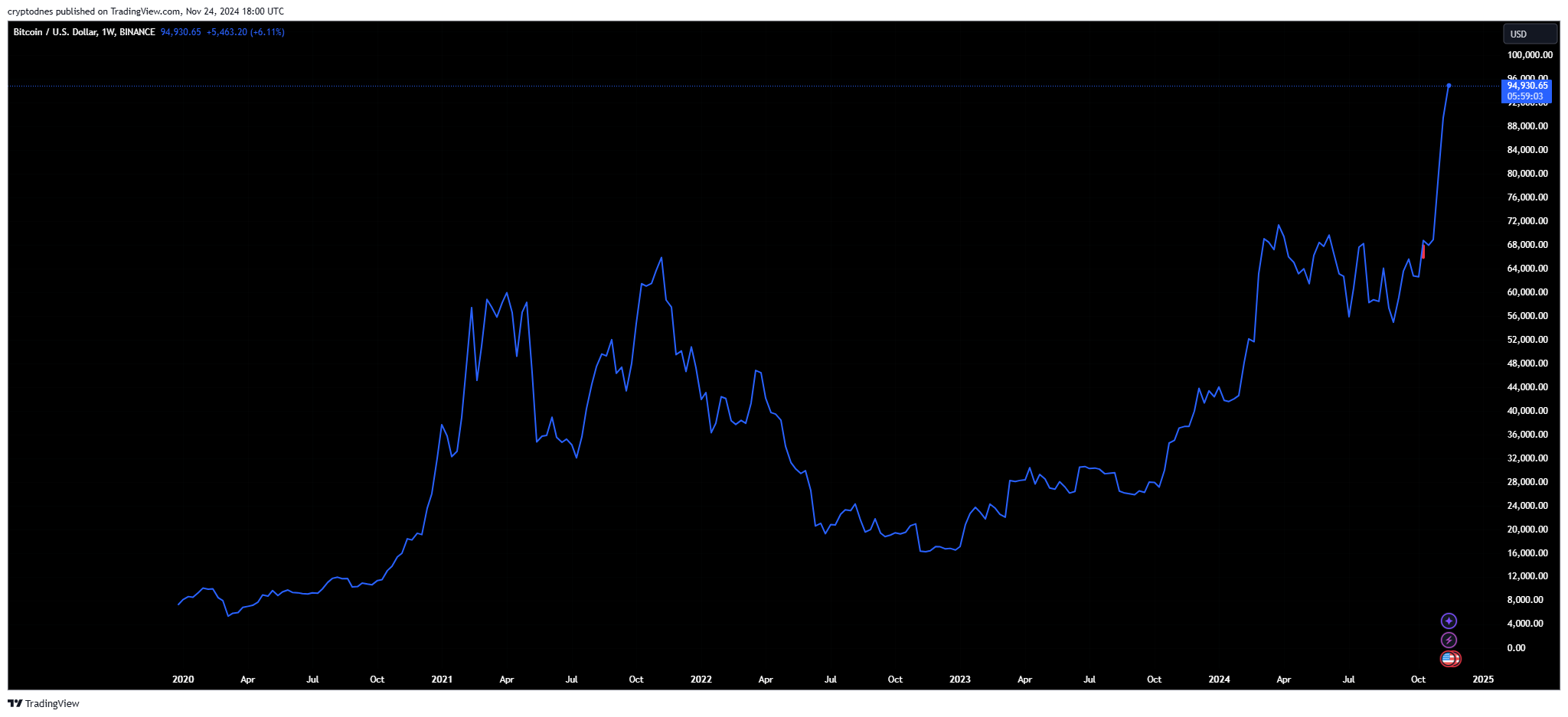

Bitcoin’s price dropped 2.3% in the past 24 hours below $95,000, but is still up 5.8% on the weekly chart. The flagship cryptocurrency has a market cap of $1.896 trillion and a 24-hour trading volume of $48 billion.

During this period, positions worth $493.18 million were wiped out – $385.67 million in longs, and $107.51 million in shorts, according to data from Coinglass.

Despite this price drop, the 1-day technical analysis from TradingView remains bullish with the summary pointing to “buy” at 15, moving averages show “strong buy” at 13, and oscillators remain “neutral” at 7.

The total cap of the crypto market declined by 2.83% in the past 24 hours and is currently at $3.26 trillion.

Ethereum lost 3.6% of its value in this timeframe with a trading volume of $29 billion. Nevertheless, ETH is still up 6.4% in the past 7 days and has a market cap of around $399 billion.

The biggest loser today is XRP, which lost over 11% with volumes reaching $11 billion. The altcoins is still up 24.7% this week, following the major price surge we witnessed some days ago.

-

1

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read -

2

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read -

3

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

4

Dogecoin Price Prediction: DOGE Volumes Nearly Double – Can It Get to $1 In This Cycle?

18.07.2025 20:10 3 min. read -

5

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read

Bitcoin Risk Cycle Flips Again as Market Enters Safer Zone

Bitcoin’s market signal has officially shifted back into a low-risk phase, according to a new chart shared by Bitcoin Vector in collaboration with Glassnode and Swissblock.

Robert Kiyosaki Warns of 1929-Style Crash, Urges Bitcoin Hedge

Financial author Robert Kiyosaki is once again sounding the alarm on America’s economic health.

Metaplanet Adds $92.5M in Bitcoin, Surpasses 17,000 BTC Holdings

Metaplanet Inc., a Tokyo-listed company, has just added 780 more Bitcoin to its treasury. The purchase, announced on July 28, cost around ¥13.666 billion or $92.5 million, with an average price of $118,622 per BTC.

Ethereum Surges Past $3,900 as Altcoin Season Sparks ETF Boom

Ethereum just crossed the $3,900 mark, rising over 62% in the past month, according to CoinMarketCap data.

-

1

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read -

2

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read -

3

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

4

Dogecoin Price Prediction: DOGE Volumes Nearly Double – Can It Get to $1 In This Cycle?

18.07.2025 20:10 3 min. read -

5

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read