Crypto Market Slump Has Left Traders With Millions of Dollars in Losses

05.08.2024 12:36 1 min. read Kosta Gushterov

The cryptocurrency market has recently experienced a significant downturn, resulting in large losses for many investors.

Blockchain security company PeckShield found that on Monday morning, a whale portfolio designated as “0xac4e…7597f” that had a long position in perpetual Ethereum (ETH) contracts experienced liquidations worth 7,467.5 ETH, which equates to approximately $22.3 million.

Another trader, identified by the address “0x0b5a…d8c5,” had lost close to $6 million, accompanied by 2 other Ethereum whales who lost $5.8 million and $7.38 million respectively.

These losses were part of a larger market crash that resulted in the liquidation of over $1 billion in digital assets on various exchanges.

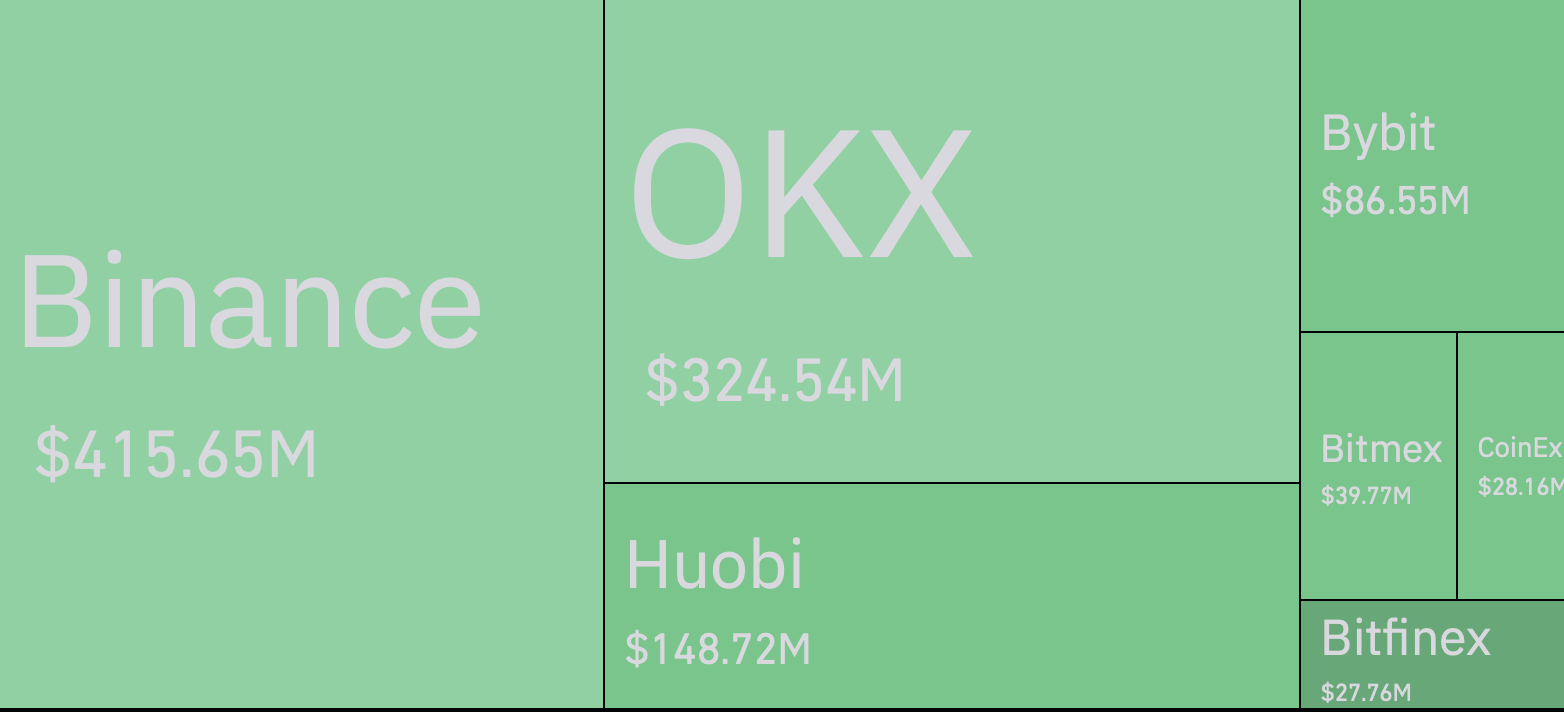

These liquidations occurred primarily on exchanges such as Binance, HTX, Bybit, BitMEX, and OKX. The largest single liquidation order took place on Huobi via the BTC/USD pair worth around $27 million.

Crypto traders on Binance lost around $415 million as the bears outnumbered the bulls over the weekend. Similarly, OKX saw losses of around $324 million, while Huobi traders lost approximately $148.7 million.

-

1

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

2

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

Spot Bitcoin ETFs recorded a massive influx of over $1 billion in a single day on Thursday, fueled by Bitcoin’s surge to a new all-time high above $118,000.

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

Bitcoin’s breakout to a new all-time high above $118,000 has reignited momentum across the crypto market. While BTC itself saw nice gains several altcoins are riding the wave of renewed investor interest.

Bitcoin Outlook: Rising U.S. Debt and Subdued Euphoria Suggest More Upside Ahead

As Bitcoin breaks above $118,000, fresh macro and on-chain data suggest the rally may still be in its early innings.

Analysis Firm Explains Why Bitcoin’s Breakout Looks Different This Time

Bitcoin’s surge to new all-time highs is playing out differently than previous rallies, according to a July 11 report by crypto research and investment firm Matrixport.

-

1

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

2

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read