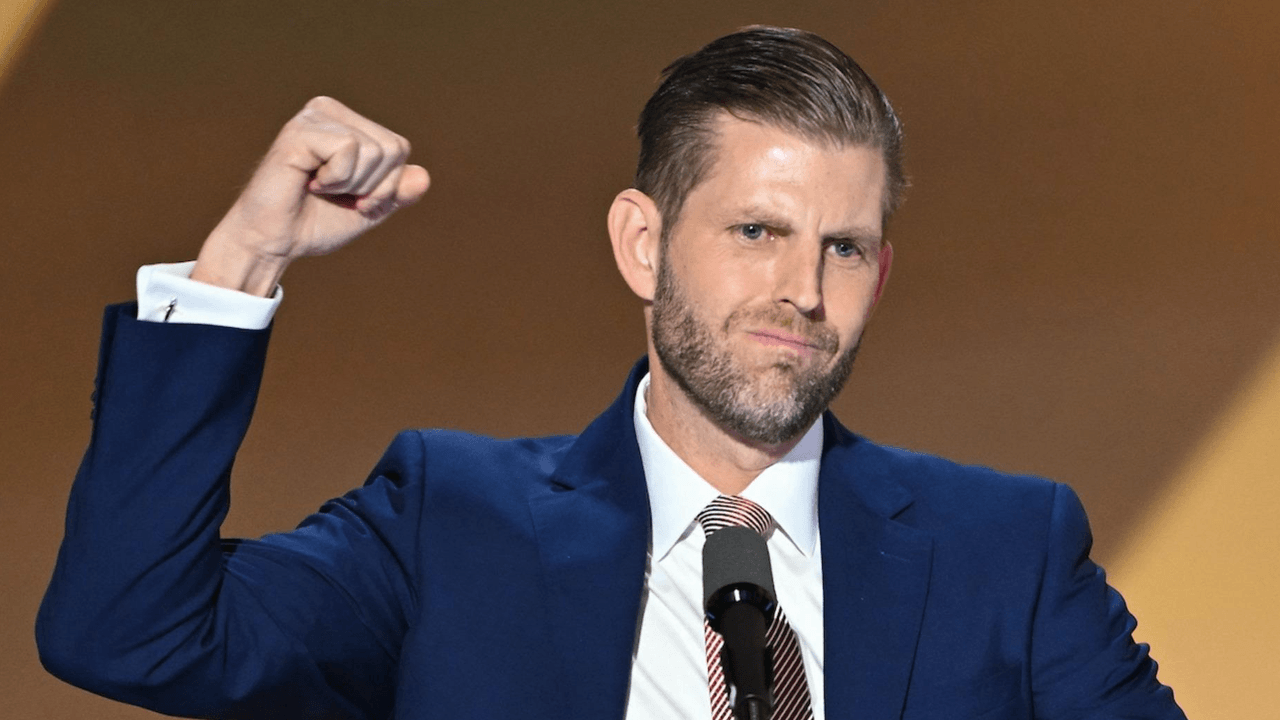

Crypto Is the Future, Not Banks, Says Eric Trump

30.04.2025 21:00 1 min. read Alexander Stefanov

Eric Trump has voiced strong support for cryptocurrency, criticizing traditional banking for falling behind the times.

In an April 30 interview, he described the legacy financial system as slow, inefficient, and biased toward the elite—key reasons he says he was drawn to digital assets.

He argued that banks are on a path to irrelevance unless they adapt to blockchain innovation, calling out outdated systems like SWIFT and praising decentralized platforms for offering faster, cheaper, and more transparent alternatives.

Despite skepticism from institutions like the Bank of Italy, Trump sees growing global interest in crypto as a sign that change is inevitable.

Eric’s recent push into the space includes backing a stablecoin called USD1, launched in March 2025 on the BNB Chain and pegged to U.S. dollar reserves.

The move has fueled speculation about deeper ties between the Trump family and Binance, especially following rumors about a possible revival of Binance.US with Trump involvement—claims both Donald Trump and Binance have denied.

Eric Trump had previously predicted Bitcoin could hit $1 million, and his latest remarks suggest he sees crypto as more than a passing trend—he sees it as the future of finance.

-

1

Peter Thiel-Backed Bullish Quietly Files for IPO as Crypto Firms Eye Wall Street

11.06.2025 22:00 1 min. read -

2

MEXC Sets Up $100M Emergency Fund to Protect Users From Major Security Incidents

12.06.2025 11:00 1 min. read -

3

Binance Enters Syrian Market as Sanctions Ease

12.06.2025 22:00 1 min. read -

4

Cardano Considers Crypto Wealth Fund to Supercharge DeFi

13.06.2025 21:00 2 min. read -

5

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

13.06.2025 22:00 1 min. read

Key U.S. Events to Watch This Week That Could Impact Crypto

The first week of July brings several important developments in the United States that could influence both traditional markets and the cryptocurrency sector.

Here Is How Your Crypto Portfolio Should Look Like According to Investment Manager

Ric Edelman, one of the most influential voices in personal finance, has radically revised his stance on crypto allocation. After years of cautious optimism, he now believes that digital assets deserve a far larger share in investment portfolios than ever before.

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

In the case involving Terraform Labs and its co-founder Do Hyeong Kwon, the defense has asked the Federal Court for the Southern District of New York to extend the deadline for pretrial filings by two weeks, pushing it beyond the original date of July 1, 2025.

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

Coinbase has emerged as the best-performing stock in the S&P 500 for June, climbing 43% amid a surge of bullish momentum driven by regulatory clarity, product innovation, and deeper institutional interest in crypto.

-

1

Peter Thiel-Backed Bullish Quietly Files for IPO as Crypto Firms Eye Wall Street

11.06.2025 22:00 1 min. read -

2

MEXC Sets Up $100M Emergency Fund to Protect Users From Major Security Incidents

12.06.2025 11:00 1 min. read -

3

Binance Enters Syrian Market as Sanctions Ease

12.06.2025 22:00 1 min. read -

4

Cardano Considers Crypto Wealth Fund to Supercharge DeFi

13.06.2025 21:00 2 min. read -

5

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

13.06.2025 22:00 1 min. read