Crypto Cycles are Evolving: Analyst Explains Why Old Patterns no Longer Work

16.07.2025 9:00 2 min. read Kosta Gushterov

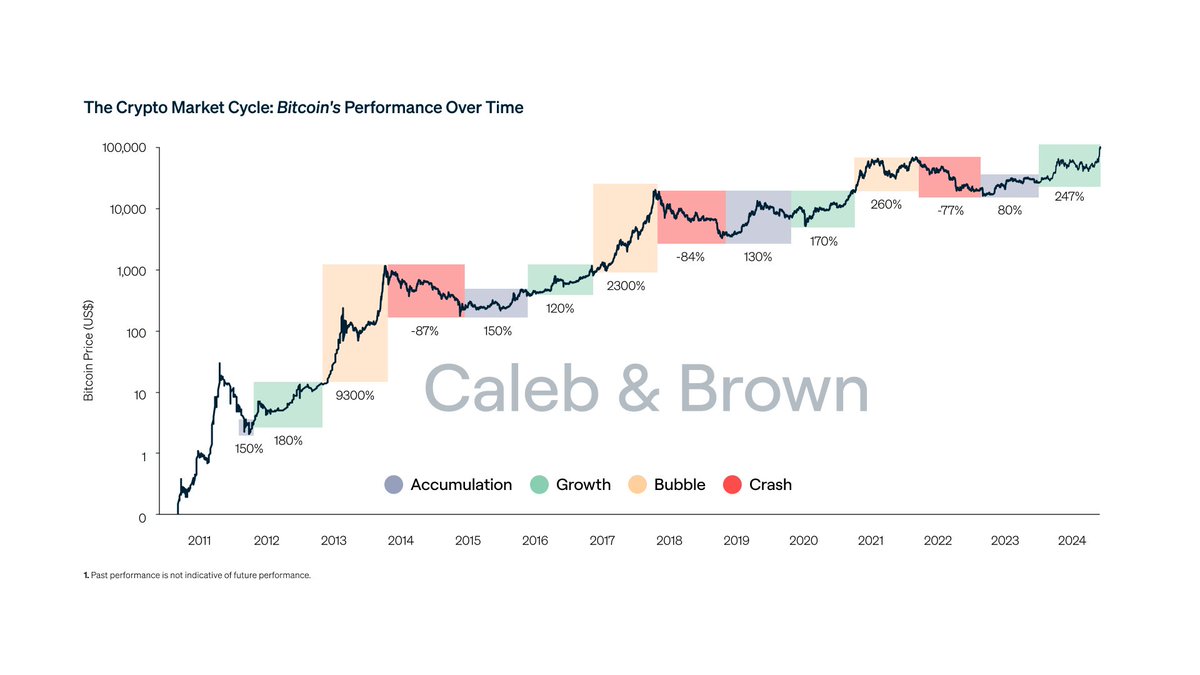

According to crypto analyst Atlas, the traditional four-year cycle that once defined Bitcoin and altcoin market behavior is now obsolete.

According to crypto analyst Atlas, the cryptocurrency market has undergone a fundamental transformation. The familiar four-year cycle structure—once considered a reliable framework for predicting bull runs and altseasons—is no longer valid. In a detailed thread, Atlas outlines the key shifts that now define this new era, shaped by macroeconomic forces, institutional adoption, and changing capital flows.

Bitcoin has become a macroeconomic asset

Atlas argues that Bitcoin is no longer a speculative tech investment, but rather a $2 trillion macro asset class embraced by institutions and sovereign actors. Major players like BlackRock now treat BTC as digital gold, with demand increasingly driven by ETFs, custody solutions, and derivatives markets. Sovereign interest is also rising, with the U.S. building strategic reserves, Middle Eastern nations quietly accumulating, and Germany’s BTC sales reinforcing its role as a national asset.

This shift, Atlas says, places Bitcoin firmly in the category of assets influenced by interest rates, inflation, and global liquidity cycles—factors previously foreign to crypto investors.

The old altseason rotation is broken

In past cycles, capital would typically rotate from Bitcoin to Ethereum, then into large-cap altcoins and eventually into meme coins. Atlas claims this pattern no longer applies. Instead of flowing predictably through the ecosystem, liquidity now either exits the market entirely or chases emerging narratives with greater speed and volatility. Legacy altcoins—once core to altseason expectations—have become “liquidity traps,” offering little reason for capital to rotate into outdated projects with no traction.

Narratives now drive performance

Retail-driven meme coins have emerged as the most consistent outperformers, despite offering no traditional fundamentals. Atlas notes that performance is increasingly dictated by attention and narrative strength rather than utility or technology. The market now rewards projects that align with viral themes like AI, tokenized assets (RWA), and other hype cycles. Assets without a compelling narrative—even in bull markets—are likely to be ignored.

READ MORE:

How Can You Tell When it’s Altcoin Season?

Traders must adapt to survive

According to Atlas, success in this new structure requires a shift in mindset. Traders must treat BTC as a macroeconomic instrument, quickly rotate between narratives as they emerge, and avoid holding onto outdated altcoin positions. While market cycles still exist, they are no longer tied to predictable halving timelines or four-year resets. Instead, volatility is higher, predictability is lower, and adaptability is the key differentiator between winners and those left behind.

-

1

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

2

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

3

Whales Buy the Dip as Retail Panics: This Week in Crypto

29.06.2025 14:00 3 min. read -

4

History Shows War Panic Selling Hurts Crypto Traders

28.06.2025 18:30 3 min. read -

5

Ripple Faces Legal Setback as Court Rejects Bid to Ease Penalties

26.06.2025 16:54 1 min. read

Kraken Launches U.S. Crypto Derivatives Platform, Eyes Broader Market Expansion

Kraken has officially launched its U.S.-regulated crypto derivatives platform, marking a major step toward merging traditional finance tools with digital asset markets.

How to Earn Yield Holding USDC: A 2025 Guide

If you’re holding USDC and want to maximize your yield, Deribit now offers rewards for eligible users who store USDC on its platform.

Kazakhstan May Invest Gold Reserves in Crypto Sector

Kazakhstan is considering allocating a portion of its gold and foreign currency reserves, along with National Fund assets, into crypto-related investments.

Grayscale Confidentially Files for New SEC-registered Offering Amid Growing Crypto Market demand

Grayscale Investments announced today that it has confidentially submitted a draft registration statement on Form S-1 to the U.S.

-

1

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

2

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

3

Whales Buy the Dip as Retail Panics: This Week in Crypto

29.06.2025 14:00 3 min. read -

4

History Shows War Panic Selling Hurts Crypto Traders

28.06.2025 18:30 3 min. read -

5

Ripple Faces Legal Setback as Court Rejects Bid to Ease Penalties

26.06.2025 16:54 1 min. read