Corporate Bitcoin Adoption Soars: 125 Public Companies Now Hold BTC

16.07.2025 20:00 2 min. read Kosta Gushterov

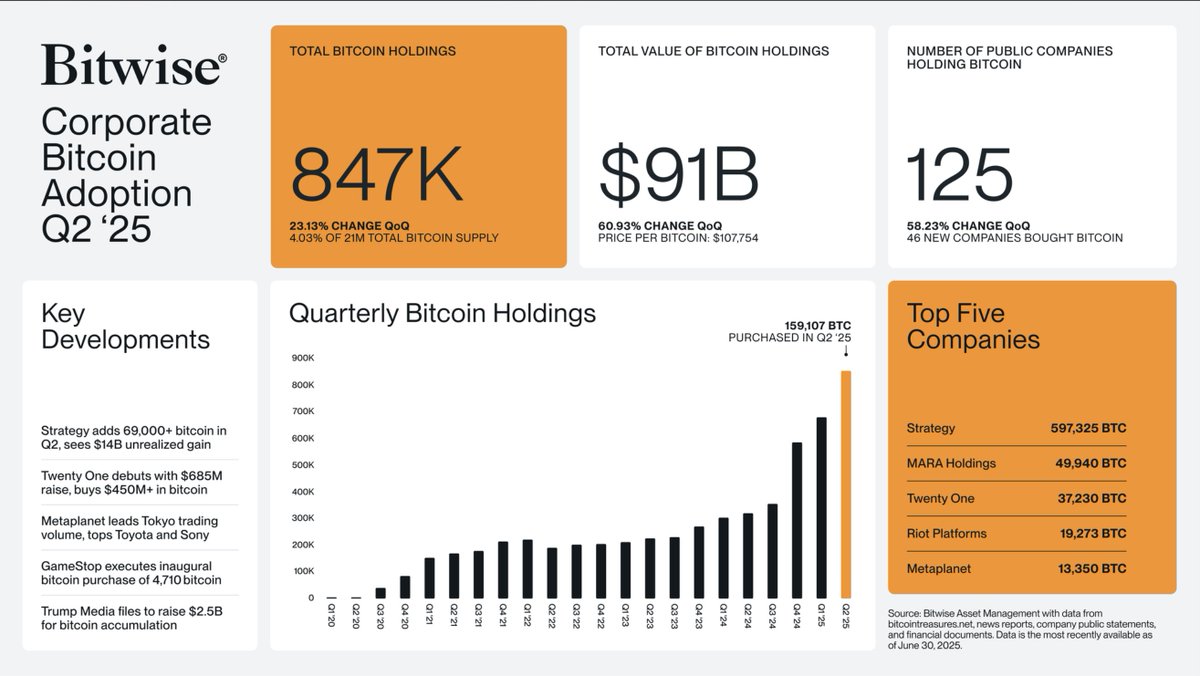

Corporate adoption of Bitcoin is gaining significant momentum, according to Bitwise Asset Management’s latest Q2 2025 report.

A total of 125 public companies now hold Bitcoin on their balance sheets, up from 79 in the previous quarter—a 58.23% increase. These firms collectively own 847,000 BTC, which accounts for 4.03% of the total Bitcoin supply.

The combined value of these holdings stands at $91 billion, reflecting a 60.93% quarter-over-quarter surge, driven in part by Bitcoin’s price averaging $107,754 during the quarter.

Top five corporate holders and record quarterly purchases

The second quarter saw 159,107 BTC added to corporate treasuries. Leading the charge is Strategy (formerly MicroStrategy), which added 69,000 BTC and now holds 597,325 BTC. MARA Holdings ranks second with 49,940 BTC, followed by newly launched Twenty One with 37,230 BTC.

Riot Platforms and Japan’s Metaplanet round out the top five with 19,273 BTC and 13,350 BTC, respectively. Notably, Metaplanet has become a dominant force in Tokyo’s trading landscape, surpassing even local giants like Toyota and Sony in market activity.

New entrants signal broadening institutional interest

Q2 also marked the debut of several major players. GameStop executed its first Bitcoin purchase, acquiring 4,710 BTC, while Twenty One raised $865 million and immediately allocated $450 million to Bitcoin.

READ MORE:

How Can You Tell When it’s Altcoin Season?

Trump Media filed plans to raise $2.5 billion for BTC accumulation. Bitwise highlighted that, despite the growth, corporate adoption remains “early stage.” With over 50,000 public companies globally and only 125 currently holding Bitcoin, the trend appears to be just beginning.

As regulatory clarity improves and digital assets gain credibility as treasury alternatives, more institutions are likely to follow suit—potentially transforming corporate finance norms in the years ahead.

-

1

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

30.06.2025 10:27 1 min. read -

2

Bitcoin Whales Accumulate as Long-Term Holders Hit All-Time High

03.07.2025 21:00 2 min. read -

3

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

4

Arizona Governor Vetoes Bill, Related to State Crypto Reserve Fund: Here Is Why

02.07.2025 16:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

Traders are rapidly shifting their focus to Ethereum and altcoins after Bitcoin’s recent all-time high triggered widespread retail FOMO.

BSTR to Launch With 30,021 BTC, Becomes 4th Largest Public Bitcoin Holder

BSTR Holdings Inc. is set to become the fourth-largest public holder of Bitcoin, announcing it will launch with 30,021 BTC on its balance sheet as part of its public debut.

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

The cryptocurrency market is experiencing a notable shift in capital flows as Bitcoin’s market dominance has dropped to 61.6%, marking a 2.36% decrease.

France Eyes Bitcoin Mining to Solve Surplus Energy Challenges

French lawmakers have introduced a groundbreaking proposal that would turn excess electricity from energy producers into a valuable digital asset—Bitcoin.

-

1

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

30.06.2025 10:27 1 min. read -

2

Bitcoin Whales Accumulate as Long-Term Holders Hit All-Time High

03.07.2025 21:00 2 min. read -

3

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

4

Arizona Governor Vetoes Bill, Related to State Crypto Reserve Fund: Here Is Why

02.07.2025 16:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read