Cardano Traders Anticipate Price Recovery Despite Recent Declines

28.08.2024 22:00 1 min. read Alexander Stefanov

Cardano (ADA) derivatives traders are showing strong confidence that the altcoin will recover from its recent price drop, according to recent data from BeInCrypto and Coinglass.

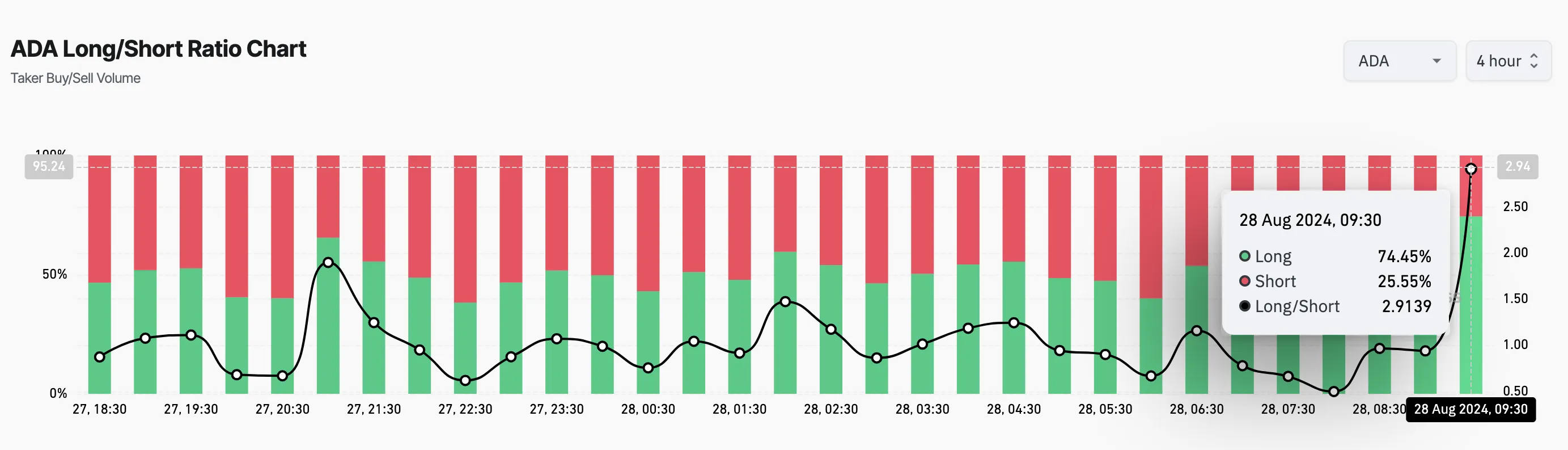

ADA has recently hit a seven-day low of $0.35 amid challenging market conditions. Despite this, traders remain optimistic about a rebound. Data from Coinglass reveals that the 4-hour Long/Short ratio for ADA stands at 2.91, indicating that nearly 75% of traders are betting on a price increase, with only 25% predicting further declines.

This bullish sentiment is supported by on-chain data from IntoTheBlock, which shows that ADA holders are increasingly holding onto their assets. The Coins’ Holding Time metric has risen by 64% over the past week and 103% over the past month, suggesting confidence among holders.

The Moving Average Convergence Divergence (MACD) indicator also points to potential bullish momentum, despite ADA’s 15% price drop since Saturday.

A positive MACD reading suggests a possible price increase if ADA maintains its position above $0.34. Failure to hold this level could lead to further declines, potentially to $0.31. Conversely, maintaining support could push ADA towards $0.39.

Traders are also wary of a potential long squeeze, which could occur if a significant price drop forces those betting on a rise to sell their positions to mitigate losses.

-

1

Pi Token Squeezes Higher After Brief Collapse—Path to $10 Still Murky

16.06.2025 14:00 1 min. read -

2

Solana Exchange Balances Surge as Bearish Signals Grow

13.06.2025 18:25 1 min. read -

3

Cardano Moves Toward Ripple Asset Integration as Hoskinson Teases DeFi Expansion

15.06.2025 11:00 2 min. read -

4

BTC Bull Token Price Prediction: The Next Crypto with 1000% Potential?

25.06.2025 18:55 4 min. read -

5

Crypto Whale Makes $3.5M Shorting Altcoins on Hyperliquid

15.06.2025 15:00 1 min. read

New Meme Coin to Watch: TOKEN6900 Presale Tipped as Next SPX6900

The recent launch of the TOKEN6900 (T6900) meme coin presale is a refreshing sight in a market oversaturated with presales focused on providing utility. Token6900 returns to the roots of meme coins, offering no utility. This is precisely what makes it appealing to those seeking a high-risk, high-reward asset to stockpile. Marketed as the world’s […]

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

XRP trading volumes have doubled in the past 24 hours. Although the price action has not reacted as expected yet, something could be brewing as bulls could be accumulating tokens at these low prices in anticipation of the token’s next leg up. Yesterday, the market reacted quite positively to the approval of the first Solana […]

Which Crypto ETFs Could Get SEC Approval in 2025? Here Are the Chances

With the U.S. Securities and Exchange Commission (SEC) already greenlighting spot Bitcoin and Ethereum ETFs, attention is now turning to the next wave of crypto-backed exchange-traded funds.

Top Trending Cryptocurrencies Today

As crypto markets navigate another week of volatility and shifting sentiment, traders are increasingly turning their attention to emerging altcoins and high-momentum tokens.

-

1

Pi Token Squeezes Higher After Brief Collapse—Path to $10 Still Murky

16.06.2025 14:00 1 min. read -

2

Solana Exchange Balances Surge as Bearish Signals Grow

13.06.2025 18:25 1 min. read -

3

Cardano Moves Toward Ripple Asset Integration as Hoskinson Teases DeFi Expansion

15.06.2025 11:00 2 min. read -

4

BTC Bull Token Price Prediction: The Next Crypto with 1000% Potential?

25.06.2025 18:55 4 min. read -

5

Crypto Whale Makes $3.5M Shorting Altcoins on Hyperliquid

15.06.2025 15:00 1 min. read