Cardano Traders Anticipate Price Recovery Despite Recent Declines

28.08.2024 22:00 1 min. read Alexander Stefanov

Cardano (ADA) derivatives traders are showing strong confidence that the altcoin will recover from its recent price drop, according to recent data from BeInCrypto and Coinglass.

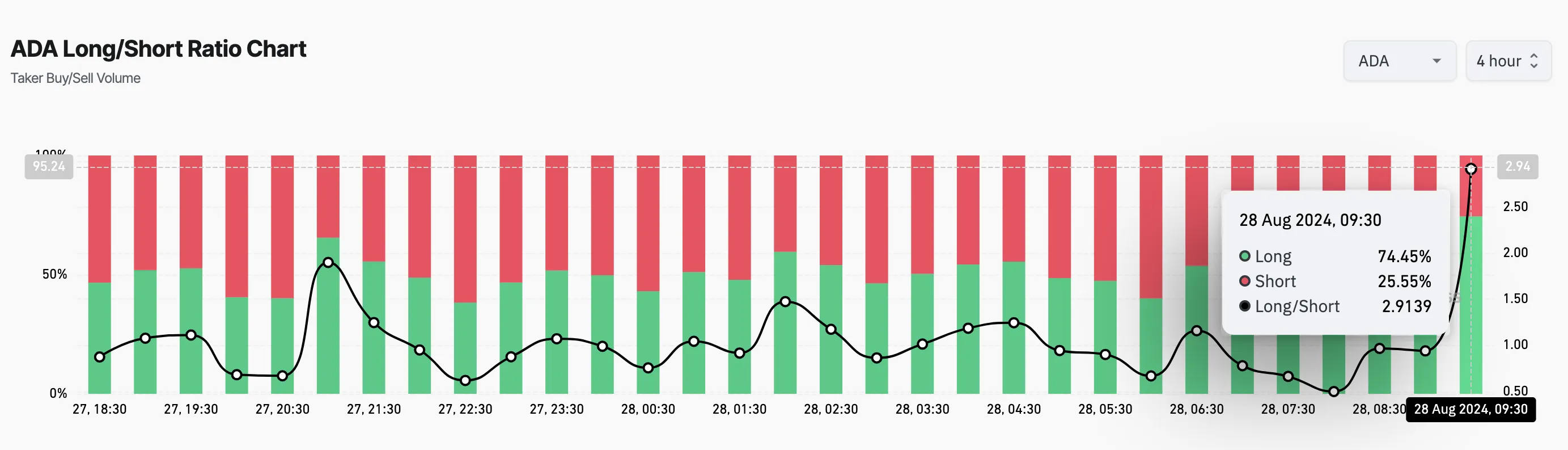

ADA has recently hit a seven-day low of $0.35 amid challenging market conditions. Despite this, traders remain optimistic about a rebound. Data from Coinglass reveals that the 4-hour Long/Short ratio for ADA stands at 2.91, indicating that nearly 75% of traders are betting on a price increase, with only 25% predicting further declines.

This bullish sentiment is supported by on-chain data from IntoTheBlock, which shows that ADA holders are increasingly holding onto their assets. The Coins’ Holding Time metric has risen by 64% over the past week and 103% over the past month, suggesting confidence among holders.

The Moving Average Convergence Divergence (MACD) indicator also points to potential bullish momentum, despite ADA’s 15% price drop since Saturday.

A positive MACD reading suggests a possible price increase if ADA maintains its position above $0.34. Failure to hold this level could lead to further declines, potentially to $0.31. Conversely, maintaining support could push ADA towards $0.39.

Traders are also wary of a potential long squeeze, which could occur if a significant price drop forces those betting on a rise to sell their positions to mitigate losses.

-

1

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read

Ethereum’s On-chain Volume Surges 288% — Is a Breakout Next?

Ethereum’s network just witnessed a seismic shift in activity.

Binance Launches New Airdrop and Trading Competition

Binance has officially launched a new airdrop event for Verasity (VRA) through its Binance Alpha platform, giving eligible users the chance to claim free tokens and compete for a massive prize pool.

XRP: What’s the Next Target After Bullish Breakout?

XRP has emerged from a months-long consolidation with renewed bullish momentum, reigniting trader interest in its next major price target.

Bitcoin Dominance Holds Firm as Altcoins Show Early Signs of Rotation

Despite recent gains across select DeFi and RWA tokens, Bitcoin continues to dominate the crypto landscape, with the Altcoin Season Index sitting at 43/100, according to today’s CoinMarketCap data.

-

1

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read