Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read Kosta Gushterov

Cardano (ADA) climbed 3.8% over the past 24 hours, reaching $0.736, as a combination of technical breakout, Bitcoin momentum, and a high-profile treasury move from Input Output Global (IOG) fueled bullish sentiment.

On July 13, ADA broke decisively above the $0.74 resistance level—a barrier that had held since May—signaling a potential trend reversal. The breakout triggered algorithmic buying and a cascade of short liquidations, helping the price jump over 27% for the week.

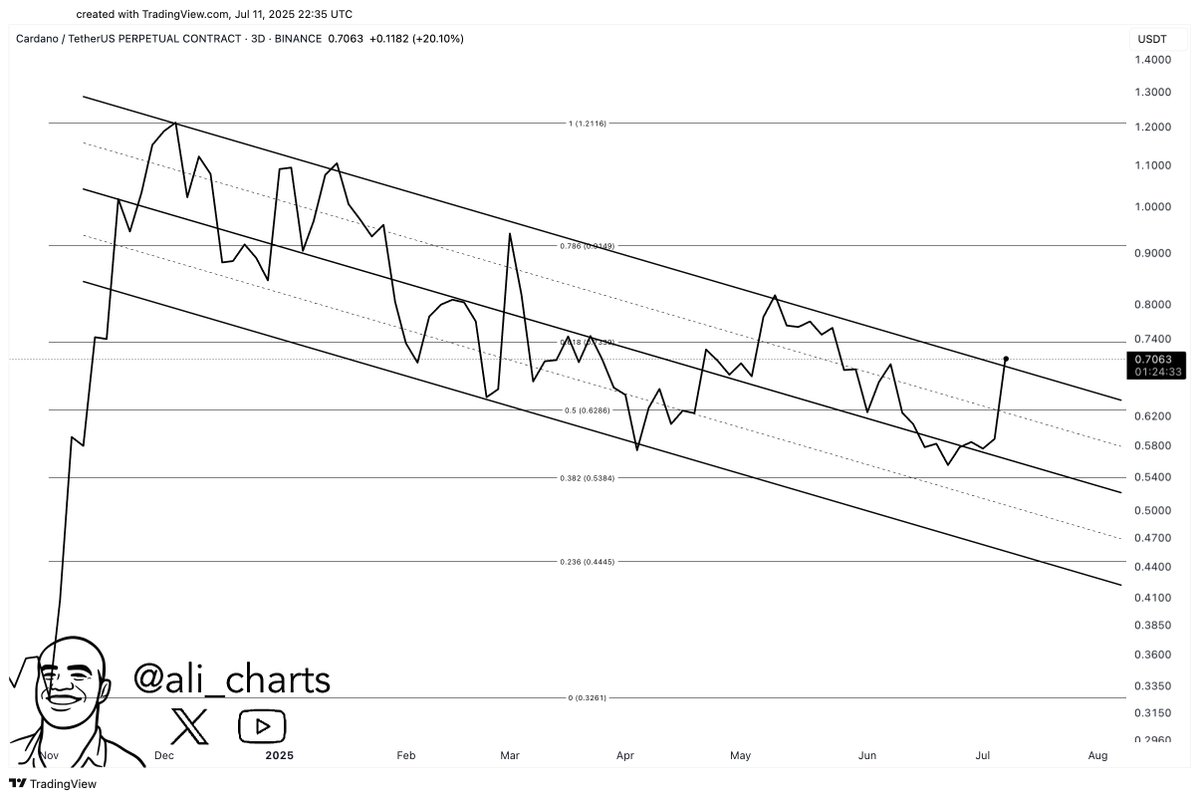

According to crypto analyst Ali Martinez, Cardano is now “breaking through a key resistance level, opening the door for a rally to $0.90–$1.20.” His chart shows ADA escaping a months-long downward channel, which had constrained the asset since early 2024. The breakout marks a shift in market structure and could signal the beginning of a new uptrend.

Treasury proposal adds fuel to rally

Cardano’s ecosystem momentum received a boost after IOG proposed converting $100 million worth of ADA from the community treasury into Bitcoin and stablecoins to fund DeFi development. The controversial yet forward-looking move sparked intense debate but ultimately signaled proactive treasury management.

Charles Hoskinson, Cardano’s founder, reinforced community confidence with a mocking response to bearish critics on X, just days after the proposal. ADA held its gains post-announcement, indicating market support for the initiative.

Broader market sentiment aligns

Cardano’s breakout coincides with Bitcoin’s surge past $118,000, lifting sentiment across major altcoins. ADA’s 24-hour trading volume stood at $1.43 billion, despite a 36% dip from the prior day, suggesting a shift from speculative churn to longer-term accumulation.

The asset’s market cap has now surpassed $26 billion, securing its position as the 10th-largest cryptocurrency by value. With a circulating supply of 35.38 billion ADA, traders are eyeing further upside if momentum sustains above the $0.74 pivot.

Outlook

If ADA maintains support above $0.74, next upside targets include $0.90 and $1.00, with resistance expected near $1.20 based on Martinez’s Fibonacci projections. A return of network activity and institutional confidence could help sustain the rally, especially if Bitcoin stabilizes above its all-time highs.

-

1

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

2

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read -

3

Altcoin Market: In Which Stage are we Now, According to Top Crypto Expert

06.07.2025 18:00 2 min. read -

4

Nasdaq-Listed Firm Targets HYPE, Solana, and Sui for Reserve Strategy

27.06.2025 19:00 2 min. read -

5

BNB Chain Boosts Transaction Speed and Stability with New Upgrade

30.06.2025 8:00 1 min. read

These Blockchains are Quietly Heating up—Sonic Leads With 89% Address Growth

According to on-chain analytics firm Nansen, several blockchain networks are witnessing a sharp rise in user activity, led by Sonic, which recorded an impressive 89% growth in active addresses over the past 7 days.

These Are the Most Trending Altcoins Right Now, According to CoinGecko

Crypto analysis platform CoinGecko has revealed the most talked-about altcoins in recent hours, highlighting a surge in investor interest across a range of sectors—from meme coins to DeFi and gaming tokens.

How Can You Tell When it’s Altcoin Season?

As the cryptocurrency market heats up, one recurring question dominates traders’ minds: are we in an Altcoin Season?

Ethereum Reclaims $3,000: What’s Driving the Renewed Bullish Momentum?

Ethereum is once again trading above the key $3,000 level after a 2.4% price jump brought it to $3,044 on July 14.

-

1

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

2

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read -

3

Altcoin Market: In Which Stage are we Now, According to Top Crypto Expert

06.07.2025 18:00 2 min. read -

4

Nasdaq-Listed Firm Targets HYPE, Solana, and Sui for Reserve Strategy

27.06.2025 19:00 2 min. read -

5

BNB Chain Boosts Transaction Speed and Stability with New Upgrade

30.06.2025 8:00 1 min. read