Cardano Investors Show Growing Confidence, Extending Holding Times Surge

15.01.2025 19:00 1 min. read Kosta Gushterov

Cardano (ADA) has seen a notable rise in the average time investors are holding their tokens, signaling increased confidence in the cryptocurrency's near-term prospects.

This trend reflects a shift in sentiment, with holders expecting the coin to maintain stability above the $1 mark.

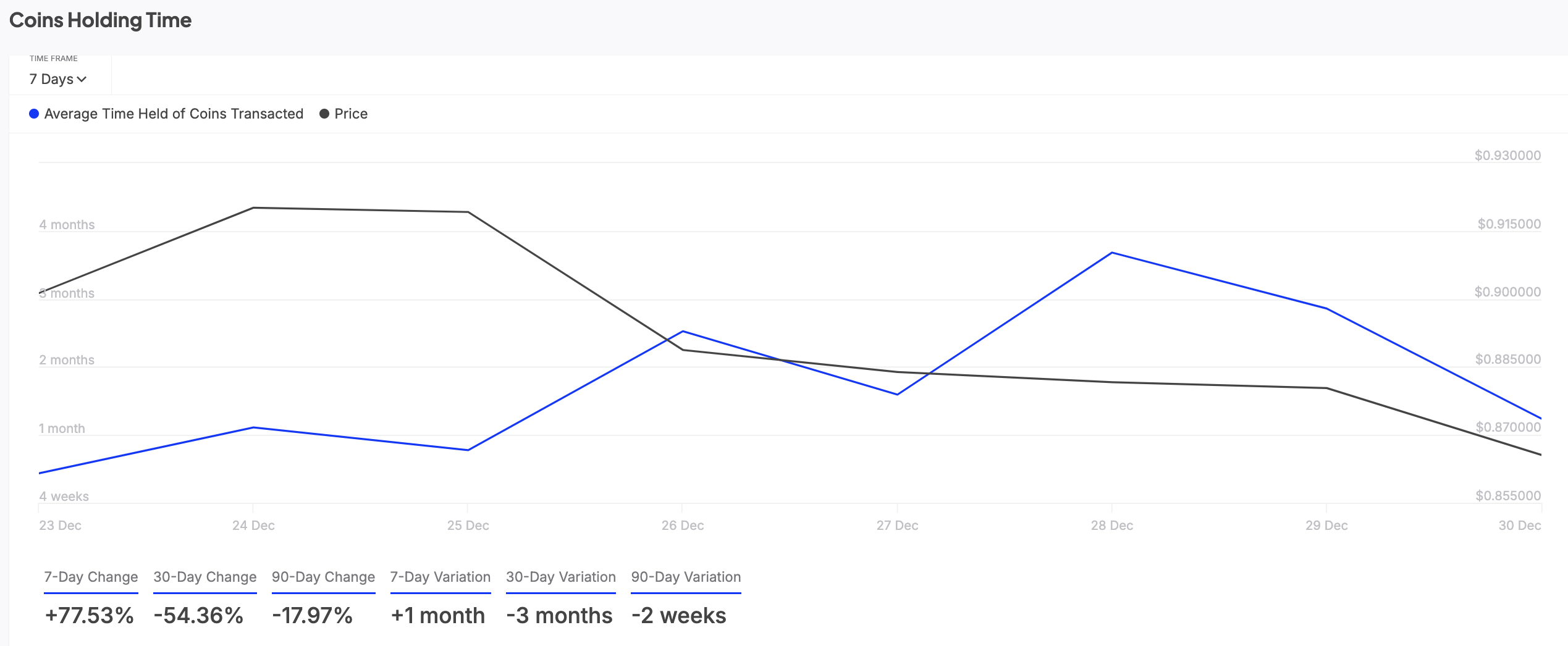

Recent on-chain data highlights a sharp increase in the average holding period for ADA tokens over the last week. Analysis from IntoTheBlock shows that this duration has surged by 78% within the review period.

This metric represents the average time tokens remain in wallets before being moved or sold, and longer holding times often indicate reduced market selling pressure.

This decrease in selloffs has contributed to an 8% rise in ADA’s value over the past week, showcasing growing conviction among investors.

Additionally, the funding rate for ADA in perpetual futures contracts remains positive, currently standing at 0.01%. A positive funding rate typically signals strong demand for long positions, reinforcing bullish sentiment in the market.

-

1

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

2

XRP Hits All-time High Amid Regulatory Breakthrough and Whale Surge

18.07.2025 11:14 2 min. read -

3

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read -

4

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

5

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read

Whale Activity Spikes as Smart Money Eyes Reversal Zones

Amid current market volatility, blockchain analytics firm Santiment has reported a notable rise in whale activity targeting a select group of altcoins.

Binance to Launch PlaysOut (PLAY) Trading on July 31 With Airdrop

Binance has officially announced the launch of PlaysOut (PLAY), a new token debuting on Binance Alpha, with trading scheduled to begin on July 31, 2025, at 08:00 UTC.

Cboe BZX Files for Injective-based ETF Alongside Solana Fund Proposal

The Cboe BZX Exchange has submitted a filing with the U.S. Securities and Exchange Commission (SEC) seeking approval for a new exchange-traded fund (ETF) that would track Injective’s native token (INJ).

Bernstein Warns Ethereum Treasuries Pose New Risks

Bernstein has flagged growing risks in Ethereum’s corporate adoption trend, cautioning that the rise of “ETH treasuries” could reshape the network’s supply and risk dynamics.

-

1

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

2

XRP Hits All-time High Amid Regulatory Breakthrough and Whale Surge

18.07.2025 11:14 2 min. read -

3

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read -

4

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

5

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read