Cardano Faces Pressure as Whales Scale Back and Bearish Sentiment Grows

05.02.2025 19:30 1 min. read Alexander Stefanov

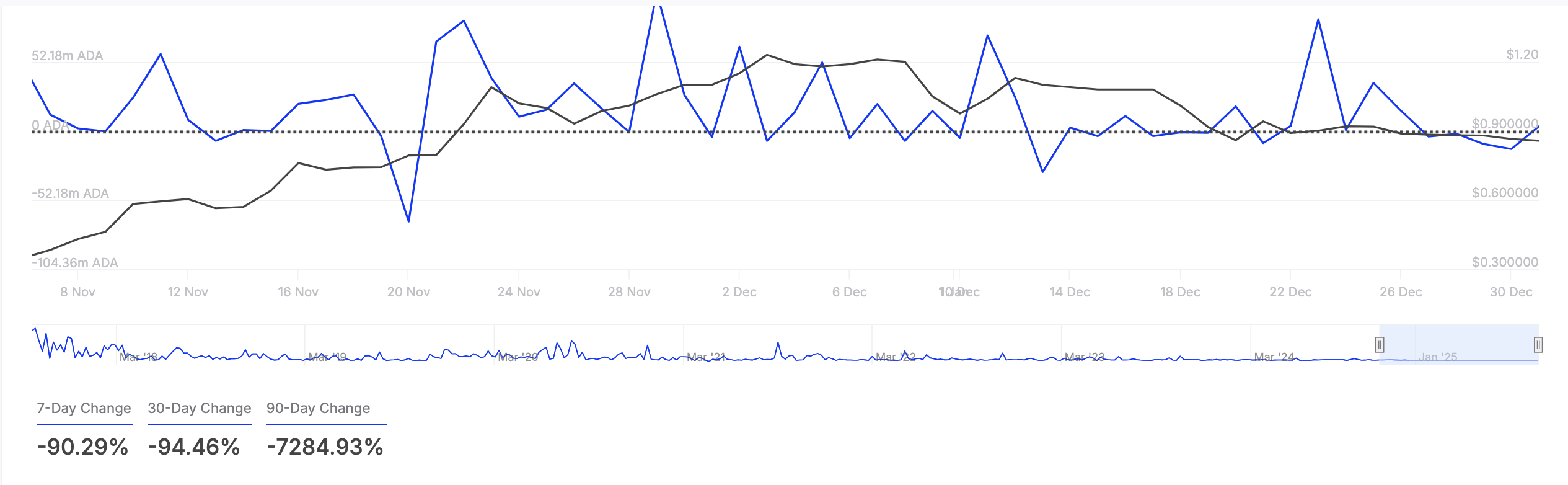

Cardano's largest investors, often referred to as ADA whales, have been scaling back their trading activity, indicating a shift in sentiment around the altcoin.

Over the past week, on-chain data from IntoTheBlock has shown a staggering 90% decrease in the netflow of ADA from these major holders. This decline suggests that these large investors are either offloading their holdings or refraining from adding more to their positions.

The drop in whale activity could be a red flag for ADA, as it may lead to lower liquidity and increased price volatility.

With these key players pulling back, there is less buying pressure, which could contribute to a further decline in the coin’s value. This change in behavior aligns with a growing bearish outlook on ADA.

Adding to the negative sentiment is the increasing demand for short positions in ADA’s futures market, highlighted by its negative funding rate of -0.005%.

A negative funding rate indicates that more traders are betting against the asset, further suggesting a lack of confidence in ADA’s short-term performance. As the market sentiment continues to sour and whale activity remains subdued, ADA faces the risk of prolonged downward pressure unless new buying momentum materializes.

-

1

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

2

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

3

XRP Hits All-time High Amid Regulatory Breakthrough and Whale Surge

18.07.2025 11:14 2 min. read -

4

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

5

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read

Binance to Launch PlaysOut (PLAY) Trading on July 31 With Airdrop

Binance has officially announced the launch of PlaysOut (PLAY), a new token debuting on Binance Alpha, with trading scheduled to begin on July 31, 2025, at 08:00 UTC.

Cboe BZX Files for Injective-based ETF Alongside Solana Fund Proposal

The Cboe BZX Exchange has submitted a filing with the U.S. Securities and Exchange Commission (SEC) seeking approval for a new exchange-traded fund (ETF) that would track Injective’s native token (INJ).

Bernstein Warns Ethereum Treasuries Pose New Risks

Bernstein has flagged growing risks in Ethereum’s corporate adoption trend, cautioning that the rise of “ETH treasuries” could reshape the network’s supply and risk dynamics.

Interactive Brokers Weighs Stablecoin Launch

Interactive Brokers, one of the world’s largest online brokerage platforms, is exploring the possibility of issuing its own stablecoin, signaling a potential expansion into blockchain-driven financial infrastructure as U.S. crypto regulation begins to ease.

-

1

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

2

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

3

XRP Hits All-time High Amid Regulatory Breakthrough and Whale Surge

18.07.2025 11:14 2 min. read -

4

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

5

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read