Cardano Faces Potential Price Drop Amid Weakening Demand

01.10.2024 9:30 1 min. read Kosta Gushterov

Cardano has enjoyed a 12% price increase over the past month, but there are signs that the token could face a downturn in October.

With selling pressure gradually picking up, a potential correction could send ADA down by as much as 29% in the coming weeks.

Investors seem to be taking profits, as suggested by declining capital inflows tracked by the Chaikin Money Flow (CMF). While buying interest remains, the slowing momentum hints at weakening demand.

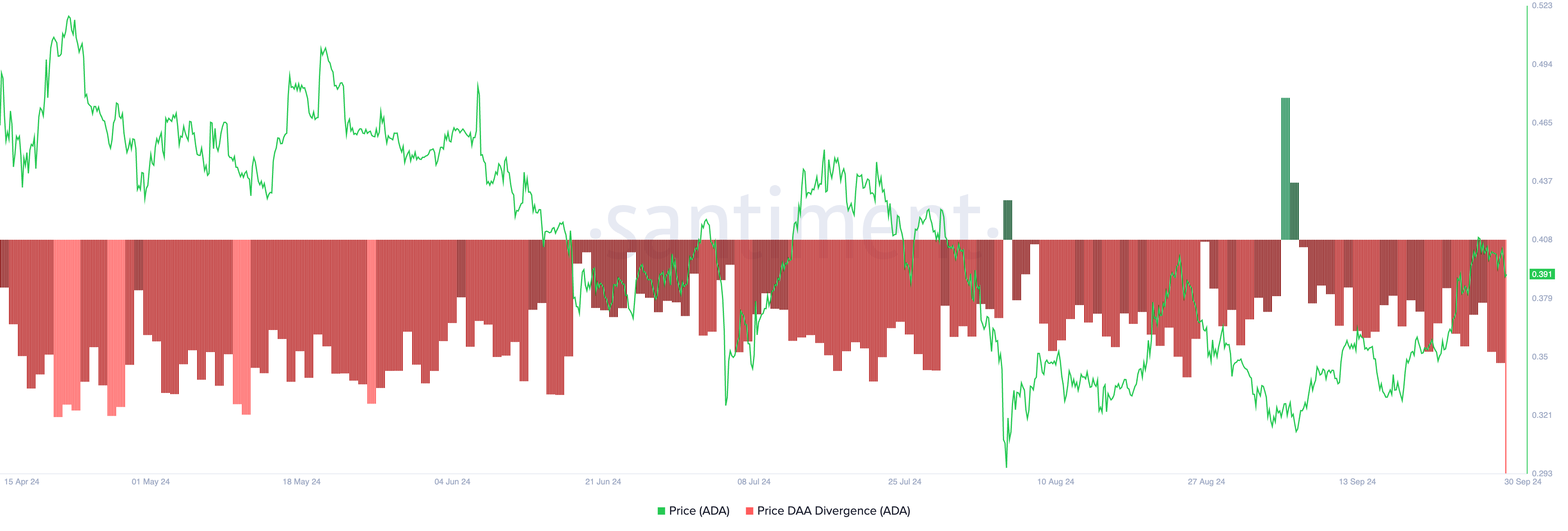

This shift is echoed by the falling number of active addresses interacting with the token, which shows that Cardano’s recent price surge might be more a result of broader market trends rather than direct interest in ADA.

Currently priced at $0.39, ADA is close to losing support from a key technical indicator, the Ichimoku Cloud. A break below this level could lead to a drop to $0.27, though a market rebound might instead drive the price toward $0.47.

-

1

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

2

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read -

3

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read -

4

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

17.07.2025 18:30 2 min. read -

5

SOL Price Tests Key Level: Can a Weekly Close Above $170 Trigger a Bull Run?

12.07.2025 16:20 2 min. read

Fartcoin Price Prediction: Trader Expects Big Bounce as FARTCOIN Nears $1

Fartcoin (FARTCOIN) has gone down by 17.3% in the past 24 hours and currently sits at $1.14. As the token approaches $1, one trader favors a bullish Fartcoin price prediction. DevKhabib, a pseudonymous trader whose X account is followed by nearly 46,000 users, says that he expects a big bounce off the $1 support after […]

Whale Activity Spikes as Smart Money Eyes Reversal Zones

Amid current market volatility, blockchain analytics firm Santiment has reported a notable rise in whale activity targeting a select group of altcoins.

Binance to Launch PlaysOut (PLAY) Trading on July 31 With Airdrop

Binance has officially announced the launch of PlaysOut (PLAY), a new token debuting on Binance Alpha, with trading scheduled to begin on July 31, 2025, at 08:00 UTC.

Cboe BZX Files for Injective-based ETF Alongside Solana Fund Proposal

The Cboe BZX Exchange has submitted a filing with the U.S. Securities and Exchange Commission (SEC) seeking approval for a new exchange-traded fund (ETF) that would track Injective’s native token (INJ).

-

1

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

2

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read -

3

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read -

4

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

17.07.2025 18:30 2 min. read -

5

SOL Price Tests Key Level: Can a Weekly Close Above $170 Trigger a Bull Run?

12.07.2025 16:20 2 min. read