Cardano (ADA) Sees Increased Activity, But Price Remains Flat

08.09.2024 9:00 1 min. read Alexander Stefanov

Recently, previously inactive Cardano (ADA) coins were moved, coinciding with a surge in daily active addresses and increased trading activity.

Despite this, ADA’s price remained relatively unchanged over the past 24 hours, hinting that the coin movement might not indicate a bullish trend.

According to data from Santiment, ADA’s age consumed—a metric that tracks the movement of long-held coins—spiked to a seven-day high of 6.33 billion on Friday.

This is significant because long-term holders usually move their coins infrequently, and such movements can often signal upcoming market shifts.

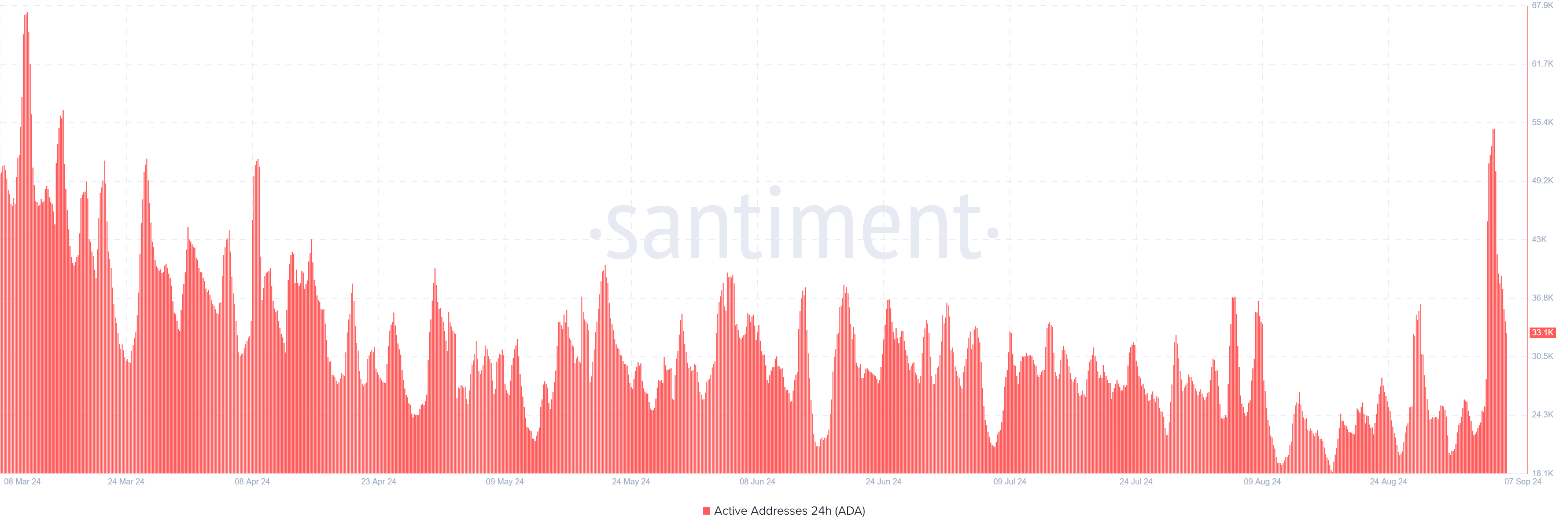

Alongside the rise in age consumed, the number of active addresses trading ADA also increased. Santiment reports that 54,200 addresses were involved in transactions, marking the highest single-day activity since March 6.

However, while a rise in active addresses typically suggests a positive trend, the subsequent decline in ADA’s price following the age consumed spike indicates that a local peak may have been reached, suggesting a potential further decline for the coin.

-

1

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

2

XRP Hits All-time High Amid Regulatory Breakthrough and Whale Surge

18.07.2025 11:14 2 min. read -

3

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read -

4

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

5

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read

Fartcoin Price Prediction: Trader Expects Big Bounce as FARTCOIN Nears $1

Fartcoin (FARTCOIN) has gone down by 17.3% in the past 24 hours and currently sits at $1.14. As the token approaches $1, one trader favors a bullish Fartcoin price prediction. DevKhabib, a pseudonymous trader whose X account is followed by nearly 46,000 users, says that he expects a big bounce off the $1 support after […]

Whale Activity Spikes as Smart Money Eyes Reversal Zones

Amid current market volatility, blockchain analytics firm Santiment has reported a notable rise in whale activity targeting a select group of altcoins.

Binance to Launch PlaysOut (PLAY) Trading on July 31 With Airdrop

Binance has officially announced the launch of PlaysOut (PLAY), a new token debuting on Binance Alpha, with trading scheduled to begin on July 31, 2025, at 08:00 UTC.

Cboe BZX Files for Injective-based ETF Alongside Solana Fund Proposal

The Cboe BZX Exchange has submitted a filing with the U.S. Securities and Exchange Commission (SEC) seeking approval for a new exchange-traded fund (ETF) that would track Injective’s native token (INJ).

-

1

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

2

XRP Hits All-time High Amid Regulatory Breakthrough and Whale Surge

18.07.2025 11:14 2 min. read -

3

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read -

4

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

5

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read