Bulls vs. Bears: Diverse Views on Bitcoin’s Market Sentiment

11.07.2024 17:30 1 min. read Alexander Stefanov

Bitcoin's recent price movements following the halving event have created a diverse landscape of opinions within the cryptocurrency community.

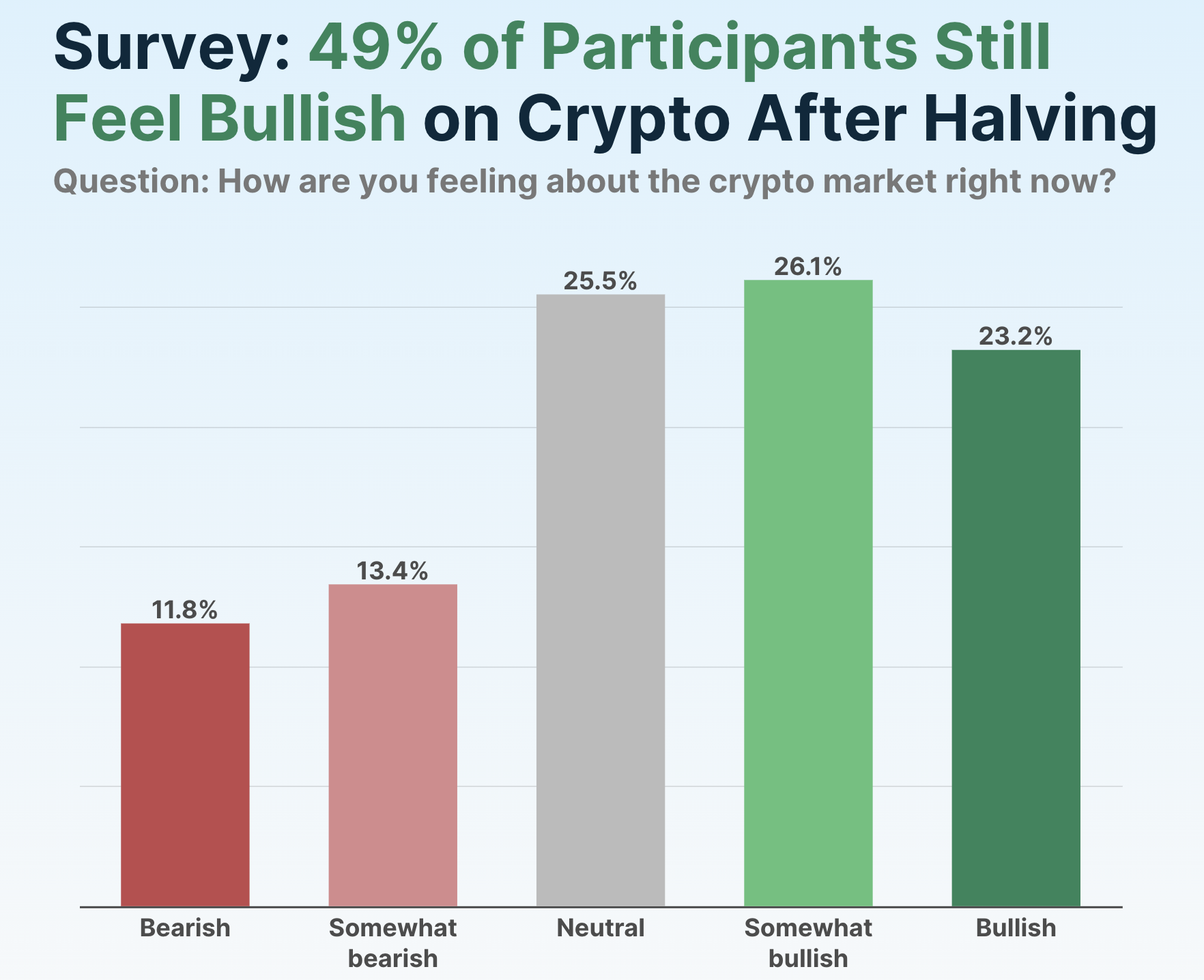

CoinGecko’s survey, conducted from mid-June to July 8 with over 2,500 participants, underscores the nuanced views across different market segments, with 49% of participants feeling bullish on BTC post-halving.

Despite the general bullish sentiment among investors, concerns linger over market stability amid significant price fluctuations. Traders, in particular, exhibit cautious optimism, balancing between potential opportunities and market volatility.

Speculators, on the other hand, remain more skeptical, possibly influenced by recent profit-taking and external market pressures.

READ MORE:

Ethereum: Crucial Resistance Level to Watch

The impact of German authorities selling 50,000 BTC seized from the illegal film website Movie2k has exacerbated market uncertainties, as highlighted by industry figures like Anthony Pompliano.

His observations on CNBC about Bitcoin’s liquidity challenges emphasize the broader implications of large-scale asset movements on market dynamics.

These developments underscore the complexity of current market conditions, where sentiment shifts can influence short-term price movements while long-term investors assess broader trends and opportunities.

-

1

BlackRock’s Bitcoin ETF Now Out-Earning Its $624B S&P 500 Fund

03.07.2025 10:00 1 min. read -

2

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

21.06.2025 16:00 2 min. read -

3

Strategy’ Michael Saylor Drops Another Cryptic Bitcoin Message

24.06.2025 21:00 1 min. read -

4

‘Nobody Saw This Coming’: Saylor Points to Political Winds Fueling Bitcoin Boom

22.06.2025 10:00 2 min. read -

5

Strategy Adds to Its Bitcoin Pile Again, Shrugging Off Market Slump

23.06.2025 17:00 1 min. read

Bitcoin: Is the Cycle Top In and How to Spot It?

Bitcoin may not have reached its peak in the current market cycle, according to a recent analysis by crypto analytics firm Alphractal.

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

BlackRock’s iShares Bitcoin Trust (IBIT) has officially crossed the 700,000 BTC mark, reinforcing its position as one of the fastest-growing exchange-traded funds in financial history.

Bitcoin: Historical Trends Point to Likely Upside Movement

Bitcoin may be gearing up for a significant move as its volatility continues to tighten, according to on-chain insights from crypto analyst Axel Adler.

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

Two major developments are converging in July that could shape the future of Bitcoin in the United States—both tied to President Trump’s administration and its expanding crypto agenda.

-

1

BlackRock’s Bitcoin ETF Now Out-Earning Its $624B S&P 500 Fund

03.07.2025 10:00 1 min. read -

2

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

21.06.2025 16:00 2 min. read -

3

Strategy’ Michael Saylor Drops Another Cryptic Bitcoin Message

24.06.2025 21:00 1 min. read -

4

‘Nobody Saw This Coming’: Saylor Points to Political Winds Fueling Bitcoin Boom

22.06.2025 10:00 2 min. read -

5

Strategy Adds to Its Bitcoin Pile Again, Shrugging Off Market Slump

23.06.2025 17:00 1 min. read