Bulls vs. Bears: Diverse Views on Bitcoin’s Market Sentiment

11.07.2024 17:30 1 min. read Alexander Stefanov

Bitcoin's recent price movements following the halving event have created a diverse landscape of opinions within the cryptocurrency community.

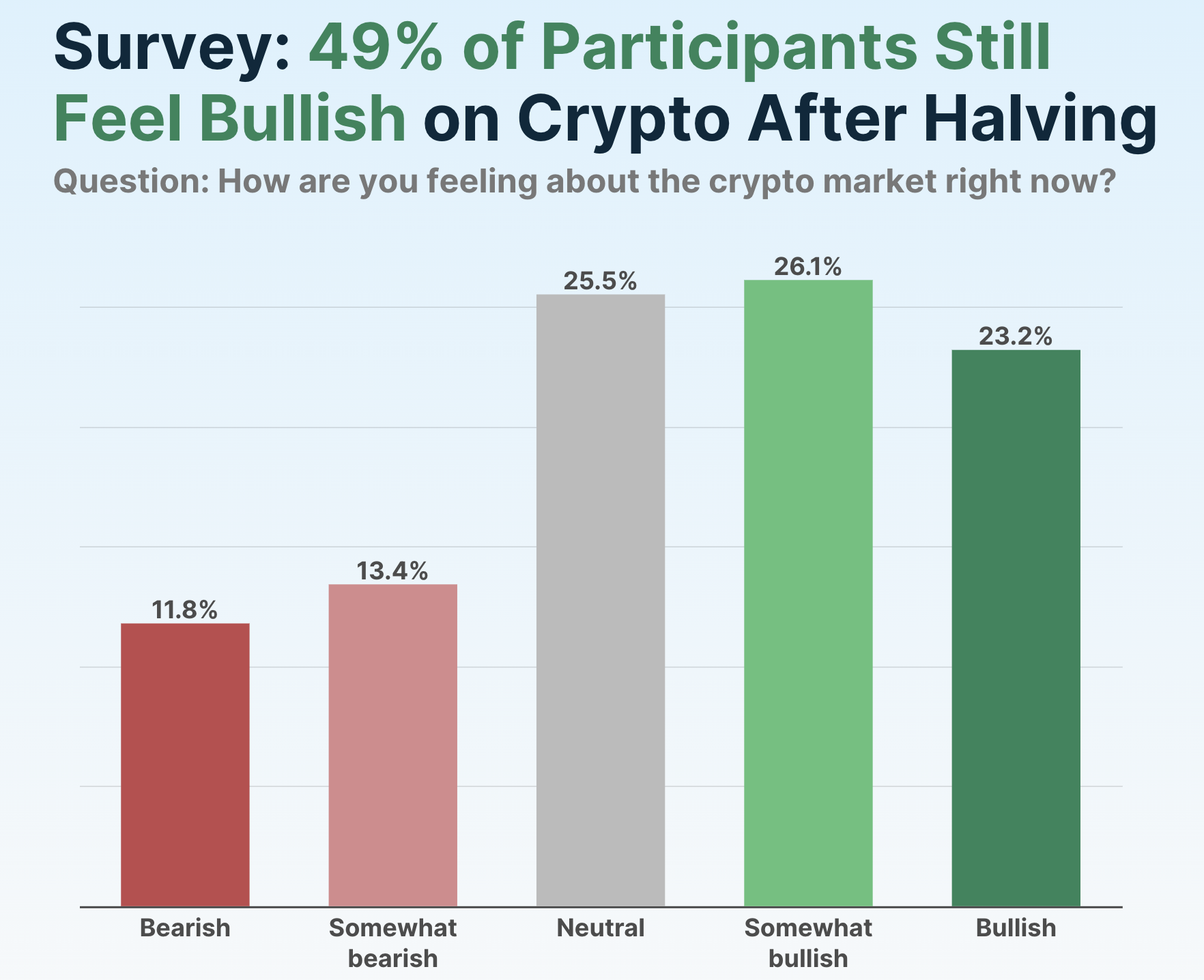

CoinGecko’s survey, conducted from mid-June to July 8 with over 2,500 participants, underscores the nuanced views across different market segments, with 49% of participants feeling bullish on BTC post-halving.

Despite the general bullish sentiment among investors, concerns linger over market stability amid significant price fluctuations. Traders, in particular, exhibit cautious optimism, balancing between potential opportunities and market volatility.

Speculators, on the other hand, remain more skeptical, possibly influenced by recent profit-taking and external market pressures.

READ MORE:

Ethereum: Crucial Resistance Level to Watch

The impact of German authorities selling 50,000 BTC seized from the illegal film website Movie2k has exacerbated market uncertainties, as highlighted by industry figures like Anthony Pompliano.

His observations on CNBC about Bitcoin’s liquidity challenges emphasize the broader implications of large-scale asset movements on market dynamics.

These developments underscore the complexity of current market conditions, where sentiment shifts can influence short-term price movements while long-term investors assess broader trends and opportunities.

-

1

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

2

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

3

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

4

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read -

5

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

08.07.2025 19:00 2 min. read

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

According to data shared by Wu Blockchain, over $5.8 billion in crypto options expired today, with Ethereum leading the action.

IMF Disputes El Salvador’s Bitcoin Purchases, Cites Asset Consolidation

A new report from the International Monetary Fund (IMF) suggests that El Salvador’s recent Bitcoin accumulation may not stem from ongoing purchases, but rather from a reshuffling of assets across government-controlled wallets.

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

Traders are rapidly shifting their focus to Ethereum and altcoins after Bitcoin’s recent all-time high triggered widespread retail FOMO.

BSTR to Launch With 30,021 BTC, Becomes 4th Largest Public Bitcoin Holder

BSTR Holdings Inc. is set to become the fourth-largest public holder of Bitcoin, announcing it will launch with 30,021 BTC on its balance sheet as part of its public debut.

-

1

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

2

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

3

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

4

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read -

5

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

08.07.2025 19:00 2 min. read