Bold Bitcoin Price Prediction From Top Investment Firm

27.11.2024 9:30 2 min. read Alexander Stefanov

Pantera Capital has made a bold prediction, estimating that Bitcoin could reach $740,000 by April 2028.

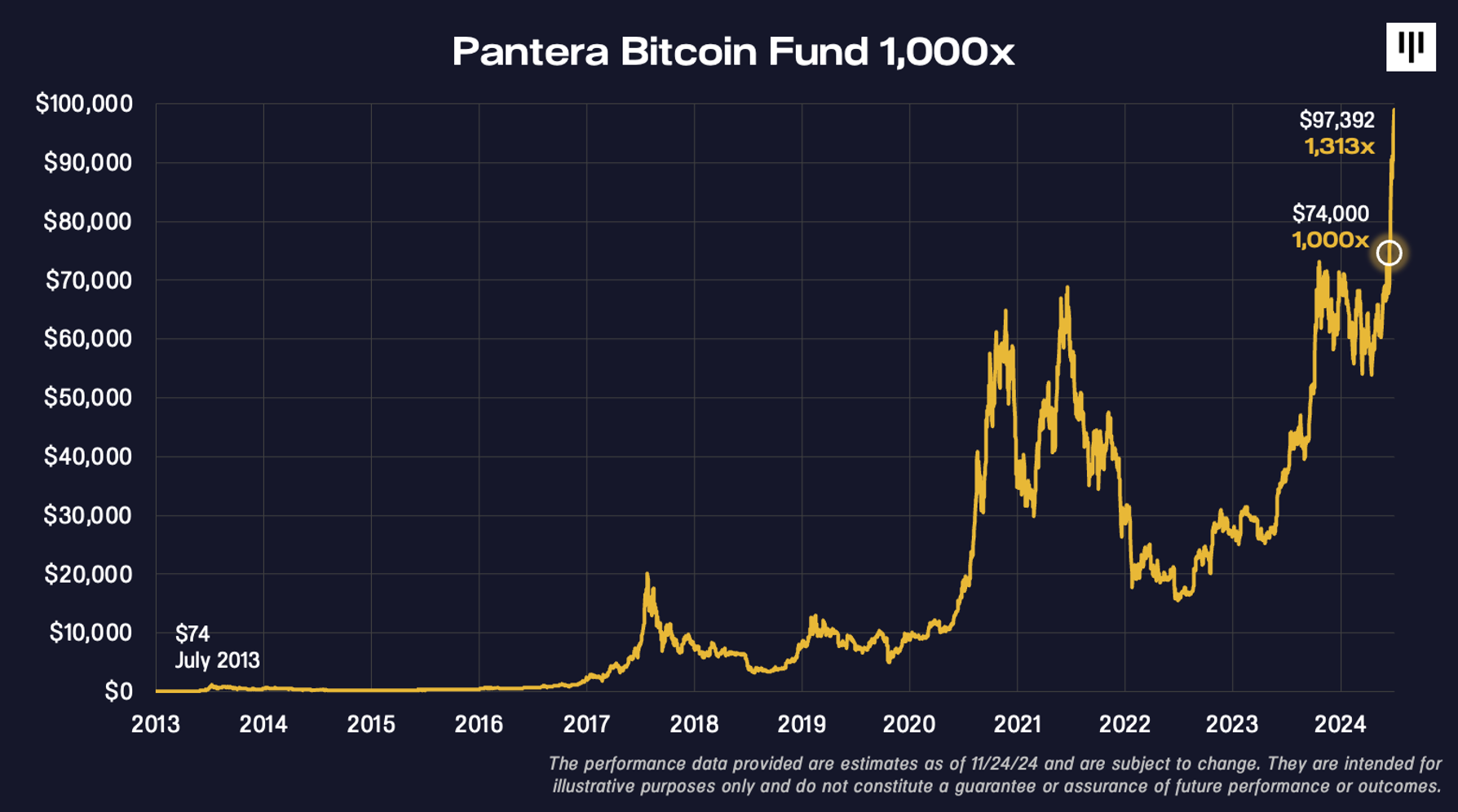

The firm also shared that its Bitcoin Fund has delivered an extraordinary 1,000x return, with a lifetime performance surge of 131,165%, after accounting for all fees and expenses.

Launched in 2013, Pantera’s Bitcoin Fund was one of the earliest U.S. investment vehicles to offer exposure to Bitcoin when the cryptocurrency was priced at just $74. At that time, the firm seized the opportunity to acquire 2% of the total Bitcoin supply. With Bitcoin’s recent surge to $99,000, Pantera’s original investment has now multiplied by over 1,000 times.

In a statement, Pantera Capital’s Dan Morehead explained that Bitcoin outshines traditional assets like cash, gold, and bearer bonds, positioning itself as the first truly global and borderless currency since gold. Morehead emphasized Bitcoin’s ability to fulfill roles that other forms of money have served, making it a pivotal development in the financial landscape.

Looking ahead, Pantera Capital previously projected Bitcoin could hit $117,000 by 2025, but with the new forecast for 2028, they are clearly maintaining an optimistic outlook. Beyond Bitcoin, Pantera is diversifying its portfolio through Pantera Fund V, which is exploring investments in blockchain assets, including private tokens and opportunities from entities like FTX’s estate, with a particular interest in locked Solana tokens. Additionally, the firm raised funds earlier in the year to increase its holdings in Toncoin.

-

1

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

2

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

3

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

4

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

5

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read

Bitcoin Risk Cycle Flips Again as Market Enters Safer Zone

Bitcoin’s market signal has officially shifted back into a low-risk phase, according to a new chart shared by Bitcoin Vector in collaboration with Glassnode and Swissblock.

Robert Kiyosaki Warns of 1929-Style Crash, Urges Bitcoin Hedge

Financial author Robert Kiyosaki is once again sounding the alarm on America’s economic health.

Metaplanet Adds $92.5M in Bitcoin, Surpasses 17,000 BTC Holdings

Metaplanet Inc., a Tokyo-listed company, has just added 780 more Bitcoin to its treasury. The purchase, announced on July 28, cost around ¥13.666 billion or $92.5 million, with an average price of $118,622 per BTC.

China and U.S. Plan Trade Truce Extension Before Talks: How It Can Affect Bitcoin

The United States and China are expected to extend their trade truce by 90 days. The extension would delay new tariffs and create space for fresh negotiations in Stockholm.

-

1

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

2

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

3

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

4

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

5

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read