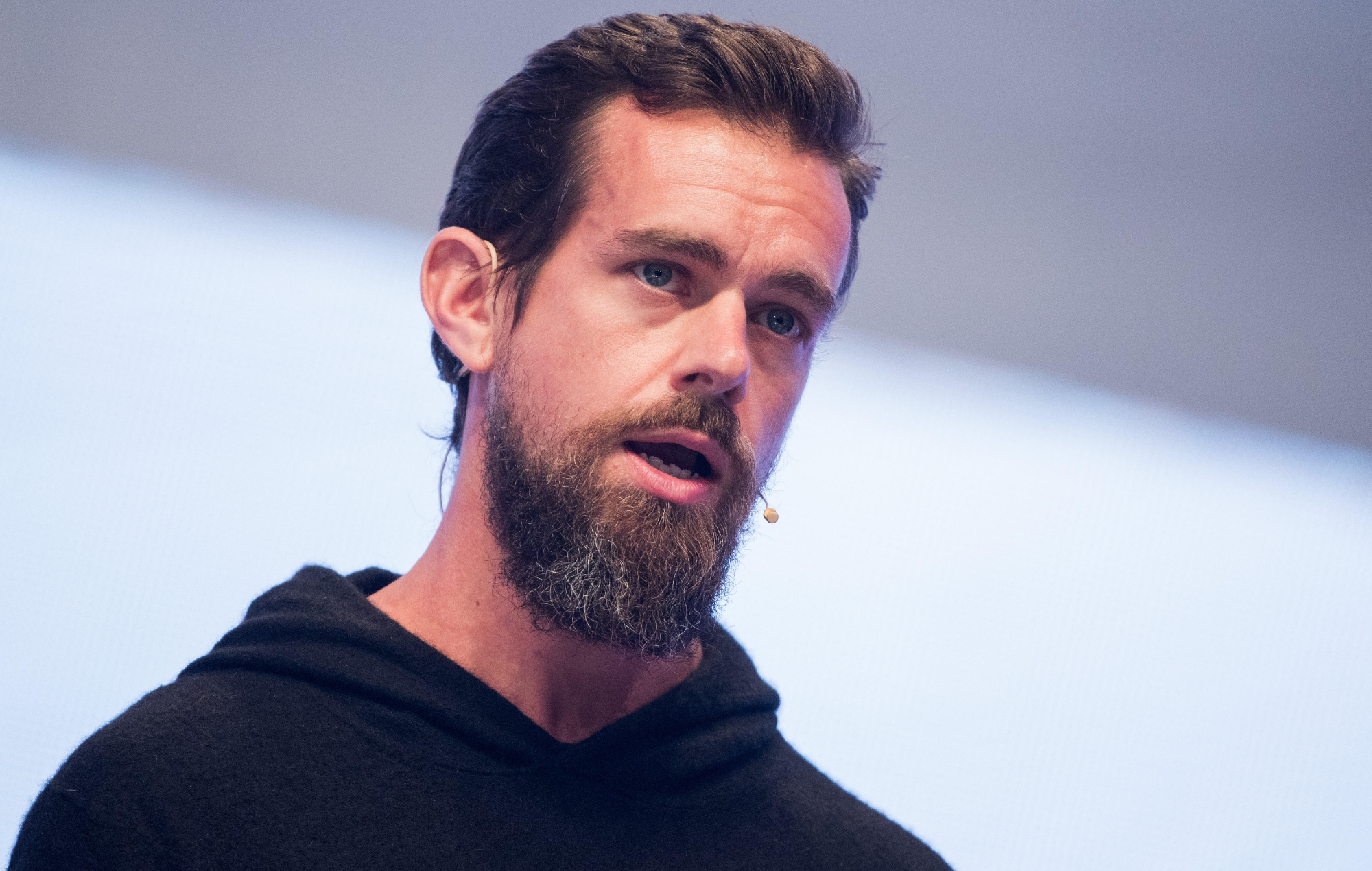

Block Inc. Shares Slide After Q3 Revenue Miss and Flat Bitcoin Earnings

08.11.2024 14:00 1 min. read Kosta Gushterov

Block Inc.’s stock took a hit in after-hours trading following a disappointing Q3 performance, with both total revenue and Bitcoin-related income missing market expectations.

The company’s shares fell by over 12% soon after the closing bell, though they recovered slightly, leaving them up around 4% for the year.

The tech firm, known for its Square point-of-sale system and Cash App, reported a modest 6.4% revenue increase from the previous year, reaching $5.98 billion—falling short of analyst projections of $6.17 billion. Bitcoin revenue, Block’s key income stream from crypto-related fees, remained stagnant compared to last year’s third quarter at roughly $2.43 billion.

Amid these results, Block announced plans to wind down its decentralized finance project, TBD, and reduce its investment in the TIDAL music platform to focus more on crypto-related ventures. According to Block, this shift will allow for further investment in initiatives like Bitcoin mining and the Bitkey self-custody wallet.

Despite the revenue shortfall, Block’s gross profit rose by 19% to $2.25 billion, with net income reaching $283.7 million, aligned with analyst forecasts. The revenue miss was partly attributed to Bitcoin’s price stability during the quarter, averaging close to $60,000.

-

1

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read

Pump.fun Raises $600M in Record-Breaking PUMP Token Sale

Memecoin launchpad Pump.fun has stunned the crypto market by pulling off one of the fastest initial coin offerings (ICOs) in history.

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

Binance founder Changpeng Zhao has once again threatened legal action against Bloomberg.

Top 10 Biggest Crypto Developments This Week

The latest WuBlockchain Weekly report captures a high-volatility week in crypto. From Bitcoin’s new all-time high to controversy around Pump.fun’s presale and Elon Musk’s political Bitcoin endorsement, markets are witnessing sharp shifts in momentum and policy.

Federal Reserve Chair Jerome Powell Reportedly Weighing Resignation

U.S. financial circles are bracing for a potential shake-up as reports suggest Federal Reserve Chair Jerome Powell is considering stepping down.

-

1

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read