BlackRock Chief Calls Bitcoin “Digital Gold”

16.07.2024 7:30 1 min. read Alexander Stefanov

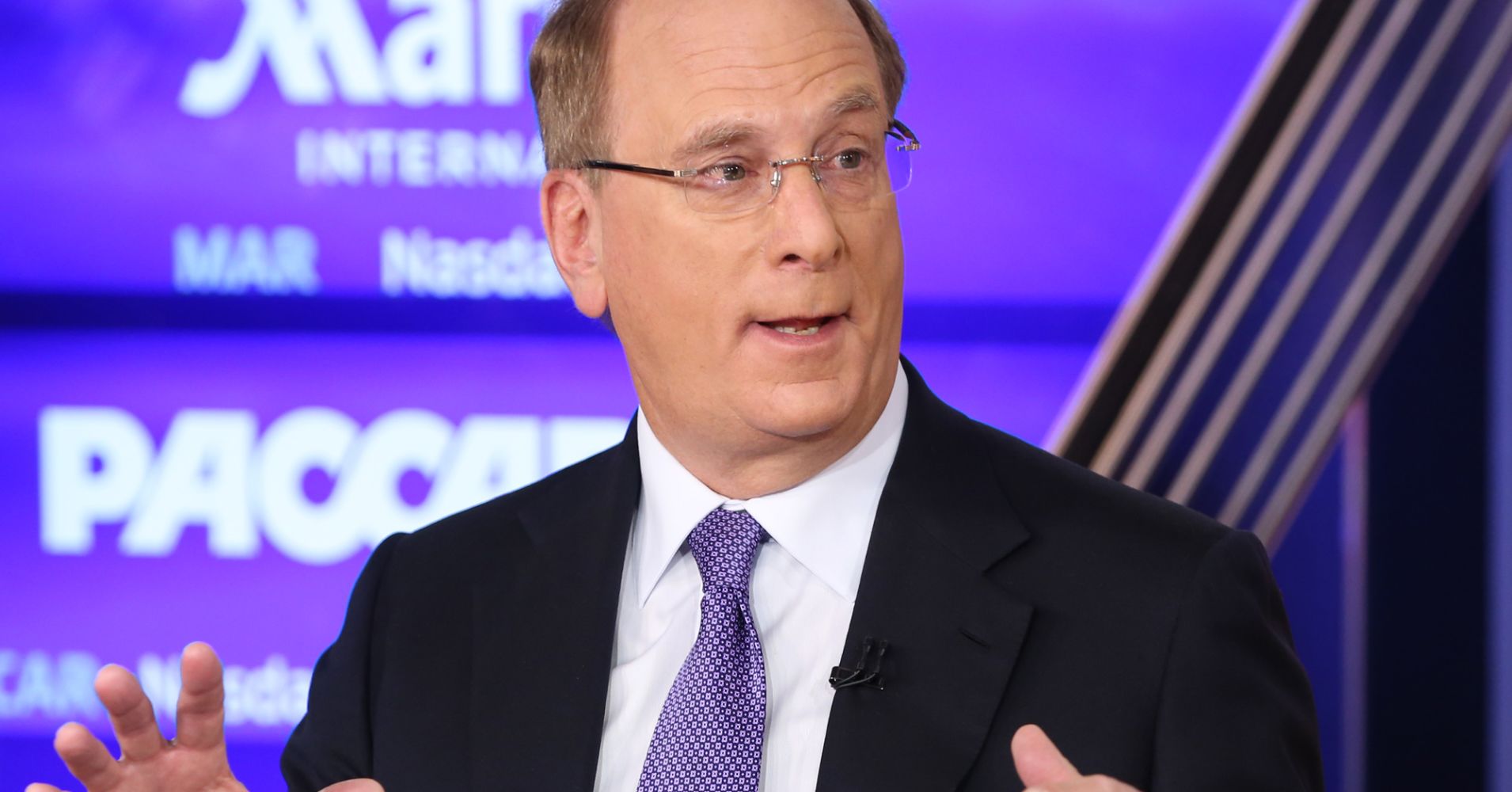

Larry Fink, the chief executive officer of the largest asset manager in the world BlackRock, described Bitcoin as "digital gold".

In an interview with CNBC, Fink spoke about Bitcoin, confirming that the cryptocurrency is “absolutely” a lucrative investment in the long run.

Previously known for his skeptical stance on the cryptocurrency market, Fink has significantly changed his stance this year. Back in March, he expressed strong optimism about Bitcoin’s long-term potential, and this view was further bolstered by the successful launch of BlackRock’s Bitcoin ETF (IBIT) in January.

In a recent conversation with Jim Cramer, Larry Fink reaffirmed his belief in Bitcoin as “digital gold,” reflecting on his journey from skepticism to endorsement of the cryptocurrency.

“I used to be a proud skeptic,” Fink admitted. “After studying and understanding Bitcoin, I realized that my previous views were wrong.”

Larry Fink believes in #Bitcoin.pic.twitter.com/hL2UZud2H3

— Michael Saylor⚡️ (@saylor) July 15, 2024

Fink describes Bitcoin as a legitimate financial instrument with inherent value. He views cryptocurrency as a promising investment for those seeking assets that are “outside the control of their country’s financial system.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read