Bitcoin’s Role in Finance Is Changing – Here’s Why

04.03.2025 14:00 2 min. read Alexander Zdravkov

Bitcoin’s reputation as a hedge against economic turmoil is fading as it moves in step with traditional risk assets.

Since Trump’s return to office, nearly $1 trillion has vanished from the crypto market, signaling a shift in investor perception.

Once seen as digital gold, Bitcoin no longer mirrors the metal’s gains. While gold continues to rise, Bitcoin has struggled, with analysts noting a sharp drop in market value despite Trump’s pro-crypto stance.

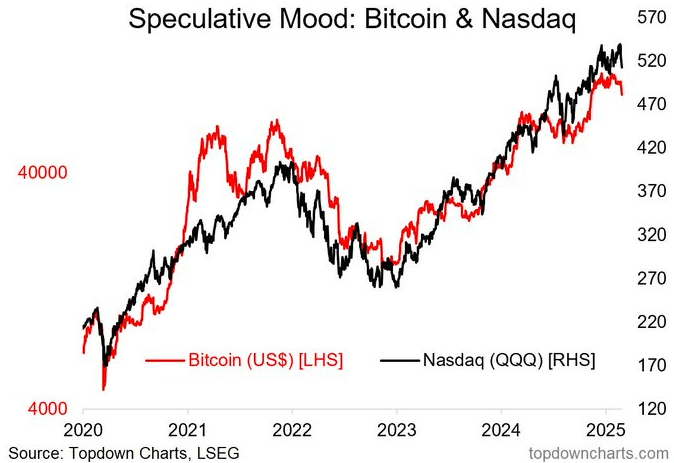

Its increasing correlation with traditional markets is a key factor—once independent, Bitcoin now moves in sync with the Nasdaq and S&P 500, though this link has weakened slightly in recent months.

Liquidity concerns add to the uncertainty. Capital is flowing back into the US dollar, leaving Bitcoin and other cryptocurrencies vulnerable to sudden crashes. ETF holdings have shrunk by $20 billion, and DeFi’s total locked value has plunged, reflecting declining confidence in crypto’s stability.

Geopolitical tensions are amplifying market volatility. A growing number of investors see trade wars as the biggest threat to risk assets in 2025, and only a small fraction still believe Bitcoin would thrive under such conditions. Meanwhile, volatility indexes are spiking, with analysts warning of continued price swings.

Despite the downturn, some believe Bitcoin could play a role in stabilizing the US economy. Advocates argue it offers an alternative to traditional finance, while corporations exploring Bitcoin holdings could fuel long-term demand.

Even skeptics admit Bitcoin functions as digital gold, though its ability to serve as a true financial hedge remains uncertain. Whether it rebounds or continues behaving like a high-risk asset will depend on how investors adapt to shifting economic conditions.

-

1

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

2

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

3

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

4

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read -

5

Bitcoin ETFs Top $50 Billion in Inflows, Marking Institutional Breakthrough

10.07.2025 11:00 2 min. read

Elon Musk’s SpaceX Moves $150M in Bitcoin

SpaceX has moved 1,308 BTC—worth roughly $150 million—to a new wallet address, marking its first on-chain activity in more than three years.

Here’s When the Bitcoin Cycle May Peak, Based on Past bull Markets

According to a new chart shared by Bitcoin Magazine Pro, the current Bitcoin market cycle may be entering its final stretch—with fewer than 100 days remaining before a potential market top.

Bitcoin Price Prediction: $130K in Sight After ‘Crypto Week’ Boost

Bitcoin (BTC) is once again hovering near its all-time high today as trading volumes have jumped by 13% in the past 24 hours upon breaking the $119,000 barrier, favoring a bullish Bitcoin price prediction. The top crypto has booked gains of 16% in the past 30 days and reached a new record at $123,091 earlier […]

Support Test or Breakout Ahead? Bitcoin Hovers at Key Decision Zone

Bitcoin is consolidating around $119,000 after last week’s all-time high above $123,000.

-

1

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

2

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

3

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

4

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read -

5

Bitcoin ETFs Top $50 Billion in Inflows, Marking Institutional Breakthrough

10.07.2025 11:00 2 min. read