Bitcoin’s Consolidation Around $60,000 Could Last Several Months

27.06.2024 18:30 2 min. read Alexander Stefanov

A renowned analyst and crypto trader shared his bullish enthusiasm for Dogecoin (DOGE).

The Relative Strength Index (RSI) of Bitcoin, the leading DeFi asset, has reached its most oversold level in over 300 days.

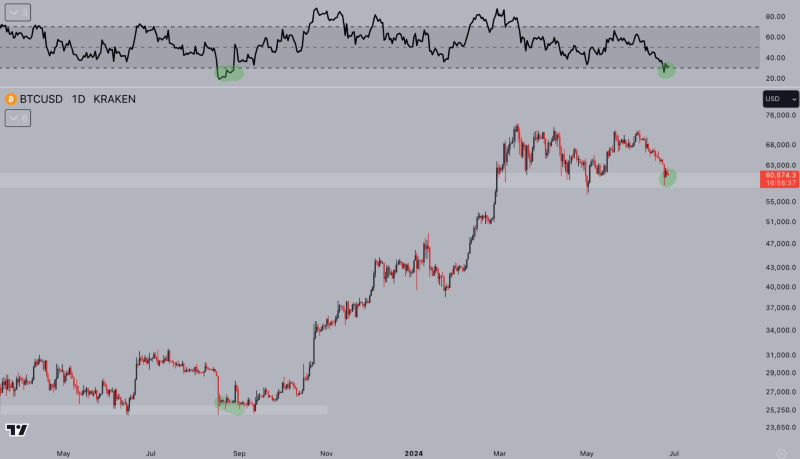

Bitcoin’s RSI has now reached 30, a level last seen in September 2023. This previous phenomenon led to an over three-month consolidation just below key resistance at $30,000, as Jelle’s pseudonymous crypto analyst noted in a post on X (Twitter) on June 27.

Given this historical chart pattern, the expert suggested that if history repeats itself, Bitcoin, the largest crypto asset by market cap, could face an over three-month consolidation below $70,000.

However, Jelle also pointed out that after this “period of shredding” followed by a “capitulation at key support,” BTC could see significant upside, as he mentioned in a comment below his post, noting that the asset is already very close to key support levels.

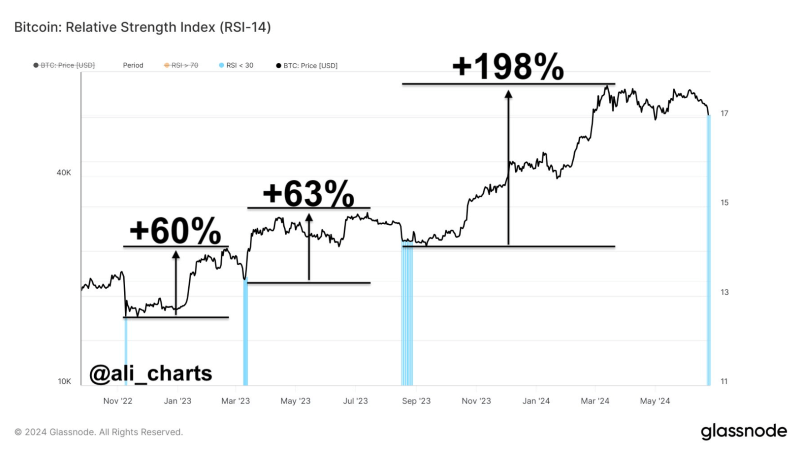

One indicator of future price performance is the RSI. Professional crypto trader Ali Martinez highlighted that the current RSI suggests that it is an ideal time to buy the declining Bitcoin.

However, the crypto market is notoriously volatile and conditions can change unexpectedly. Therefore, conducting thorough research and keeping up-to-date on relevant events is crucial when investing in assets like Bitcoin, despite its bullish outlook for future price performance.

At the time of writing, BTC was trading for $61,246.

-

1

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

2

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

3

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

4

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

5

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read

XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

Top 5 Most Trending Cryptocurrencies Today: Zora, Pudgy Penguins, SUI and More

Crypto markets are buzzing with momentum as several altcoins post double-digit gains and surging volumes.

Sui Price Jumps 14% to $4.26 amid ETF Hopes

Sui (SUI) surged 14% in the past 24 hours, reaching $4.26 as bullish technical patterns, Bitcoin’s rebound, and renewed ETF speculation pushed the altcoin higher.

HBAR Mirrors 2021 Cycle as Key Breakout Test Approaches

Hedera Hashgraph (HBAR) is closely tracking its 2021 price behavior, according to crypto analyst Rekt Capital.

-

1

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

2

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

3

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

4

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

5

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read