Bitcoin Whales Buy the Dip, Signaling Potential Bullish Momentum

09.07.2024 16:00 1 min. read Alexander Stefanov

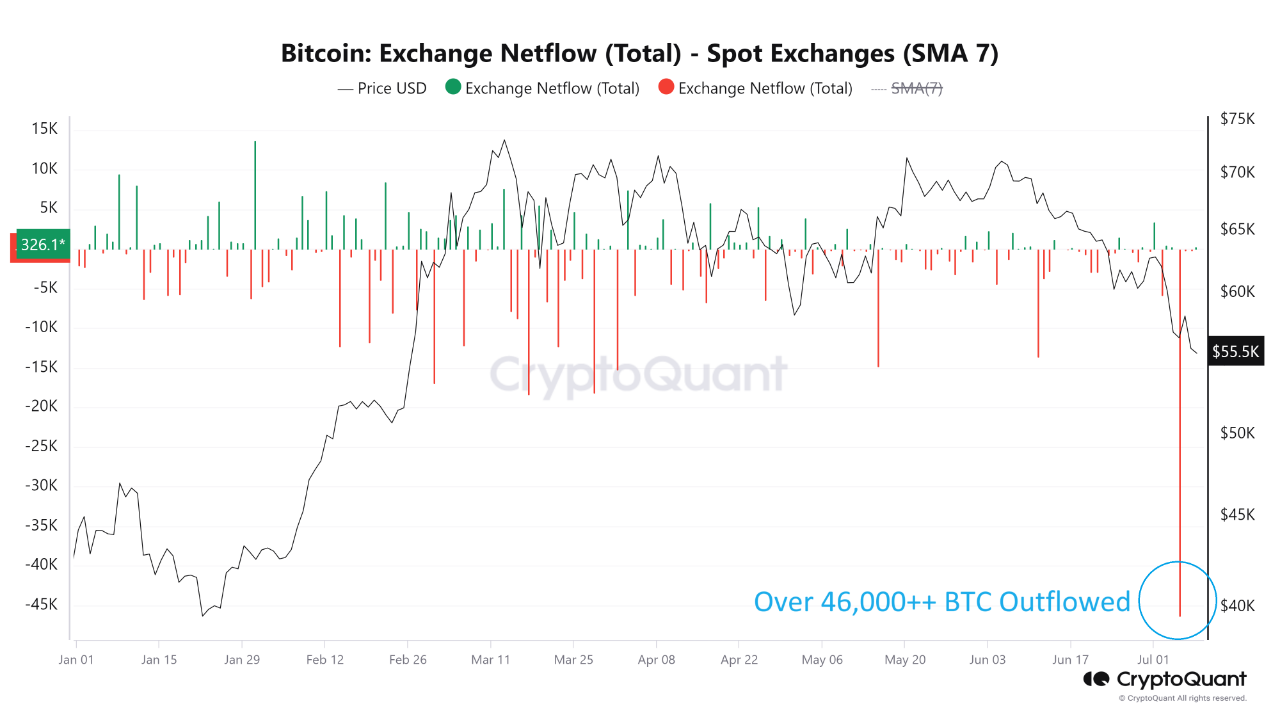

Large crypto holders are aggressively purchasing Bitcoin amid market dips, as new data from CryptoQuant shows.

In 2024, Bitcoin withdrawals from exchanges have reached unprecedented rates. Over 46,000 BTC, worth more than $2.6 billion, have been moved off exchanges on July 5, indicating a shift towards long-term holding.

This trend suggests optimism for Bitcoin’s price. Whales are betting on a future rise, even as many investors sell in panic, favoring long-term investment over short-term volatility.

Significant outflows from spot and derivatives exchanges indicate a reduction in risk exposure. Moving Bitcoin to private wallets points to a strategy focused on stability and future gains, potentially reducing market volatility.

READ MORE:

Australia Approves Another Spot Bitcoin ETF

The increased activity from whales, despite recent price drops, is a positive indicator for Bitcoin’s future. Observing these significant investors betting on a price increase is promising for the market.

-

1

BlackRock’s Bitcoin ETF Now Out-Earning Its $624B S&P 500 Fund

03.07.2025 10:00 1 min. read -

2

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

21.06.2025 16:00 2 min. read -

3

Strategy’ Michael Saylor Drops Another Cryptic Bitcoin Message

24.06.2025 21:00 1 min. read -

4

‘Nobody Saw This Coming’: Saylor Points to Political Winds Fueling Bitcoin Boom

22.06.2025 10:00 2 min. read -

5

Strategy Adds to Its Bitcoin Pile Again, Shrugging Off Market Slump

23.06.2025 17:00 1 min. read

Bitcoin: Is the Cycle Top In and How to Spot It?

Bitcoin may not have reached its peak in the current market cycle, according to a recent analysis by crypto analytics firm Alphractal.

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

BlackRock’s iShares Bitcoin Trust (IBIT) has officially crossed the 700,000 BTC mark, reinforcing its position as one of the fastest-growing exchange-traded funds in financial history.

Bitcoin: Historical Trends Point to Likely Upside Movement

Bitcoin may be gearing up for a significant move as its volatility continues to tighten, according to on-chain insights from crypto analyst Axel Adler.

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

Two major developments are converging in July that could shape the future of Bitcoin in the United States—both tied to President Trump’s administration and its expanding crypto agenda.

-

1

BlackRock’s Bitcoin ETF Now Out-Earning Its $624B S&P 500 Fund

03.07.2025 10:00 1 min. read -

2

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

21.06.2025 16:00 2 min. read -

3

Strategy’ Michael Saylor Drops Another Cryptic Bitcoin Message

24.06.2025 21:00 1 min. read -

4

‘Nobody Saw This Coming’: Saylor Points to Political Winds Fueling Bitcoin Boom

22.06.2025 10:00 2 min. read -

5

Strategy Adds to Its Bitcoin Pile Again, Shrugging Off Market Slump

23.06.2025 17:00 1 min. read