Bitcoin Whales Buy the Dip, Signaling Potential Bullish Momentum

09.07.2024 16:00 1 min. read Alexander Stefanov

Large crypto holders are aggressively purchasing Bitcoin amid market dips, as new data from CryptoQuant shows.

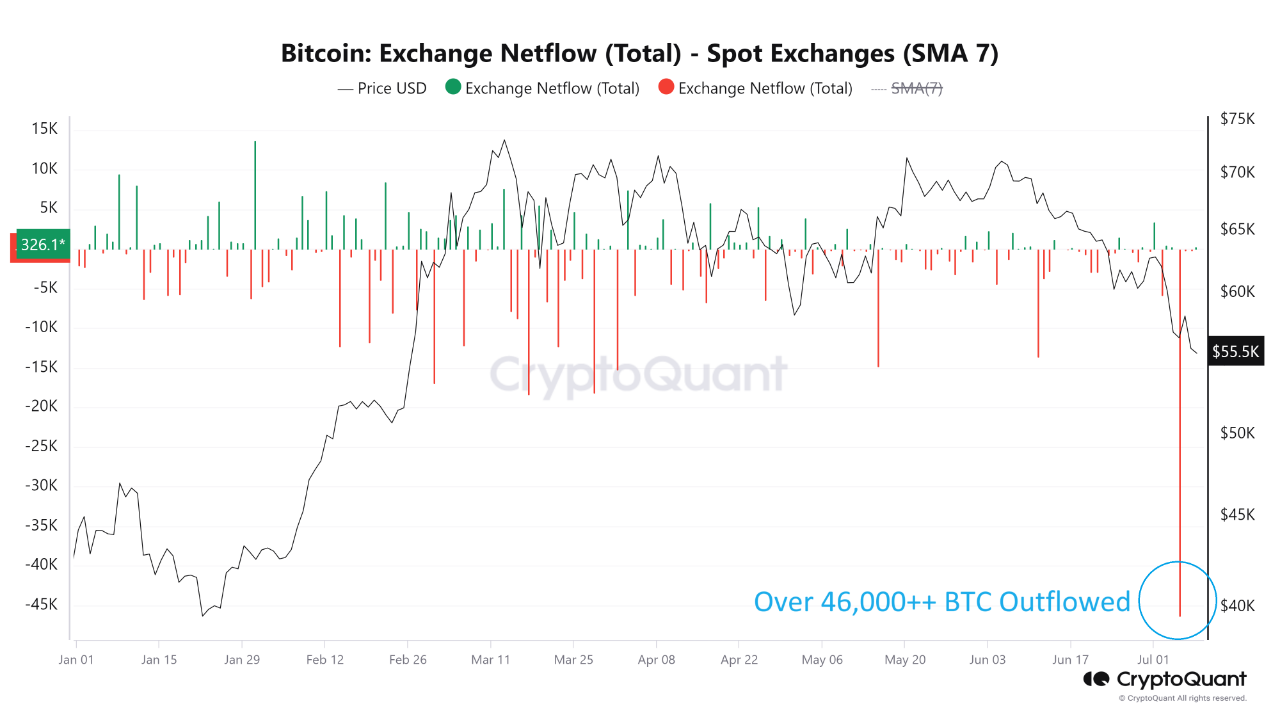

In 2024, Bitcoin withdrawals from exchanges have reached unprecedented rates. Over 46,000 BTC, worth more than $2.6 billion, have been moved off exchanges on July 5, indicating a shift towards long-term holding.

This trend suggests optimism for Bitcoin’s price. Whales are betting on a future rise, even as many investors sell in panic, favoring long-term investment over short-term volatility.

Significant outflows from spot and derivatives exchanges indicate a reduction in risk exposure. Moving Bitcoin to private wallets points to a strategy focused on stability and future gains, potentially reducing market volatility.

READ MORE:

Australia Approves Another Spot Bitcoin ETF

The increased activity from whales, despite recent price drops, is a positive indicator for Bitcoin’s future. Observing these significant investors betting on a price increase is promising for the market.

-

1

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

14.07.2025 20:00 1 min. read -

2

Top Crypto Trends Dominating Discussions This Week

15.07.2025 17:30 2 min. read -

3

Bitcoin Price Hits Record Highs as Exchange Balances Plunge

12.07.2025 19:00 2 min. read -

4

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

18.07.2025 16:00 2 min. read -

5

Bitcoin Sparks Clash Between Mike Novogratz and Peter Schiff

13.07.2025 10:00 1 min. read

Strategy Adds 21,021 Bitcoin at $117,000, Pushing Total Holdings Past $46 Billion

Michael Saylor, executive chairman of Strategy, has revealed that the company has acquired an additional 21,021 Bitcoin for approximately $2.46 billion, paying an average price of $117,256 per BTC.

Bitcoin Funding Rates Stay Elevated—Rally Ahead or Shakeout Coming?

As Bitcoin continues to consolidate above $100K, a critical market signal is flashing: BTC funding rates remain elevated, even as price action cools.

Billionaire Ray Dalio Revealed What his Portfolio Says About the Future of mMoney

Billionaire investor Ray Dalio, founder of Bridgewater Associates, has suggested that a balanced investment portfolio should include up to 15% allocation to gold or Bitcoin, though he remains personally more inclined toward the traditional asset.

Where Is The Smart Entry Point For Bitcoin Bulls?

With Bitcoin hovering near $119,000, traders are weighing their next move carefully. The question dominating the market now is simple: Buy the dip or wait for a cleaner setup?

-

1

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

14.07.2025 20:00 1 min. read -

2

Top Crypto Trends Dominating Discussions This Week

15.07.2025 17:30 2 min. read -

3

Bitcoin Price Hits Record Highs as Exchange Balances Plunge

12.07.2025 19:00 2 min. read -

4

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

18.07.2025 16:00 2 min. read -

5

Bitcoin Sparks Clash Between Mike Novogratz and Peter Schiff

13.07.2025 10:00 1 min. read