Bitcoin Surpasses Ethereum in Risk-Adjusted Performance for the First Time Since July 2022

04.09.2024 14:00 1 min. read Alexander Stefanov

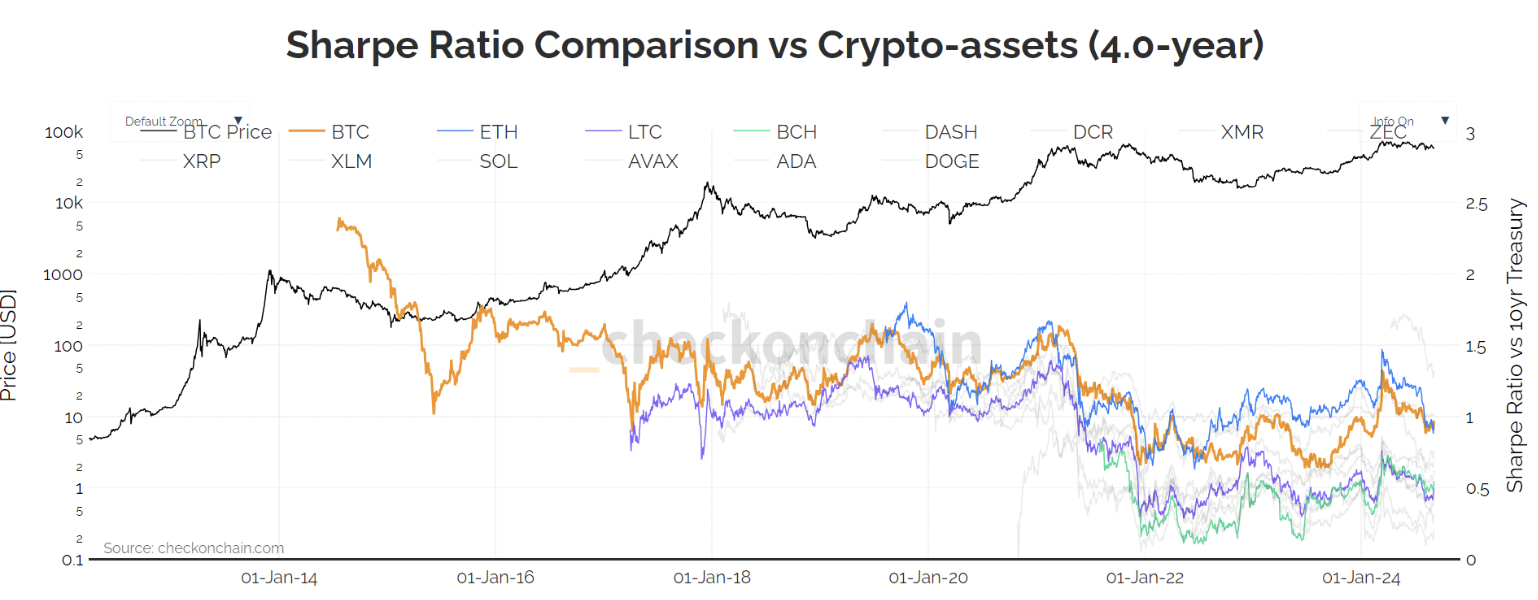

Bitcoin (BTC) currently has a Sharpe ratio of 0.97 on a four-year basis, which implies solid performance given its associated risk.

Interestingly, BTC ‘s Sharpe ratio recently outpaced that of Ethereum (ETH) for the first time since July 2022, with ETH now standing at 0.95.

The Sharpe ratio is a key financial metric that evaluates the return of an investment relative to its risk. This metric helps investors gauge what return they are getting for the level of risk they are taking.44

To calculate it, you need to subtract the risk-free rate from the investment’s return and then divide that difference by the investment’s standard deviation (which measures risk or volatility). A higher Sharpe ratio implies a more favourable risk-adjusted return.

Among known digital assets, only Solana (1.32) and Dogecoin (1) have a higher Sharpe ratio than Bitcoin. In contrast, other major cryptocurrencies such as XRP and ADA have seen their ratios decline, indicating weaker risk-adjusted returns.

-

1

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

2

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

3

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

Massive Bitcoin Move Sparks Panic, Price Tests Range Low

Bitcoin has dropped sharply to test its local range low near $115,000, with analysts pointing to renewed whale activity and long-dormant supply movements as key contributors to the decline.

Bitcoin Scarcity Deepens: Less Than 5.3% Left to Mine

Bitcoin has reached a critical milestone in its programmed supply timeline—only 5.25% of the total BTC that will ever exist remains to be mined.

Strategy to Raise Another $2.47 Billion for Bitcoin Acquisition

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

-

1

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

2

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

3

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read