Bitcoin Surges to Over $61,000 – What Could be the Reason?

13.08.2024 20:21 1 min. read Alexander Stefanov

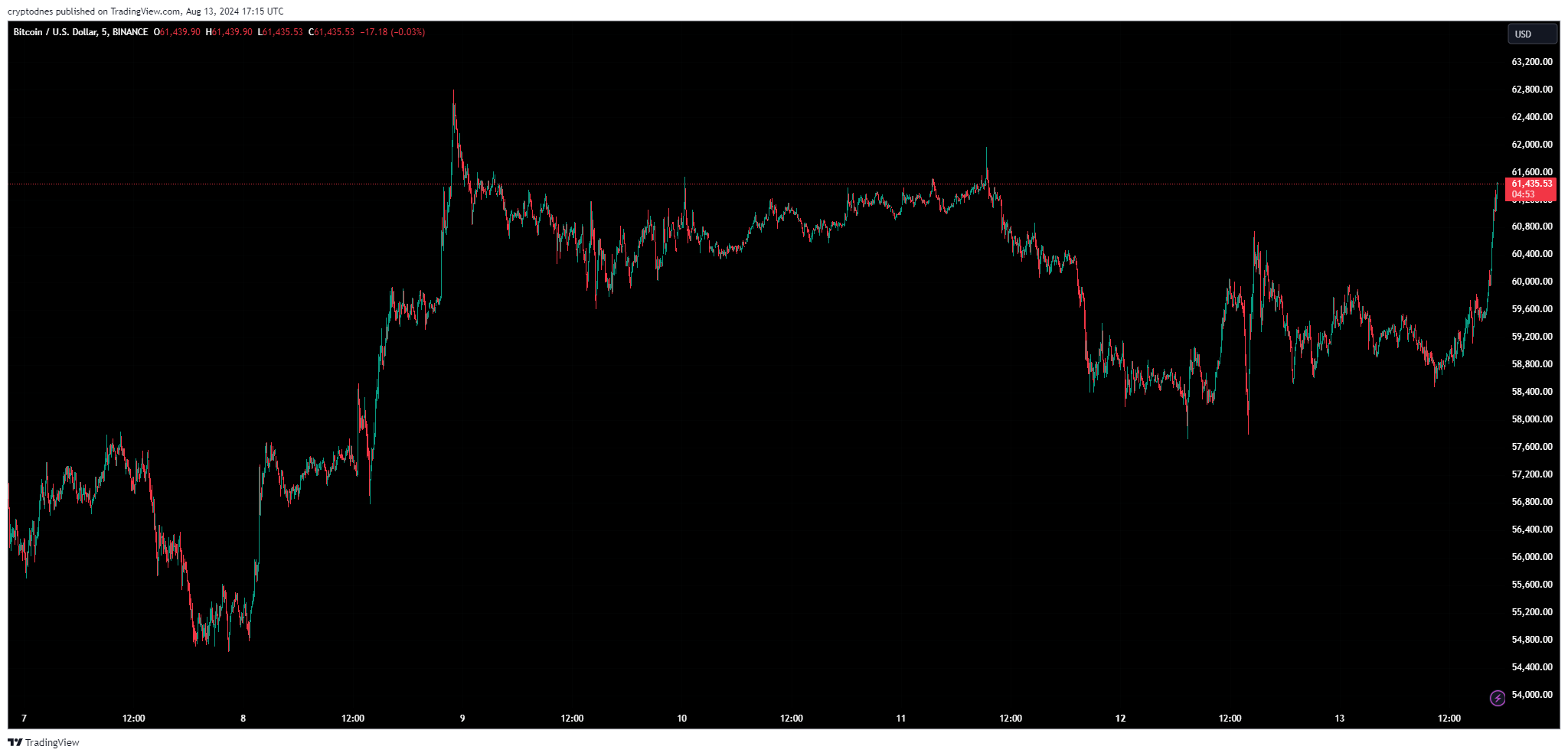

After experiencing a notable downturn, Bitcoin has managed to regain ground yet again in what looks like a short-term market revival.

Bitcoin’s price surged by around 2.6% in the past hour to $61,150. During the last 7 days, Bitcoin gained 7.4% after the recent lows and has a 24-hour volume of over $30 billion.

The number one crypto by market cap has a valuation of $1.2 billion, according to CoinMarketCap data.

Looking at the 1-day technical analysis from TradingView, there doesn’t seem to be any indication of where BTC is headed next. The summary and oscillators show “neutral” at 10 and 9, respectively, while moving averages point to “sell” at 8.

In the past 24 hours, $108.55 million were liquidated from the crypto market – $57.55 million in shorts and $51 million in long positions, according to CoinGlass data.

Ethereum also registered a significant surge of 1.8% in less than an hour and is currently trading over $2,700. The top altcoin has a 24-hour volume of around $17.3 billion.

The main reason for this notable surge could be that Mt.Gox’s repayment plan may be coming to an end after a wallet related to the exchange started testing out transactions earlier today.

-

1

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

2

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

3

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read -

4

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

30.06.2025 15:23 2 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

Bitcoin soared to a new all-time high above $119,000 on July 13, extending its bullish momentum on the back of institutional accumulation, shrinking exchange reserves, and technical breakout patterns.

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

A major shift in the crypto cycle may be approaching as Bitcoin dominance (BTC.D) once again reaches critical long-term resistance.

Bitcoin Sparks Clash Between Mike Novogratz and Peter Schiff

Galaxy Digital CEO Mike Novogratz reignited a long-running feud with economist and gold advocate Peter Schiff after the latter criticized Биткойн yet again.

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

Gold advocate Peter Schiff issued a stark warning on monetary policy and sparked fresh debate about Bitcoin’s perceived scarcity. In a pair of high-profile posts on July 12, Schiff criticized the current Fed rate stance and challenged the logic behind Bitcoin’s 21 million supply cap.

-

1

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

2

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

3

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read -

4

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

30.06.2025 15:23 2 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read