Bitcoin Soars to One-Month High: Is the Uptrend Here to Stay?

26.09.2024 17:34 1 min. read Kosta Gushterov

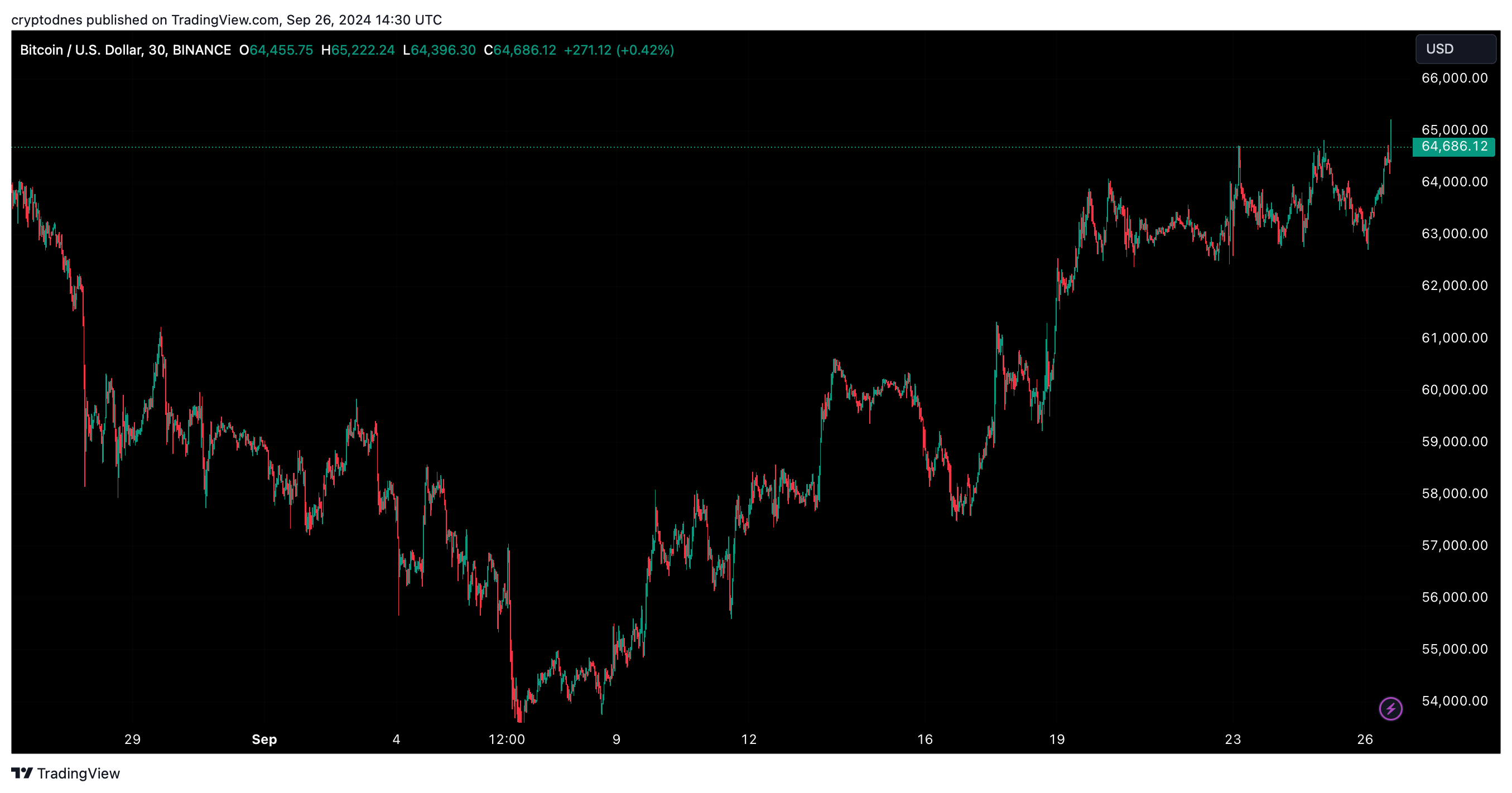

The price of Bitcoin reached a one-month high after central banks cut interest rates in September, with analysts expecting the upward trend to continue.

In the past 30 days, the price of Bitcoin has risen nearly 5 percent, climbing to over $65,000 on Thursday, September 26, marking its highest level since August 26. However, at the time of writing, BTC has lost some of its gains and is trading around $64,680.

The rally is believed by many to be due to easing policies by global central banks. Cryptocurrencies have benefited greatly from central banks’ commitments to cut interest rates.

The European Central Bank implemented its second rate cut of the year, and the U.S. Federal Reserve introduced a 0.5 percent cut. On Tuesday, the People’s Bank of China joined them with cuts in key lending rates and an increase in market liquidity.

Historically, the price of Bitcoin has risen in periods of monetary easing, such as in 2020 when prices jumped more than 1,500% due to near-zero interest rates.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read