Bitcoin Sets New All-Time High Above $105,000

16.12.2024 1:51 1 min. read Alexander Zdravkov

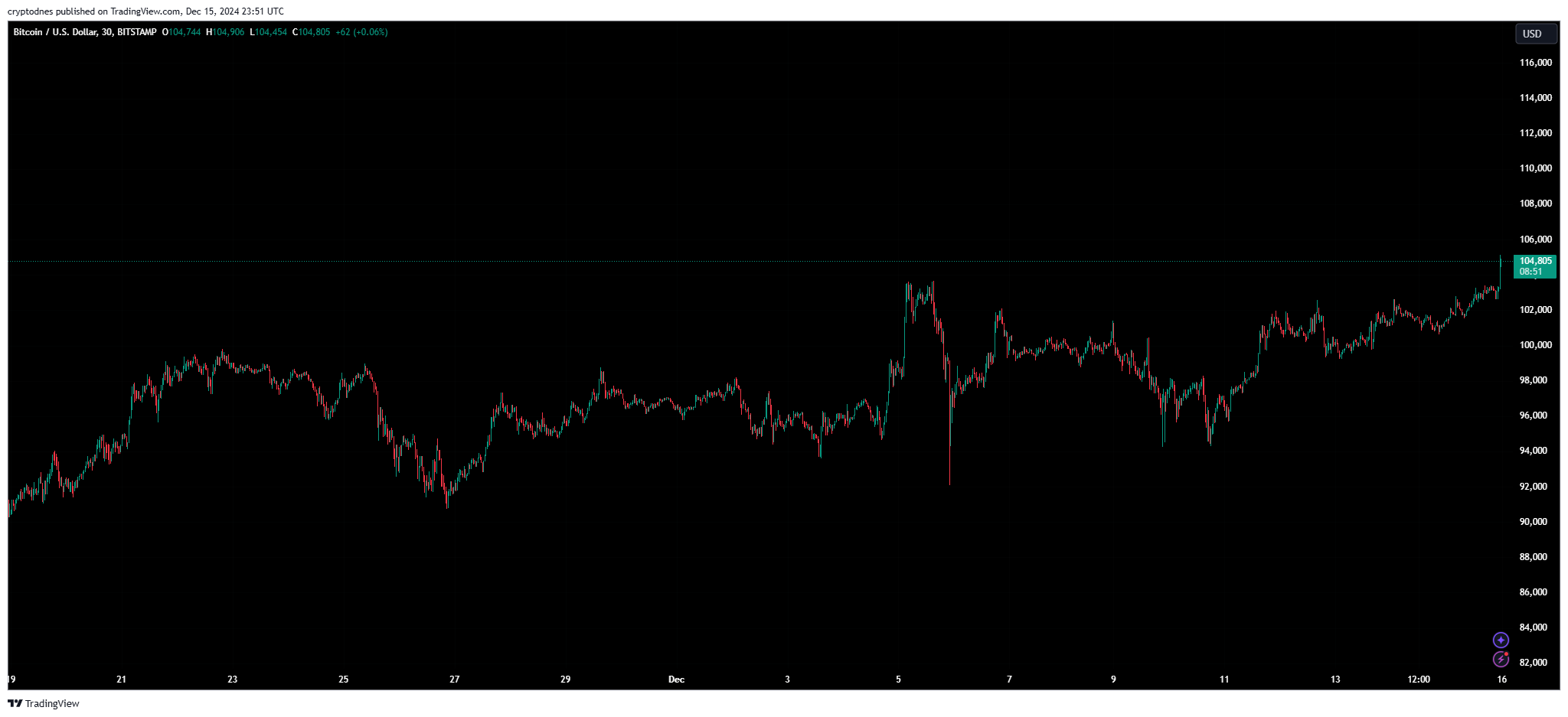

After reclaiming the $100,000 level, Bitcoin seems to have gained momentum and continues to surge.

Bitcoin’s price recently broke the $105,000 level, marking yet another historic moment for the cryptocurrency industry.

At the time of writing, BTC is trading at $104,800 after a 3.28% surge in the past 24 hours with $50 billion in trading volume. Bitcoin is up more than 4% on the weekly chart and.has a market cap of $2.07 trillion.

The top cryptocurrency is currently the 7th most valuable asset in the world, right after Google.

The total market cap of all cryptos grew 2.67% and hit $3.7 trillion.

As for the futures market, $225.6 million were rekt in the past 24 hours – $102.62 million in long positions and $122.98 million in shorts. BTC accounted for $50.44 million of those liqidations, according to data from CoinGlass.

The 1-day technical analysis from TradingView reflects the current bullish momentum – the summary shows “buy” at 15, the moving averages pont to “strong buy” at 14, while oscillators remain “neutral” at 9.

-

1

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

2

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

3

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

4

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

5

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read

Bitcoin Risk Cycle Flips Again as Market Enters Safer Zone

Bitcoin’s market signal has officially shifted back into a low-risk phase, according to a new chart shared by Bitcoin Vector in collaboration with Glassnode and Swissblock.

Robert Kiyosaki Warns of 1929-Style Crash, Urges Bitcoin Hedge

Financial author Robert Kiyosaki is once again sounding the alarm on America’s economic health.

Metaplanet Adds $92.5M in Bitcoin, Surpasses 17,000 BTC Holdings

Metaplanet Inc., a Tokyo-listed company, has just added 780 more Bitcoin to its treasury. The purchase, announced on July 28, cost around ¥13.666 billion or $92.5 million, with an average price of $118,622 per BTC.

China and U.S. Plan Trade Truce Extension Before Talks: How It Can Affect Bitcoin

The United States and China are expected to extend their trade truce by 90 days. The extension would delay new tariffs and create space for fresh negotiations in Stockholm.

-

1

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

2

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

3

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

4

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

5

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read